Microsoft’s shares fell 3.9% in pre-market trading after its results revealed slower than expected growth for its Azure cloud computing business. Meanwhile Tesla shares initially slumped but were up 2.5% in pre-market trading at the time of writing.

Despite the market’s muted reaction, Microsoft beat estimates for sales and earnings for the third quarter in a row, said Dan Coatsworth, investment analyst at AJ Bell. “It’s no longer enough to beat expectations; investors want the world from Microsoft and failure to deliver means the share price risks going down.”

Its fiscal second quarter revenue marked a 12% rise compared to the same period last year, beating analysts’ expectations of $68.9bn. Net income was 10% higher at $24.1bn, whereas analysts had predicted $23.5bn.

However, although sales at Azure cloud division climbed 21% to $40.9bn, analysts had hoped for more and were anticipating $41.1bn.

Other areas of the business are struggling. Gaming revenue declined by 7% and Xbox hardware revenue fell 29%. “The gaming industry has been going through a hard time since getting a temporary boost during the Covid-19 pandemic. Microsoft seems to now be focusing more on games rather than pushing hardware,” Coatsworth said.

Share price of Microsoft over 5 days

Source: Google Finance

Another concern for investors in Microsoft and some of the other tech giants such as Meta Platforms is their colossal spending commitments. Microsoft plans to invest about $80bn during its 2025 fiscal year on data centres, artificial intelligence (AI) and cloud applications.

This is why Stephen Yiu, manager of the Blue Whale Growth fund, reduced his exposure to Microsoft and Meta late last year and has a more positive view on the recipients of this spending, such as Nvidia and Broadcom.

Furthermore, tech stocks were roiled at the start of this week by the launch of DeepSeek – a Chinese AI app developed at a fraction of the cost of competitors using older, reduced-capacity Nvidia chips. DeepSeek is a competitor to ChatGTP developer OpenAI, in which Microsoft is a major investor.

Coatsworth said DeepSeek’s breakthrough in bringing down the costs and barriers to entry for AI could ultimately play into Microsoft’s hands. “Microsoft’s army of software services are well positioned to help users embrace AI and it’s in the front pack of contenders to win the race,” he said.

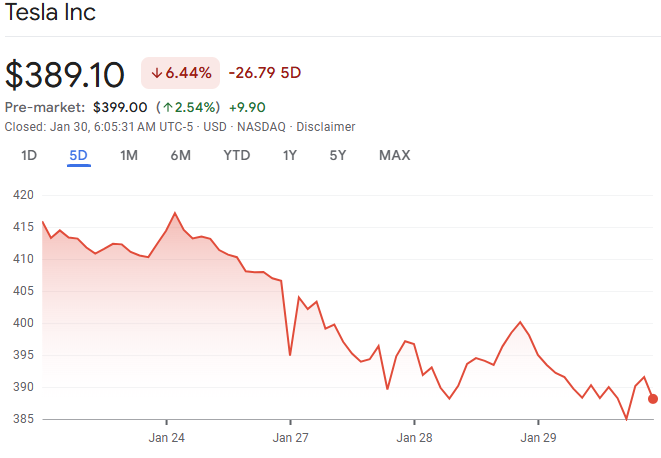

Unlike Microsoft, Tesla’s fourth quarter earnings and revenue came in below market expectations, which initially sent the share price lower. However, shares began to climb again after Elon Musk predicted “an epic 2026 and a ridiculous 2027 and 2028” during an analyst conference call.

Share price of Tesla over 5 days

Source: Google Finance

Coatsworth said: “Tesla has now missed earnings expectations in five out of the past six quarters. The electric vehicle industry has spluttered over the past year or so as take-up has been slower than expected. At the same time, companies like Tesla, which had enjoyed a first-mover advantage, have seen the emergence of serious competition.

“This cocktail of events has made life very hard and put pressure on Tesla to fight it out through price cuts, new models and more favourable financing deals.”

Tesla’s shares have performed strongly since Donald Trump, with whom Musk has a close relationship, won the US presidential election. Yet Coatsworth is concerned that Musk – who is co-leading the Department of Government Efficiency (DOGE) – is spending too much time on politics and not enough on his day job.

“The fact politics appears to be taking the front seat for Musk complicates Tesla’s investment case,” he said.

“Bulls might argue that his elevated political status in the US could be advantageous to Tesla if Musk is with the ‘in-crowd’ of people deciding the rules of the country. Bears might argue that political involvement means Musk is spreading himself more thinly than before, with too many interests, and that his political interests aren’t limited to the US which means even more uncertainty.”