The Liontrust UK Smaller Companies fund was one of the most-sold UK strategies of 2024, with £202m in outflows throughout the year, yet two experts out of three think it might still have something to offer to investors who choose to stick with it.

Run by the Liontrust Economic Advantage team, which was founded by FE fundinfo Alpha Managers Anthony Cross and Julian Fosh (the latter of which retired in January after an illness), the fund invests in businesses believed to have distinct competitive advantages that allows them to continue to grow.

The strategy has outperformed in seven of the past 10 years, becoming one of the most consistent regional small-cap funds of the decade, yet it failed to maintain its long-term track record, falling to the second and then third quartile of the IA UK Smaller Companies sector over five and three years respectively and ranking 41st out of 44 funds over 12 months, as recently reported on Trustnet.

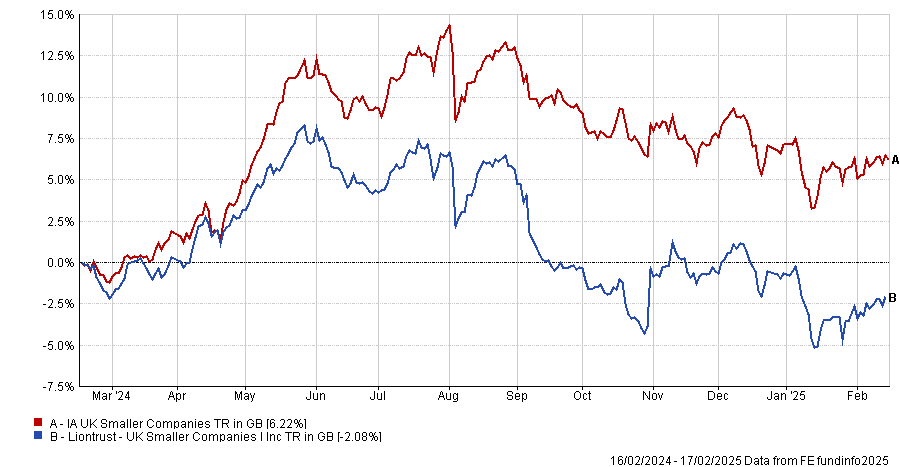

Performance of fund against sector over 1yr

Source: FE Analytics

The fund tends to have a quality rather than cyclical bias according RSMR analysts, who rank it for its “well-defined process and its consistent implementation”, “very credible” performance numbers and for being different from most UK smaller companies funds, enabling it to be used as “a genuine diversifier” in UK equity portfolios.

In February, the strategy was also awarded a ‘Hidden Value’ ranking (reviewed monthly) by analysts at FundExpert, a label which indicates that a fund has certain qualities “not fully reflected in short-term performance or momentum”.

Dennehy Wealth (owner of FundExpert) discretionary investment manager Joe Richardson explained: “Hidden Value is about spotting opportunities where the market may be underestimating a fund’s future potential. This might be certain types of funds, such as value-style funds in UK and emerging market equities in 2020.”

The Liontrust portfolio is therefore highlighted for investors who are ready to focus on what is cheap, taking a longer view, said Richardson.

He noted the case for UK small-caps is “strong” given the trajectory of interest rates now in the UK seems to be lower, while valuations are also at the lower end.

For the Liontrust UK Smaller Companies fund specifically, he noted it is a long-term outperformer – nearly doubling the sector average over 10 years and since inception.

Darius McDermott, managing director at FundCalibre, agreed. To him, the fund is a ‘buy’ thanks to the team’s “exceptional” long-term track record.

“While Fosh’s departure was a setback for the broader Liontrust UK franchise, its impact on this fund has been minimal as his focus was primarily on large-caps. Continuity remains strong with Cross, who has managed the fund since 1998,” he said.

McDermott also lauded the rest of the team. Small-cap specialists Victoria Stevens and Matthew Tonge have been co-managers on the fund since 2015 and have been joined since by Natalie Bell, who brings sell-side experience, and Alex Game, formerly a fund manager at UK equity specialist Unicorn Asset Management.

“While returns in recent years have softened amid the UK’s tilt toward value, history suggests that when growth stocks and UK smaller companies regain favour, this fund’s experienced team will be well-positioned to outperform,” he concluded.

A complete opposite view was offered by Chris Metcalfe, managing director at iBoss, who decided “with a heavy heart” at the beginning of the year not to hold UK smaller companies funds in his portfolios.

His rationale for this was that many vehicles in this space have lost anything up to 60% of their assets over the past three years (with a few exceptions, such as the Fidelity UK Smaller Companies and Artemis UK Smaller Companies funds), as the chart below shows.

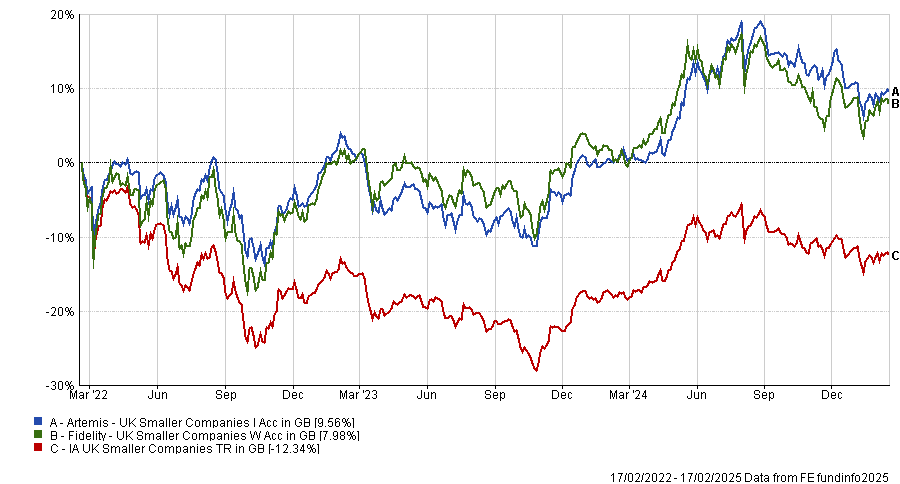

Performance of funds against sector over 3yrs

Source: FE Analytics

Metcalfe lamented a constant selling pressure making life more difficult for fund managers in the asset class, which has led him to invest in smaller UK companies via all-cap funds, which haven't fared particularly better in terms of fund flows but have come with fewer liquidity issues as they also own some of the larger names in the domestic market.

He also said that in the case of Liontrust, it is “almost impossible to quantify how much of the performance is down to Fosh’s influence”.

“The fund produced stellar returns from the end of the great financial crisis in 2008 until 2019, but since then, its has been more in line with the peer group,” he said.

“We know the UK has faced growing challenges ever since the Brexit vote, and smaller companies have felt this more acutely than their larger peers. The period we put the most importance on for UK funds is the one following the [Liz] Truss budget, which turned out to be a low point for both sterling and UK sentiment.”

During this time, the fund that performed the best, which now runs for nearly two and a half years, is the JPM UK Smaller Companies fund, managed by managers Georgina Brittain and Katen Patel.

“If we were to revisit the UK smaller companies sector, it would potentially be a fund such as this where the managers have been in place for several years, as this takes out some of the uncertainty of which managers in the team was adding the most alpha,” concluded Metcalfe.