Savers who try their luck with Premium Bonds, the popular prize-draw product by the National Savings & Investments (NS&I) bank, will be in for a smaller annual average prize of 3.8% from April. This is down from the 4.0% introduced last month, when it was cut from the previous 4.15%.

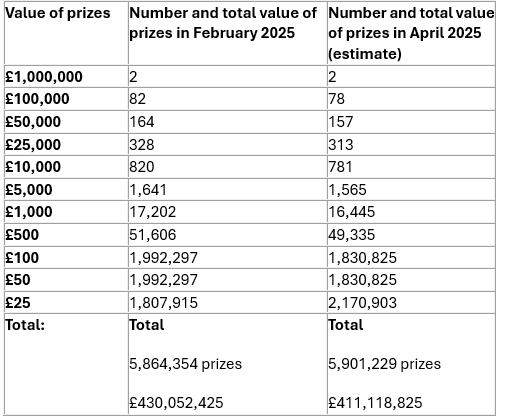

The total prize money is now £411,118,825 – a decrease of £18.9m compared to the last draw, to be split between 5,901,229 prizes (up from 5,864,354). The odds of winning will remain at 22,000 to 1, but there will be an estimated 20% more prizes worth just £25, while the number of higher wins will drop significantly. There will be 8% fewer prizes worth £50 and £100, and more than 4% fewer prizes for each of the other amounts, as the numbers in the table below show. Two lucky people among the over 24 million who own Premium Bonds will win £1m.

Number and value of Premium Bonds prizes

Source: NS&I

The rate on other NS&I products is changing too, with the Direct ISA account now yielding a gross 3.5% from today, up from the previous 3.0%, and a reduced rate on the Direct Saver (3.3% instead of 3.5%) and Income Bonds (3.26% instead of 3.44%) accounts from 5 March 2025.

Andrew Westhead, NS&I retail director, said: “We regularly review our products to ensure they reflect current market conditions. The changes we are making to Premium Bonds, Direct Saver and Income Bonds rates enable us to continue to balance the interests of savers, taxpayers and the stability of the broader financial services sector.”

“Even with the change to the Premium Bonds prize fund rate, we are expecting more than 5.9 million tax-free prizes worth over £411 million to be won in the April 2025 draw.”

Laura Suter, director of personal finance at AJ Bell, said savers with money in Premium Bonds should "take a step back and consider whether they’re really getting the best deal".

"While the prize draw element is appealing, the reality is that many Premium Bond holders will never win a prize and the average return is far lower than what’s available in the top easy-access savings accounts. For those who want certainty on their returns, a traditional savings account could be a smarter choice."

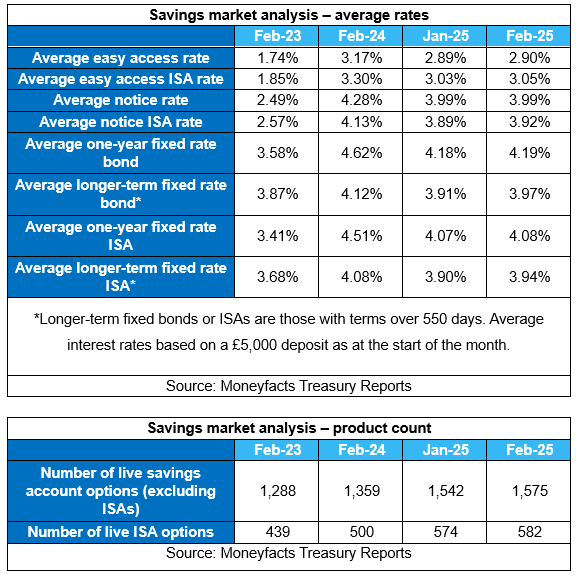

At present, savers who prefer cash returns can benefit from a “buoyant” savings market, according to Rachel Springall, finance expert at Moneyfacts.

The average easy access ISA rate rose to 3.05% month-on-month, its first rise since last August, data from Moneyfacts’ UK Savings Trends Treasury Report has shown. Those who can afford to lock their money in for one year can get an improved average yield of 4.19%, the first rise since last July.

The report has also shown a record-breaking choice of Cash ISAs. As the end of the 2024/25 tax-year edges closer, now is the time for savers to ensure they are taking full advantage of their ISA allowances, said Springall, as providers “have been working hard to inject some healthy competition to entice deposits”.

Suter agreed. She said: "ISA season is in full flow, and competition in the ISA market is red hot. For savers who have unused ISA allowance and want to protect their cash from tax, now is the time to pounce. Choice in the ISA market has hit a record high.

"Cash ISAs are now the top-paying accounts in the easy-access market, eclipsing the interest rates on offer from non-ISA accounts. This reflects the fact that lots more people are using ISAs to avoid tax bills on their savings interest. Savers put almost £50bn into Cash ISAs in 2024, according to Bank of England figures, and that trend will almost certainly be continuing this year."