Columbia Threadneedle Investments (CT) has been among the 10 largest fund houses by assets under management since it assimilated BMO’s EMEA asset management business in November 2021. While the acquisition was mostly successful, it created some challenges that the firm has still to tackle, according to experts.

These include a very large range of funds, possibly too large, according to Ben Yearsley, director at Fairview Investing. Currently, CT has 95 funds available in the UK, plus investment trusts. In comparison, JP Morgan Asset Management has 44 open-ended funds.

“Fund managers seem largely content with how the integration went, but CT hasn’t got rid of any funds yet, which surely has to come,” Yearsley said.

“Do they need two different multi-manager ranges with 10 funds? Do they need American and American Select and North American Equity? And that's just a random brief selection. They need to halve their range.”

Another example of integration challenges was the departure of veteran manager Rob Burdett and his team earlier this year, said Darius McDermott, managing director of FundCalibre.

“Retaining key talent is always critical in such deals, and inevitably, some departures occur,” he said. “However, the situation has stabilised and the current teams are strong.”

A CT spokesperson said the acquisition brought together two business that were “genuinely complementary in both strengths and product sets” and that, despite the higher turnover this year, the team is “well-resourced”.

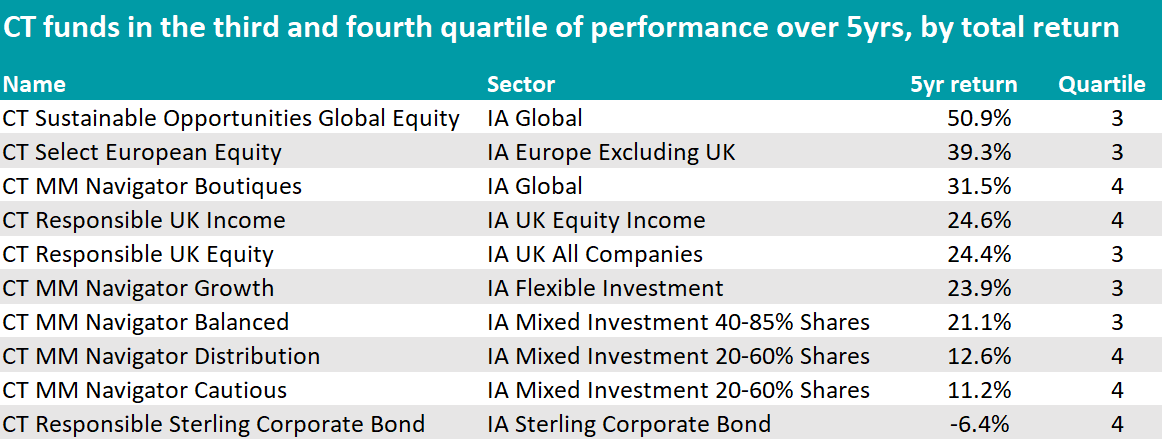

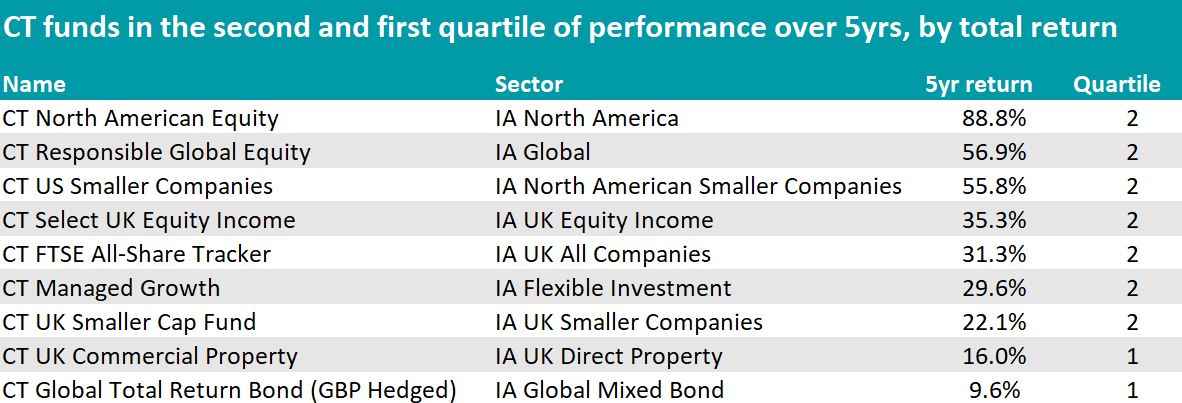

Turning to performance, the multi-asset team was among the worst-performing desks in the past five years, as the table below shows.

