Capital Gearing, Personal Assets and Ruffer Investment Company could all be used by investors as safe havens during the current tariff crisis, according to investment company selectors.

Although US president Donald Trump has paused the bulk of his ‘Liberation Day’ tariffs, some are still concerned that uncertainty could cause markets to remain choppy in the coming days, weeks and months.

As such, looking to add some defensive positioning to a portfolio makes sense for those uncomfortable with large falls. Below, analysts reveal their top trust picks for a turbulent world.

Multi-asset, defensive trusts

Ewan Lovett-Turner, head of investment companies research at Deutsche Numis, described Capital Gearing, Personal Assets, Ruffer and BH Macro as “safe havens in a storm”.

Capital Gearing and Personal Assets benefit from their inflation-linked bond allocations and the latter’s gold exposure has performed well in recent months, while Ruffer employs several market hedges, he said.

“In addition, we believe the multi-asset approach of RIT Capital Partners, combined with a circa 30% discount, should make it attractive in this environment,” he added.

BH Macro and Ruffer enjoyed share price gains this month as most other stocks and trusts were falling, said William Heathcoat Amory, managing partner at Kepler Partners.

“They have proven to be negatively correlated with equity market moves over the past few days; share prices were up 5% and 3% respectively over the five days to market close on 9 April,” he said.

Ruffer invests in stocks (including Chinese equities) but also protection assets such as the yen. “It benefited in March as credit spreads widened and this would have continued so far in April. Ruffer has long viewed the compressed level of spreads as a clear sign of investor complacency, meaning even minor disruptions could push them wider,” Heathcoat Amory said.

Investec has ‘buy’ recommendations for Capital Gearing, Personal Assets, BH Macro and Ruffer.

Of the four, Ruffer and BH Macro have greater toolkits and portfolio flexibility, which should leave them well-placed if the risk-off move intensifies, said analysts Elliott Hardy, Alan Brierley and Ben Newell.

“Ruffer’s use of illiquid strategies and options (now 13.2% of NAV) is a core differentiating feature. During risk-off environments, the protection strategies have proven to be critical in preserving capital, with the fund achieving an inverse correlation with global equities,” Investec’s analysts said.

“Since the start of 2020 to 31 March 2025, protection strategies have contributed 18% to performance, including 7.1% from credit, 6.8% from swaptions, 3.2% from VIX call options and 1% from equity downside put options.”

BH Macro, which aims to deliver steady returns uncorrelated to equities, is also worth considering while markets are volatile, they noted. “During times of elevated market distress, the correlation with equities has inverted and been most pronounced,” they said.

By contrast, Capital Gearing and Personal Assets have more vanilla portfolios, which are easier to understand, with no exposure to derivatives and commensurately lower charges, the Investec analysts said. They also have strict discount policies, meaning that they trade close to NAV.

Equity investment trust picks: Murray International

Many investors will be keen to keep a foothold in equities, however, especially as stock markets mount a relief rally following yesterday’s tariff reprieve. Some equity trusts, such as Murray International, are more defensively positioned, so could appeal in the current environment.

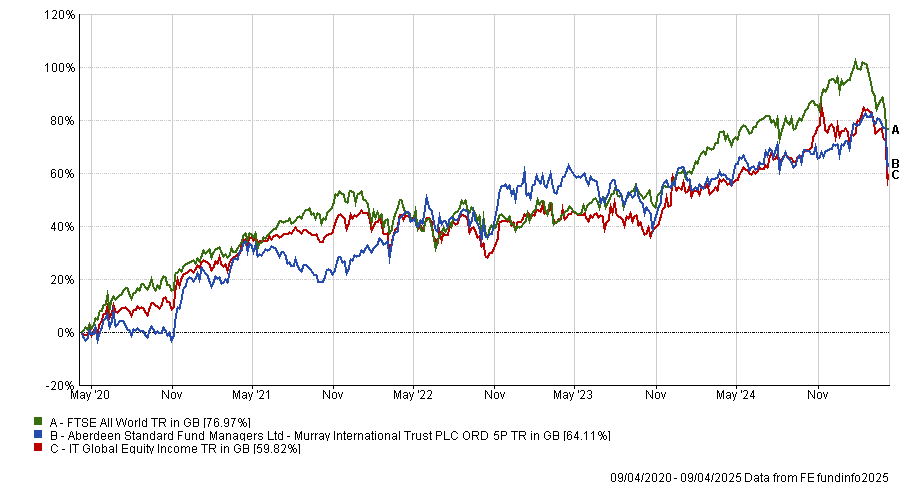

Stifel research analysts Iain Scouller and William Crighton said Murray International’s defensive value strategy has held up relatively well since Liberation Day.

“Murray International has no exposure to the Magnificent Seven and offers a defensive income approach. Whilst its performance has significantly lagged many of the other global trusts over the past couple of years, its investment approach has started to deliver relative performance in the past couple of months following the market shift away from growth,” they said.

