Having conviction in a manager is often one of the reasons why fund selectors and investors choose one fund over another.

But loading up a portfolio with strategies run by the same manager is usually not recommended, as it may lower diversification and increase the so-called key-person risk – the potential negative impact on performance due to the departure or unavailability of a manager. The extreme would be ending up ‘worshipping’ a fund manager.

Below, experts discuss where to draw the line between conviction and worship in a manager, whether investors should avoid owning more than one fund run by the same team or manager and if there are cases that are worth making an exception.

Dennehy Wealth’s Richardson: We actively avoid placing too much reliance on any single fund manager

The strongest disapproval for the practice came from Joe Richardson, discretionary investment manager at Dennehy Wealth, who “actively avoids placing too much reliance on any single fund manager or team”.

“Fund manager worship can be a very dangerous thing,” he said. “Most managers are very impressive with strong conviction in their approach but we should all be aware of a media frenzy surrounding any fund manager – history shows that can backfire and Woodford is a prime example of how things can go wrong.”

Indeed, in 2019 the once-renowned Neil Woodford came under fire for his illiquid holdings and shortly afterwards his eponymous fund house – Woodford Investment Management – collapsed.

“No one manager is infallible”, said Richardson, who instead focuses more on funds with a “solid” investment process and that stay disciplined in the execution, regardless of any one individual’s reputation.

EQ Investors’ Cheung: Owning multiple funds from the same asset management company is fine

Broadly agreeing with Richardson, EQ Investors’ investment analyst Andrew Cheung stressed the importance of the process over the manager, but allowed the ownership of funds by the same asset management house.

“Owning multiple funds from the same asset management company is fine, but not from the same individual manager,” he said.

“It is important to avoid group think and embrace a diverse range of opinions and strategies. It is the investment process that gives investors clarity as to their investment approach given the changing market conditions and their investment mindset.”

Progeny’s Sparke: We only make one exception to our rule

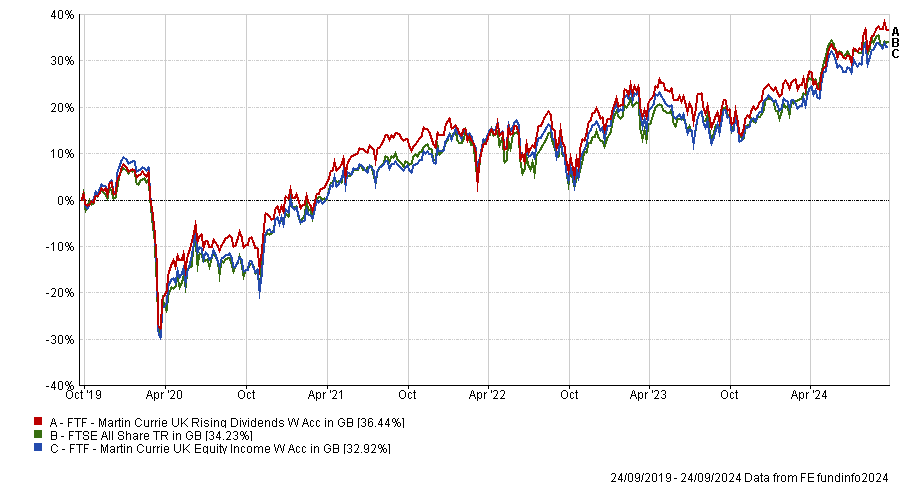

Tom Sparke, portfolio manager at Progeny Asset Management, was the first to admit he allows exceptions. While historically he has not tended to use two funds from the same manager or team, there is one exception within Progeny’s UK exposure – the Martin Currie UK Equity Income and Rising Dividend funds, both co-managed by Will Bradwell and FE fundinfo Alpha Managers Ben Russon and Joanne Rands.

Both however are “relatively small holdings” for Progeny, and are used to “nuance the exposure we gain from their overall position”.

Performance of funds against index over 5yrs

Source: FE Analytics

“In my experience, a manager or team will generally have a style that we would look to complement with another of a different style, rather than another manager from within the same house,” Sparke said.

“It may be more prevalent in strategies with a more systematic approach, meaning the same strategy could be replicated in the US, UK or Europe.”

A good example of this would be Jupiter Merian’s systematic team, who run numerous strategies in various regions.

Elston Consulting’s Qiao: A single-team approach makes more sense for multi-asset funds

For Jackie Qiao, head of fund research at Elston Consulting, key-person risk becomes a lesser concern when two things are in place. First, the success of the fund is more about the team's overall capability and consistency rather than just one person's influence. Secondly, the investment process is “robust and disciplined”.

That said, there are some qualifiers. For example, if using multiple funds run by the same team, the considerations are different for security selection funds compared to asset allocation funds.

In the first case, it can make sense if the investment philosophy and approach are similar, according to Qiao.

“For example, a team looking at UK small-cap and UK small-cap value have a lot of overlap,” she said. “But if security selection strategies are very different (say UK small-cap versus UK large-cap) it seems less likely that there is overlap and we could question if the same team can do both.”

For asset-allocation funds, it’s more about multi-asset capabilities. For example at Elston, Qiao uses the VT Avastra Global Fixed Income, VT Avastra Global Alternatives and VT Avastra Global Equity funds – all three are funds-of-funds managed by Paul Denley and Richard Morrison, who offer “broad diversification and dynamic asset allocation management”.

In this instance, having a consistent approach across asset classes from the same team makes sense to ensure consistency of outlook, Qiao said.

“It would be odd to have an equity fund positioned for rate hikes and a bond fund positioned for rate cuts, so a single team-based approach for asset allocation funds makes more sense than for security selection funds,” she concluded.