Shoot-the-lights-out equity funds are all well and good in a bull market but they can drop dramatically and suddenly when the tide turns. Therefore many fund selectors seek to balance high-octane investments with more conservative and diversified multi-asset funds.

Although defensive funds won’t necessarily maximise returns, they should protect capital during downturns. To that end, Trustnet asked fund selectors which multi-asset strategies they use to complement equities and bring down portfolio volatility.

Troy's Trojan fund and its ethical sibling

Laith Khalaf, head of investment analysis at AJ Bell, said Troy Asset Management’s Trojan fund is a good option for cautious investors who want some growth to combat inflation while mitigating market volatility.

FE fundinfo Alpha Manager Sebastian Lyon and Charlotte Yonge build the fund around four pillars of quality: equities, index-linked bonds, gold and cash, with – like all of Troy’s funds – an emphasis on capital preservation above all else.

“Within the equity portion of the portfolio, the managers take a conservative approach, opting for large, liquid companies with robust balance sheets and quality characteristics,” Khalaf said.

IBOSS Asset Management added stablemate Trojan Ethical to its global equity portfolio a year ago to add some downside protection and lower the portfolio’s beta, which had been rising. Trojan Ethical has a beta of 0.28 to the IA Global sector due to its diversified portfolio, including a 29% allocation to money markets.

Chris Metcalfe, chief investment officer of IBOSS, said Trojan Ethical tends to perform well in relative terms during weeks when global equity markets stumble and complements higher octane strategies such as Rathbone Global Opportunities.

Metcalfe also wanted to gain more exposure to gold, which he correctly anticipated would perform well once monetary policy easing got underway (because gold doesn’t have an income so is sometimes seen as less appealing than other asset classes when interest rates are rising).

Trojan Ethical has 13% in gold – IBOSS’ second-largest exposure to the yellow metal, after the Ninety One Global Gold fund.

Gold is being propped up by buyers who are not price sensitive, such as central banks trying to diversify their exposure away from the US. As geopolitical tensions increase, it is the ultimate safe haven, he said.

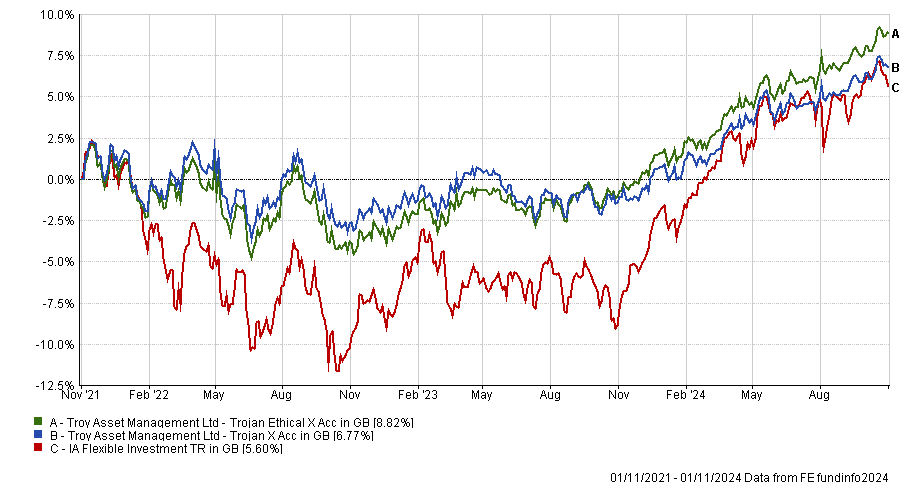

Performance of funds vs sector over 3yrs

Source: FE Analytics

Latitude Horizon

Latitude Horizon has a structural equity weighting of 50% with the remainder invested in a variety of fixed income securities, commodities and currency exposures.

Joe Holland, assistant investment manager at Tyndall Investment Management, said: “The equity portion of the portfolio focuses on defensive global equities with low unit sizes; currently no equity holding exceeds 3%. These companies tend to be firms that are able to maintain or grow earnings despite wider financial conditions.”

