Donald Trump’s tariffs have unleashed a wave of uncertainty and volatility in financial markets.

Yesterday afternoon, the US president announced a 90-day pause on reciprocal tariffs and a blanket rate of 10% for all countries except China, whose tariffs were raised to 125%.

After suffering steep losses since ‘Liberation Day’ on 2 April, US equity markets leapt upwards in a relief rally. It’s enough to give investors whiplash.

Remaining invested in equities at the moment – through days of severe losses then unexpected rebounds and an overall atmosphere of unpredictability – can be scary.

But selling out of stocks when markets are volatile is precisely the wrong thing to do, said Duncan Lamont, head of strategic research at Schroders. Selling during falling markets risks crystallising losses, which leads to lower returns over the long term.

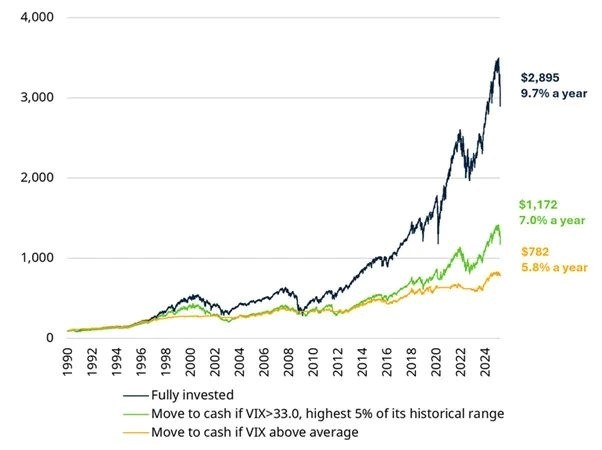

In a bid to reassure investors, Lamont looked at market volatility since 1990 and found that if investors had sold out of US equities (the S&P 500) and moved into cash whenever markets were volatile, then shifted back into stocks after markets calmed, they would have returned 7% a year before costs.

Had they stayed the course and remained invested in equities, they would have achieved 9.7% per annum before costs.

He judged markets to be volatile if the CBOE Volatility index – known as the VIX or ‘fear gauge’ – was above 33, a level it has only exceeded 5% of the time. On Friday 4 April, it closed at 45, well above its long-term average of 19.

Growth of $100 fully invested in stocks vs switch to cash when VIX high

Sources: CBOE, LSEG Datastream, Schroders

Furthermore, by selling equities when markets fall, investors could rob themselves of the chance to profit if markets bounce back unexpectedly – as yesterday’s events illustrate.