Source: FE Analytics

The CT MM Navigator Distribution and Cautious funds were close to the bottom of the IA Mixed Investment 20-60% Shares sector over the time frame.

McDermott said that for mixed-asset strategies and fixed income, he “tends to look elsewhere”.

However, Yearsley commended Keith Balmer and the team behind the multi-asset Universal MAP range, which is “very good” and charges “just 0.39% in fees”.

Among the less successful areas, fixed income was “definitely lacklustre”, according to Yearsley. “Bonds used to be a strong point years ago then [CT] seems to have lost its way a bit.”

For example, CT Responsible Sterling Corporate Bond has one of the worst track records among all CT funds, never having been able to rise above the fourth quartile of performance over the past 10, five and three years.

“UK equity income was a strong point at Threadneedle and again it feels like it’s slipped,” he continued. Here, CT Responsible UK Income came in in fourth quartile over five years, although it was in the second over the past decade and rose to the first over the past 12 months.

Many other CT strategies are working well for investors. The property team headed up by Marcus Phayre-Mudge is one of the largest pan-European real estate equity groups and is “top quality”, according to Yearsley, who highlighted CT Property Growth & Income and TR Property.

McDermott was also a fan of the “excellent” coverage of real estate investment trusts (REITs) through the TR Property investment trust and the suite of open-ended funds, including CT European Real Estate Securities.

The European franchise also has standouts, such as CT European Select and CT European Smaller Companies. The former, led by Ben Moore, has been “consistently strong” and represents a core European equities holding for McDermott.

“Moore’s patient approach has delivered some of the strongest returns in the sector, all while being less volatile than its peers,” he said.

The fund was previously managed by David Dudding, who has replicated his “strong” track record on a global scale with the Global Focus Strategy, a “hidden gem in the sector”, remaining relatively small in size despite consistently delivering “outstanding” performance, McDermott observed.

Source: FE Analytics

Both McDermott and FE Investments fund analyst Tom Green praised CT’s environmental, social and governance (ESG) funds. Green said he was impressed by Catherine Stanley, co-head of UK equities, and her colleagues’ stock-picking skills, as well as their ability to avoid “blow ups”. “Unlike most of her peers, the stock selection from Stanley’s team has been pretty good,” he said. “CT is very well resourced in the space.”

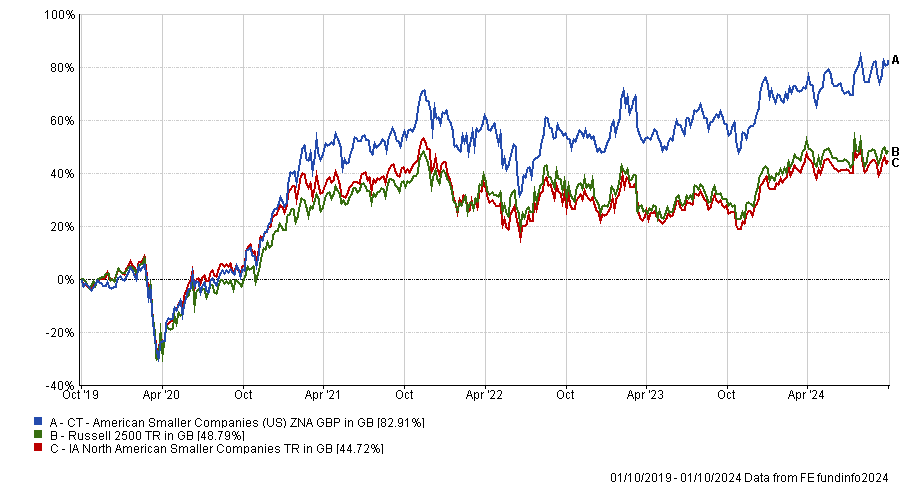

McDermott spoke highly of Nicolas Janvier, manager of the CT American Smaller Companies fund, who has delivered almost double the performance of the sector average.

Performance of fund versus sector and benchmark over 5yrs

Source: FE Analytics