More than a quarter of a million savers who put their cash with National Savings & Investments (NS&I) will miss out on a win in December after the popular savings vehicle cut the rate on its flagship product.

The prize fund rate for Premium Bonds will fall to 4.15% tax-free for the December draw from 4.4% previously.

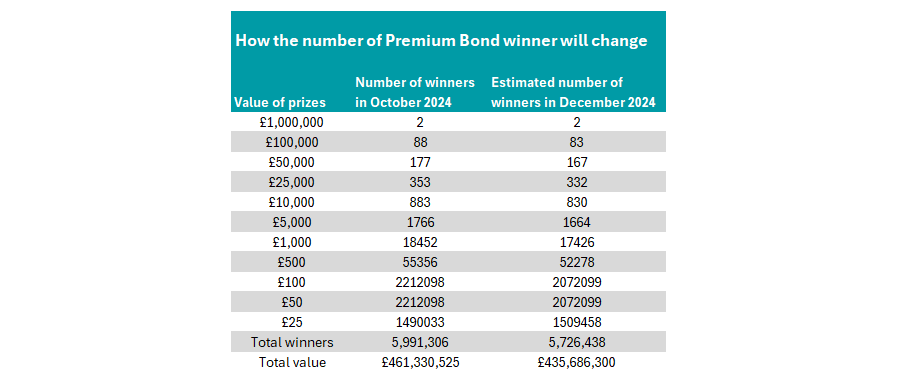

In total, there will be around 265,000 fewer prize winners in December’s Premium Bonds draw, with the odds of winning a prize decreasing to 22,000 to one, from 21,000 to one.

The December Premium Bonds draw is expected to pay out more than 5.7 million prizes from a fund worth at least £435m, down from the almost six million prizes and £461m prize pool in the October draw.

The number of £1m jackpots remains the same (two) but the 83 prizes worth £100,000 is five fewer than in October, as the below table shows.

Source: NS&I

NS&I also announced that interest rates for its Direct Saver and Income Bonds will fall from 20 November. These moves follow the Bank of England’s decision to cut interest rates in August for the first time in four years.

The interest rate for Direct Saver will be lowered to 3.75% gross/AER (annual equivalent rate) on 20 November, down from 4% gross/AER. Income Bonds will drop to 3.69% gross/3.75% AER from 3.93% gross/4% AER.

Andrew Westhead, NS&I retail director, said: “As the savings market continues to change, we need to lower the rates on some of our products to help us meet our net financing target, while also ensuring we continue to balance the interests of our savers, taxpayers and the broader financial services sector.”

The savings provider also unveiled a new two-year issue of British Savings Bonds, going on sale today. The Guaranteed Growth Bond offers a 4.10% gross interest rate, while the Guaranteed Income option has an AER of 4.09% and a gross interest rate of 4.02%.