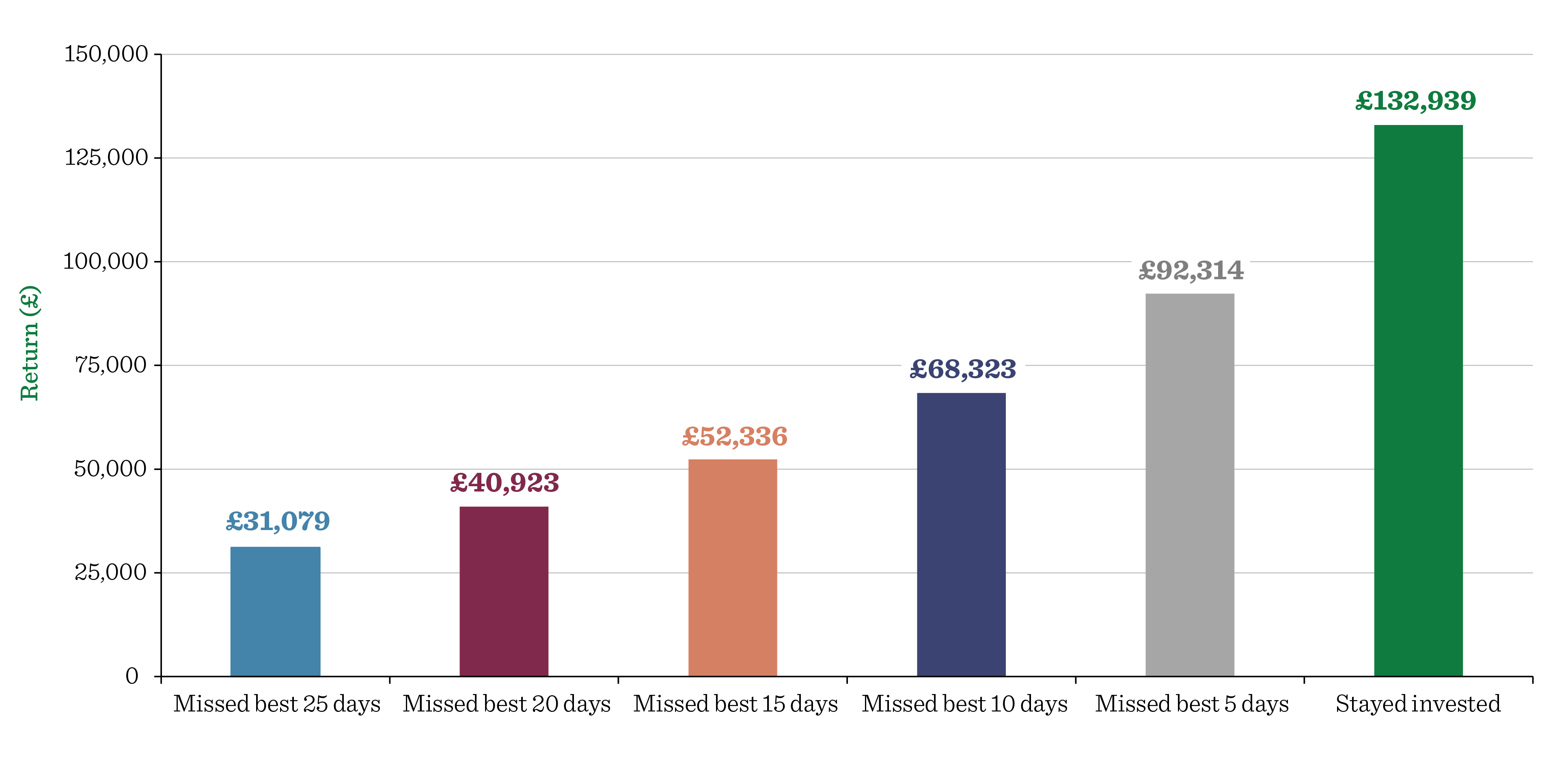

Marcus Brookes, chief investment officer at Quilter Investors, said: “The best days often follow the worst, so it is most important to make a plan, stick to it and don’t try to time the market.

“Being out of the market for just a few days can have a devastating effect on returns and the numbers proving this are stark.”

