Passive fund houses dominate the list of the 20 largest asset managers and are continuing to hoover up money, according to a report by the Thinking Ahead Institute, but most investors still back active managers.

BlackRock remains the world’s largest investment house, with some $10trn in assets under management (AUM), followed closely by Vanguard ($8.6trn).

Both groups are renowned for their passive options, but also house behemoth active management teams as well. They “remain significantly ahead of Fidelity Investments and State Street Global – ranked third and fourth respectively,” the report found.

Fund groups with both active and passive offerings dominated the top 20 firms, which include the likes of Fidelity Investment and JP Morgan Asset Management, as well as Invesco and Franklin Templeton.

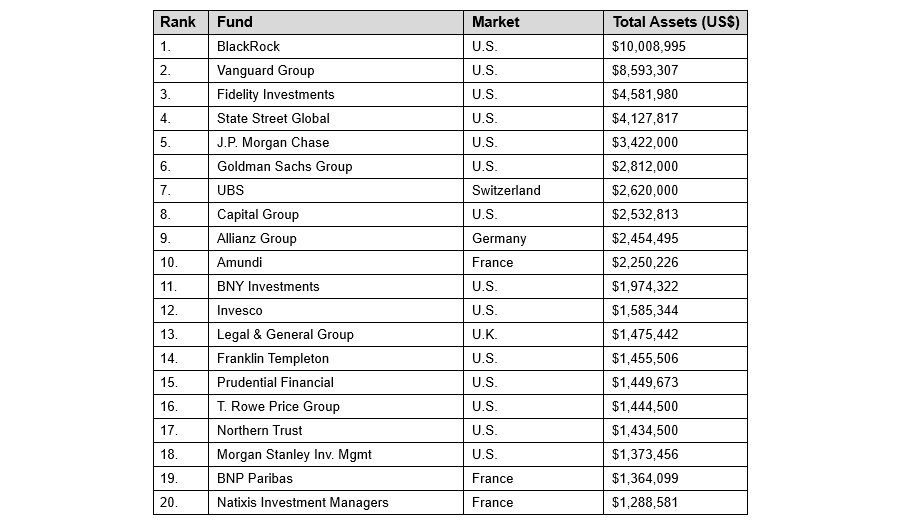

The list is dominated by US firms, which account for 14 of the top 20, as the below table shows. The only UK-based name on the list is Legal & General Investment Management, which comes in as the world’s 13th largest investment group.

Table of the world’s largest asset managers by AUM

Source: The Thinking Ahead Institute

Outside the top 10, notable risers in the past five years include Charles Schwab Investment, up 34 places to reach 25th place from 59th. Geode Capital Management, another firm in the US , is up 31 places to 23rd from 54th, while Canada’s Brookfield Asset Management is up 29 places from 60th to 31st.

Jessica Gao, director at the Thinking Ahead Institute, said: “Asset managers continue to face major pressure to evolve their own business models. Investment in technology remains essential not just to maintain a market edge, but also to meet evolving client requirements and expectations in reporting and customer service.

“Increased competition, fee compression, and the growing demand for more personalised, technology-driven investment solutions are challenging traditional structures.”

Combined, the 20 biggest firms run some $58.4trn. Extending this to the largest 500 firms in the world, this figure hit $128trn by the end of 2023, a 12.5% increase compared with 2022. It comes after the AUM of the top 500 firms dropped 13.7% in the previous year.

The report found that a third of fund managers’ combined assets are invested in passive vehicles (33.7%), while 66.3% is placed with active managers.

Gao noted: “We have continued to see net flows into passive strategies as they continue to offer a compelling value proposition, particularly in terms of lower fees and simplicity.

“Yet growing market volatility and issues with concentration, which typically highlights the need for expertise to outperform benchmarks, may be a source of caution from some allocators.”

The most popular asset class is equities, which account for 48.3% of total AUM. Bonds are in second place at 29%, giving a combined 77.3%. However this is 0.2 percentage points lower than in 2022, as investors have turned to alternatives such as private equity.

Given the rise of the ‘Magnificent Seven’ in the US, most money has flown to America, which now accounts for 60.8% of the total AUM amongst the top 500 managers, 15% higher than the previous year.