Investors are often told to think about the long term. Indeed, renowned US investor Warren Buffett is often quoted as saying his favourite holding period is forever.

While this is admirable, investors cannot afford to buy and forget about their holdings. Markets move quickly and circumstances can change in an instant. For those wanting to invest in stocks, even with the most long-term mindset, they can only accurately forecast over three years, according to FE fundinfo Alpha Manager Ed Legget.

Investors may want to make note of this, as his Artemis UK Select fund had ranked amongst the top two funds in the IA UK All Companies sector over the past one, three, five and 10 years. With the highest information ratio in the Investment Association universe, he and his co-manager Ambrose Faulks were the market's most skilled stockpickers last year.

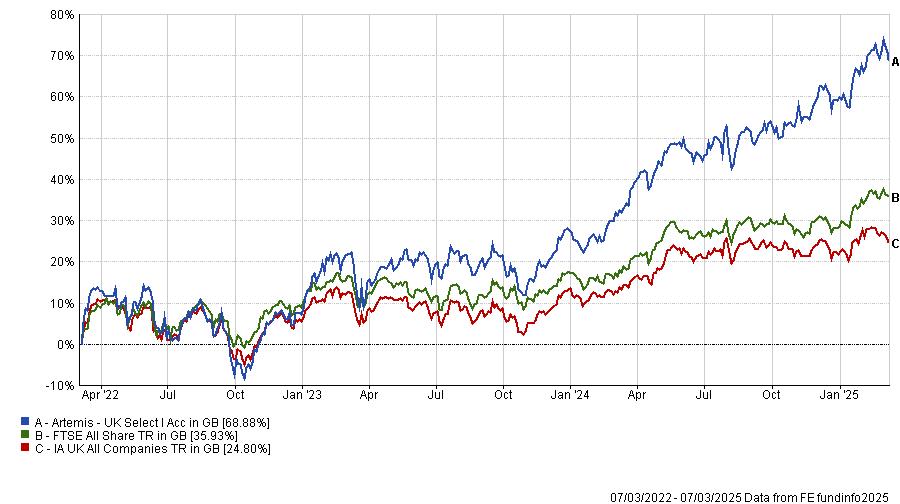

Performance of fund vs the sector and benchmark over 3yrs

Source: FE Analytics

He argued three years is an appropriate time horizon because investing over 10 years or longer is challenging for even the most skilled investors.

“I do not think you can say we are buying this thing and holding it forever because forever is a long time”, he said. “Occasionally, the whole world will change” and investors need to be willing to change their outlooks in response.

He gave the example of the Covid-19 pandemic, where portfolio turnover was extremely high. “How one saw the world on the first of January and the first of March were fundamentally different”, he said, noting that portfolios had to reflect that.

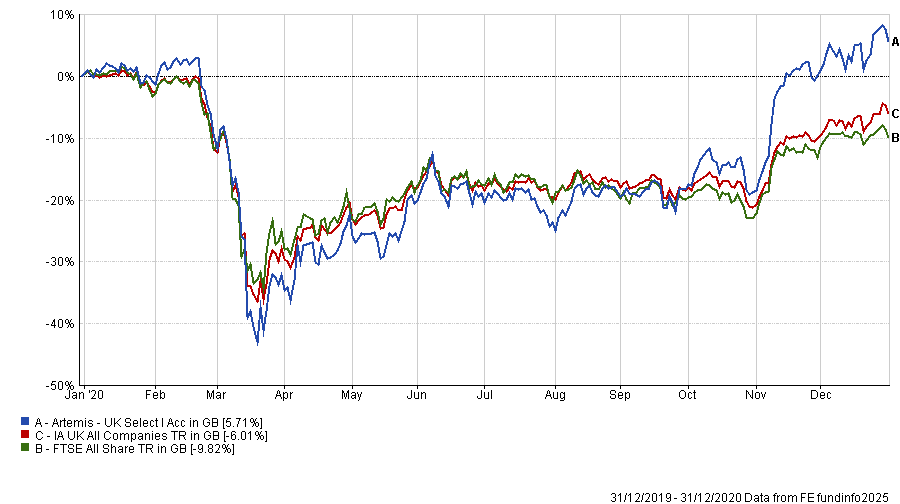

As a result of this more flexible approach, the fund was up by 5.4% in 2020, while the average peer slid by 6% and the market fell by almost 10%.

Performance of fund vs the sector and benchmark in 2020

Source: FE Analytics

More broadly, too long a time horizon may lead investors to the conclusion that “it has been right to ignore some UK sectors”, but things change all the time and the biggest example of this was banks, Legget argued.

For investors such as Terry Smith, banks were uninvestable in 2023, but for Legget, they were underappreciated opportunities and a large part of his top 10 holdings.

He explained investors had ignored banks despite fundamentally strong balance sheets, easing interest rates and regulatory cycles that had made them much better investments.

Legget said the other challenge of having a much longer time horizon is that it is easy to forget the biggest companies in the market today are not the same companies as they were 30 years ago.

He gave the example of Yell (formerly Yellow Pages), which used to be a prominent member of the FTSE 100 and well-regarded as a steady, cash-generative business.

By contrast, businesses such as RELX have transformed from a print-led service into a digital subscription service and become phenomenally successful, but investors would have struggled to predict this change.

He explained the challenge of a longer time horizon is that investors become overly optimistic and "start using hopes and dreams for the next 10 years to justify valuations today”.

However, while looking too far into the future is dangerous, Legget argued investors should not get swept up in short-term speculation either.

In a market where it is easier for investors to “get lost in the noise” of quarterly earnings and trading updates, investors should take a step back. “You need to consider where the market is going and what you want to learn in the next 18 to 36 months rather than where you want to be today for results tomorrow”.

With a three-year time horizon, Legget explained he found opportunities in companies with negative momentum but strong medium-term outlooks that his competitors may have missed.

“You do not have to look a long way ahead but if you are willing to look a little bit into the future you will find it easier to see value and opportunities in the market”.

He identified housebuilders as an example of this. The sector became extremely unpopular in 2022 due to spiking interest rates and inflation, causing investors to pull out in large numbers.

However, for Legget, this was the year when companies such as Morgan Sindall came onto his radar because the three-year forecast indicated a turn in the economic cycle that would make these stocks more popular.

“We did not get everything right. But a three-year horizon gives you opportunities to find and build positions in profitable franchises in a world of active management which has become very focused around a handful of factors”, he concluded.