The impact of missing the market’s best days

Source: Quilter Investors, data to 31 Dec 2024

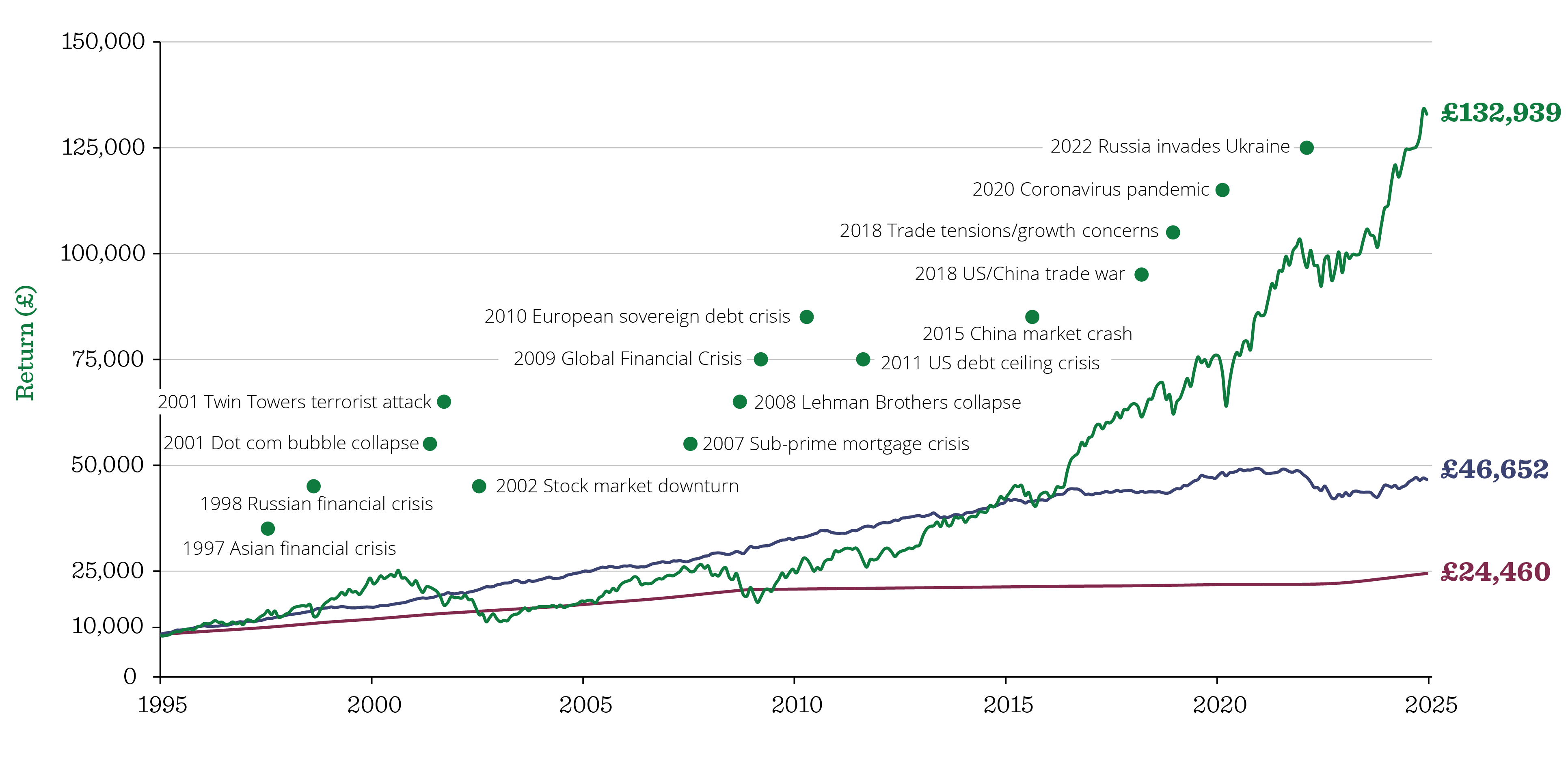

Tom Stevenson, investment director at Fidelity International, seconded that. “Looking at the 10 biggest one-day falls for the FTSE 100 since 2000, history shows that investors have typically enjoyed positive returns in the years that followed – even when short-term performance was rocky,” he said.

“After the Covid crash in March 2020, for instance, the index rose nearly 60% over three years. Even after steep declines of the global financial crisis, markets bounced back strongly.”

In the meantime, investors can reduce the impact of volatility on their portfolios by using market falls as buying opportunities or drip-feeding money regularly into the stock market, Brookes said.

“What happens after [Trump’s tariff pause], or during for that matter, is anyone’s guess and as such investors shouldn’t get used to the sugar high markets have reacted with. These sorts of market issues require calm heads and cool hands, so for investors, patience is key. Drip feeding money into investments is the best way to ride out this period of volatility and ensuring your portfolio is in good shape once things settle down again,” he explained.

He also recommended that investors use time to their advantage. “The sooner you can start investing and the longer you can invest, the more likely you are to have the potential for healthy returns and achieve your financial goals, regardless of short-term blips,” he said.

The stock market has ridden out past crises

Source: Quilter Investors, data to 31 Dec 2024

Equity markets rise over time but they do not do so in a straight line. Volatility – although difficult to stomach – is par for the course. According to Lamont, the stock market tends to fall by 20% once every four years and by 10% at some point during most years.

Stevenson added: “The price we pay for the long-run outperformance of equities compared with apparently safer assets such as bonds and cash is the volatility of the stock market. But the longer-term returns only accrue to investors who are able to hold their nerve during moments of market dislocation, who avoid crystallising losses by selling after sharp falls, and even take advantage of market falls to top up their holdings at attractive prices.”

Tom Selby, director of public policy at AJ Bell, evoked Rudyard Kipling’s poem, ‘If’, to make a similar point. “[Stock market] instability can be deeply unsettling for savers and retirees, who may log into their pensions account and see a big fall in the value of their fund. But calm at this moment, when those in the highest offices appear to be losing theirs, is the order of the day,” he said.

Don’t dash for cash

Although it may be tempting to stockpile cash in order to preserve wealth when financial markets are volatile, there is an inherent danger in leaving your money languishing in cash for years.

A cash savings account may seem like a safe bet, Brookes said, “but it is anything but”.

“Inflation of just 3%, just a fraction above the current rate of 2.8% in the UK, would see £10,000 almost halve over 25 years. So £10,000 today would only have the purchasing power of £5,537 in 25 years’ time,” he noted.

Tariffs, even at these lower levels, are expected to put prices up and could cause a fresh bout of inflation. In this scenario, “equities offer investors the best chance to beat inflation and protect their wealth over the long-term,” Brookes said.

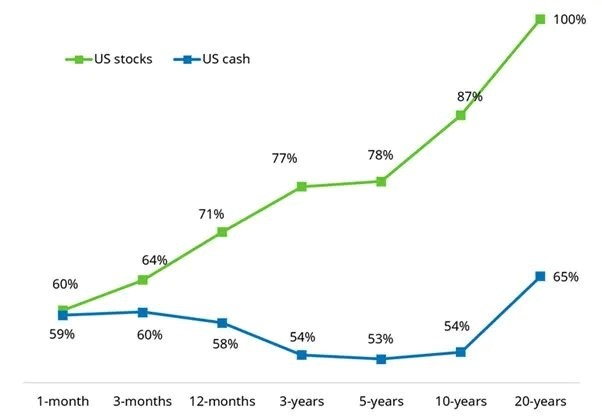

Lamont added that equities are very risky in the short-term but less so in the long run, whereas cash is the exact opposite.

Using almost 100 years of data on the US stock market, Schroders found that equities have a 60% chance of beating inflation over one month – a similar success rate to cash. But over 12 months, equities beat inflation 70% of the time. That rises to 80% over five years and almost 90% over 10 years, as the chart below shows.

Percentage of time periods where US stocks and cash have beaten inflation 1926-2024

Sources: Schroders, Morningstar Direct, CFA Institute and Ibbotson; stocks represented by Ibbotson SBBI US Large-Cap Stocks, cash by Ibbotson US (30-day) Treasury Bills, data to Dec 2024.

“There have been no 20-year periods in our analysis when stocks have failed to beat inflation,” Lamont concluded.