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

Martin Connaghan, co-manager of Murray International, said: “The human element to market volatility always results in sentiment swinging wildly from one extreme to the other based on emotion. The reality is often somewhere in the middle.

“We will certainly be looking to take advantage of what has happened during the past week. Does that automatically mean the US weight in the portfolio will be going up? No, not necessarily. We will be looking at stocks within the US alongside all the other markets. We will be looking at all the existing holdings in the portfolio in addition to those on our watchlist to see if they now make sense in terms of further or new capital being allocated to them.”

Four trust picks for Europe

European stocks enjoyed a brief moment in the sun during the first quarter before tariffs took the wind out of their sails, although markets are recovering this morning.

Looking back at the trade wars of Trump’s first term in 2018-19, European small-caps fared worse than large-caps owing to investors’ risk-off stance and smaller companies’ greater exposure to cyclical slowdowns.

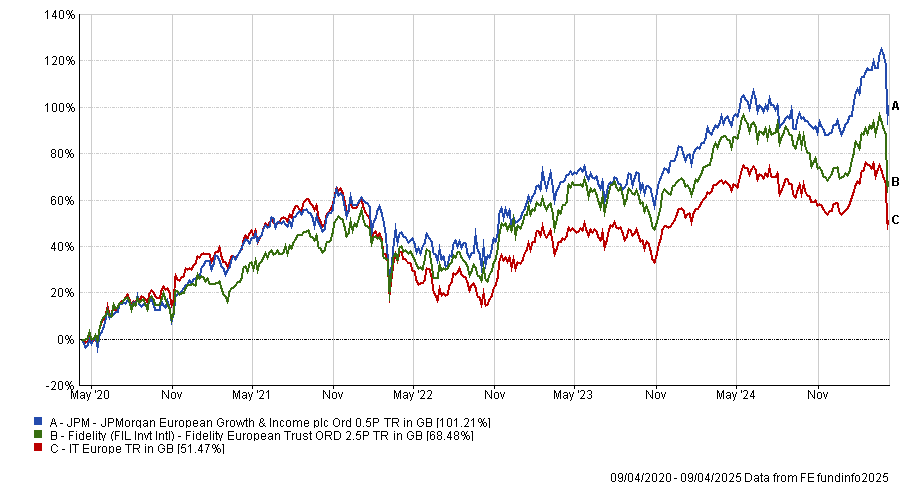

Therefore, Scouller and Crighton prefer stable trusts with a large-cap bias such as JPMorgan European Growth & Income and Fidelity European.

Performance of trusts vs sector over 5yrs

Source: FE Analytics

Pacific Assets Trust

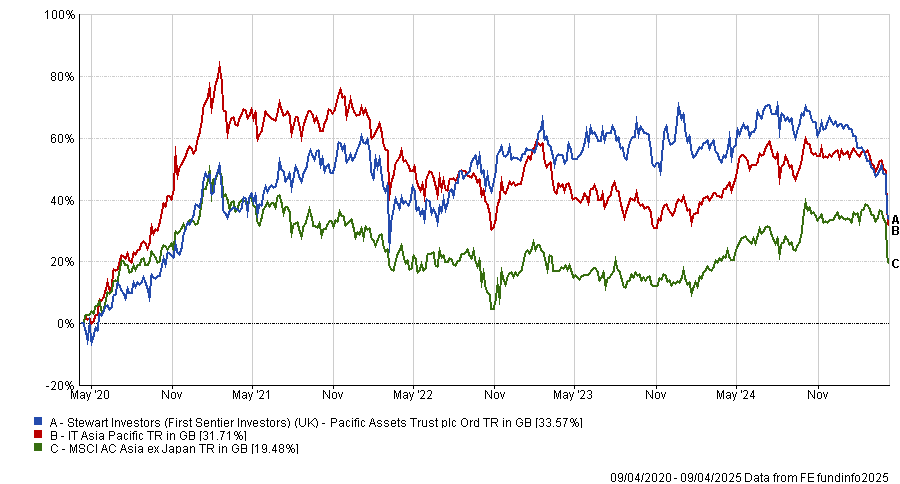

For investors who want to keep a foothold in Asia but are nervous about trade wars, Ryan Lightfoot-Aminoff, investment trust research analyst at Kepler Partners, suggested Pacific Assets Trust.

“Managers David Gait and Doug Ledingham have an absolute return mindset and view risk as the permanent loss of capital. A laser focus on quality and sustainability helps to mitigate risk, only backing companies that have the characteristics to deliver long-term value,” he explained.

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

“Pacific Assets Trust often invests alongside generational family owners that share their view on long-termism and therefore will be less concerned about near-term trade issues.

“Quality also factors in the types of companies it buys, focusing on durable franchises with long-standing relationships and pricing power plus good financials, and nearly 80% of companies in the portfolio have net cash. It is therefore well set to ride out short-term volatility,” they concluded.