For instance, the fund recently invested in United Health, a market leader in a defensive growth industry, which grew its earnings at 18% per annum from 2000 to 2023.

The other half of the portfolio is flexible and its exposures vary, depending on where manager Freddie Lait finds the best risk-adjusted returns. He also attempts to hedge some of the risks within the equity part of the portfolio. The fund currently holds 11% in long-dated bonds, 12% in short-dated gilts and 28% in short-dated bonds.

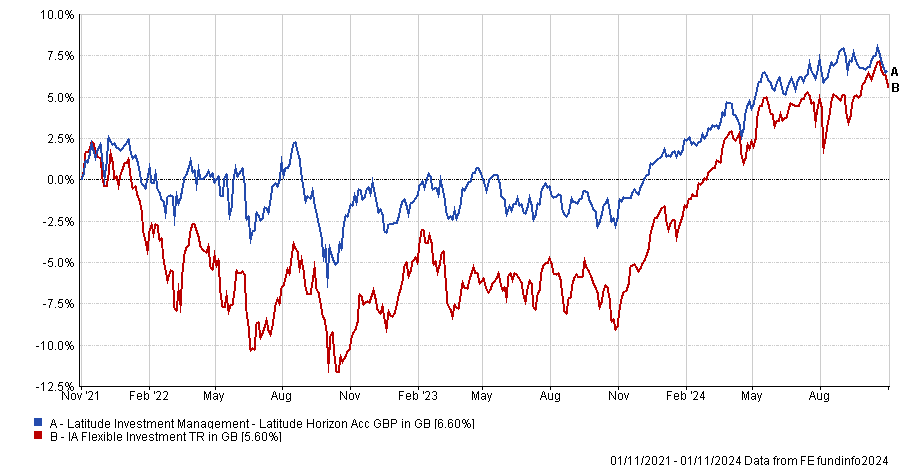

Performance of fund vs sector over 3yrs

Source: FE Analytics

“We like it because the equity element provides a defensive exposure to equity movements, whilst the non-equity element of the portfolio should help insulate it from the worst of any falls,” Holland concluded.

Winton Trend

Winton Trend employs a rules-based investment strategy, designed to profit from medium-term price trends, both up and down, in equity indices, government bonds, interest rates, currencies and commodities.

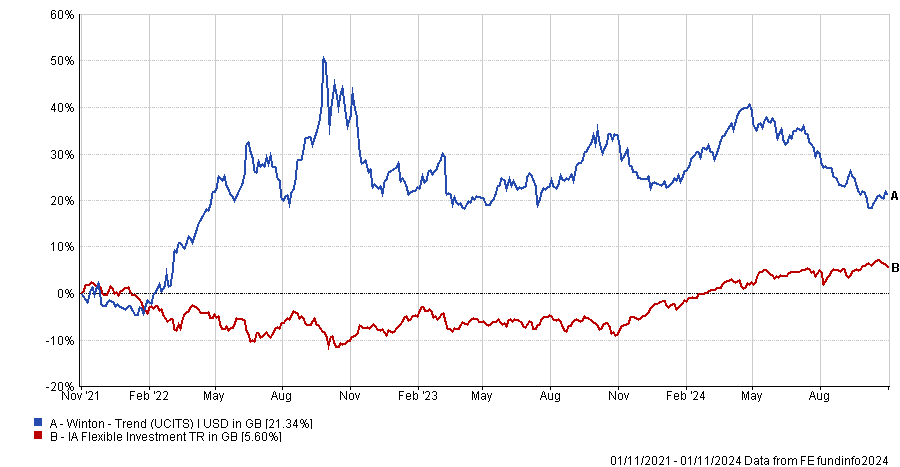

Performance of fund vs sector over 3yrs

Source: FE Analytics

Rob Burgeman, investment manager at RBC Brewin Dolphin, said: “The fund aims to generate capital appreciation over the long term, regardless of whether markets are rising or falling, making it complementary for traditional stock market and bond investments.

“It is reasonably uncorrelated with traditional equity markets and can suffer drawdowns when markets switch suddenly. However, these tend to be relatively modest, making this a good diversifier for portfolios and a reasonable source of liquidity when required.”