October was gold funds’ time to shine after a new record high for the yellow metal caused them to surge up the performance tables, FE fundinfo data shows.

Ben Yearsley, director at Fairview Investing, described October as “another fascinating month”, with the UK Budget causing volatility in the gilt market, banks like HSBC and Standard Chartered reporting strong earnings, and mixed results from the US tech sector putting their “sky high valuations” under the spotlight.

“Looking at indices, it was a pretty drab affair last month. It was all a bit turgid with the only bright spot being Japan where the Topix gained 2.19% despite an inconclusive general election result with the ruling LDP under new prime minister Ishiba recording the second worst result in their history,” he said.

“The FTSE, in anticipation of this week’s Budget, fell 1.45% placing it mid table. After the Chinese supercharged September, it was no wonder October was a bit flat – Beijing can’t keep up the stimulus the market demands.”

Source: FinXL

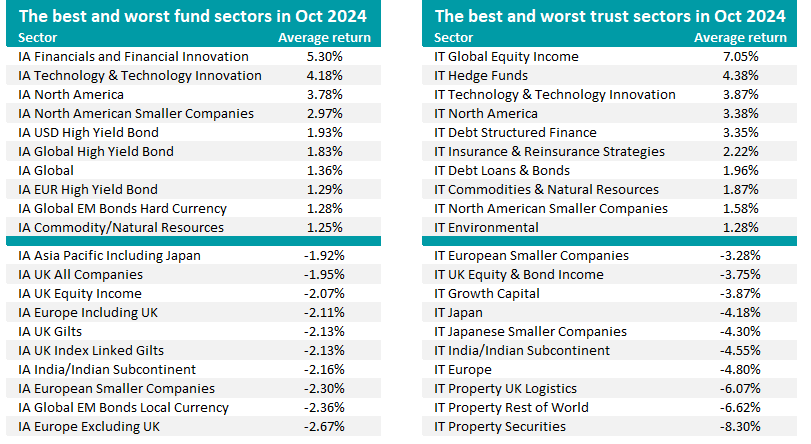

When it comes to the best and worst fund sectors of the month, the IA Financials and Financial Innovation peer group led the Investment Association universe with an average return of 5.3%. This was in part due to those strong earnings from banks during October.

IA Financials and Financial Innovation is the strongest Investment Association sector over 2024 so far thanks to an average return of 17.3%.

The IA Technology & Technology Innovation came in second place during October, followed by three peer groups focused on US assets (IA North America, IA North American Smaller Companies, IA USD High Yield Bond).

Yearsley put this down to “a strong dollar and weak pound boosting returns” in US-focused funds. “Currency was an important factor in returns last month with the US dollar performing strongly after a weak few months,” he added.

The IA Europe Excluding UK sector comes at the bottom of October’s leaderboard, as its average member made a 2.7% loss, while IA European Smaller Companies was the third worst. Europe has struggled of late, with the German economy flirting with recession and companies such as VW closing factories.

IA UK Gilts and IA UK Index Linked Gilts were also among the worst sectors after the gilt market was hit with volatility around the Autumn Budget, which saw chancellor Rachel Reeves hike taxes by £40bn while promising higher government spending.

In the investment trust universe, IT Global Equity Income led the month with an average return of 7.1% driven by the stronger dollar. Like in the open-ended peer groups, strategies investing in tech and US stocks also performed strongly.

Property, Europe and Indian trusts were among the worst performers.

Source: FinXL

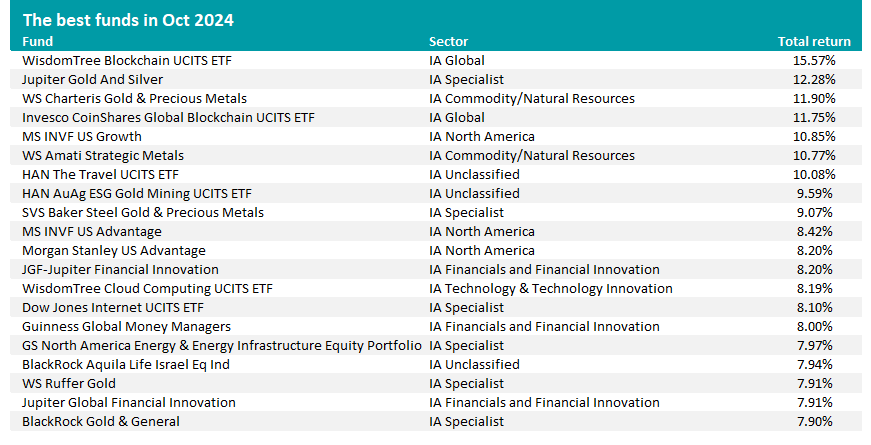

Turning to individual funds, WisdomTree Blockchain UCITS ETF made October’s highest returns with a gain of 15.6%. Similarly, Invesco CoinShares Global Blockchain UCITS ETF was up 11.8%.

The outperformance of these ETFs is linked to the strong gains made by cryptocurrencies last month, with bitcoin passing $71,000 and nearing a new record high.

However, the big story among funds for Yearsley was gold and other precious metals, which have been rallying in recent months. Gold started October at $2,654 an ounce but passed the $2,800 mark; it fell back slightly to end the month at $2,749.

“Gold funds were the pretty clear winner in October – unsurprising with gold hitting another new all time high. Silver has joined in the rally too meaning it was gold and precious metals that delivered. Four of the top 10 funds were gold and precious metals with more in the top 20,” he noted.

“Gold has been a clear winner in 2024 with falling interest rates and geopolitics a clear driver. Gold equities had felt like they were lagging the actual price of physical gold, but it does seem as if equities are coming to the party now.”

Jupiter Gold And Silver, WS Charteris Gold & Precious Metals, HAN AuAg ESG Gold Mining UCITS ETF, SVS Baker Steel Gold & Precious Metals, WS Ruffer Gold and BlackRock Gold & General are among the month’s best funds.

The strong performance of financials is reflected by the presence of Guinness Global Money Managers and Jupiter Global Financial Innovation in the top 20 while WisdomTree Cloud Computing UCITS ETF and Dow Jones Internet UCITS ETF show investors’ continued interest in tech stocks despite high valuations.

Among investment trusts, Tetragon Financial was the best performer in October with a 35.5% total return. The trust focuses on alternative assets, investing in opportunities such as private equity stakes in asset management companies, venture capital and hedge funds.

British & American was up 23.9% while Atrato Onsite Energy gained 18.6% after a takeover bid was announced.

Source: FinXL

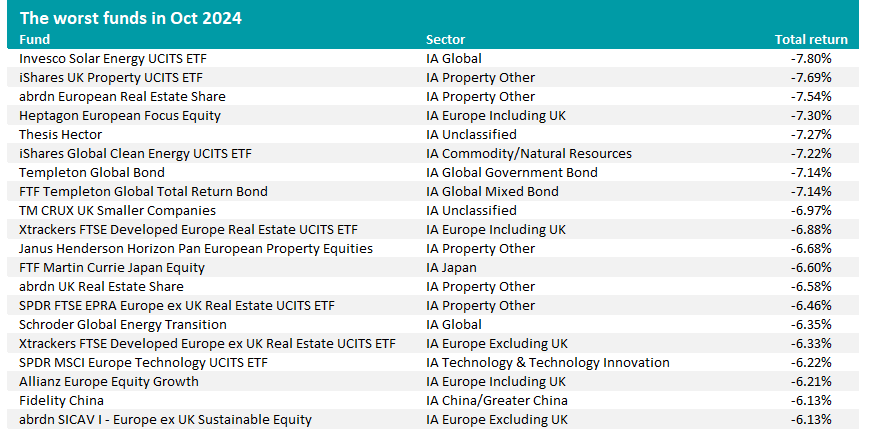

A couple of themes are also apparent among the worst performing funds of October.

Invesco Solar Energy UCITS ETF has hit with the heaviest loss, falling 7.8% over the course of the month. Other funds investing in similar stocks can be seen in the list of last month’s worst performers, including iShares Global Clean Energy UCITS ETF and Schroder Global Energy Transition.

There are also plenty of property funds among the month’s worst performers, such as iShares UK Property UCITS ETF, abrdn European Real Estate Share, Xtrackers FTSE Developed Europe Real Estate UCITS ETF, Janus Henderson Horizon Pan European Property Equities and abrdn UK Real Estate Share.