The Latin America (LatAm) index derated significantly last year as fiscal pressures in Brazil and a volatile political backdrop for Mexico squeezed equity markets. However, there reasons to be more optimistic on the region than valuations suggest, if you look in the right places.

After a significant sell-off over 2024, the Latin America index is now trading at extremely depressed multiples both relative to its own history and in absolute terms, of around 8x forward earnings. The index fell by c.30% last year, driven by a derating in the two largest markets, Brazil and Mexico.

Brazil: Fiscal pressures obscure a more positive macro backdrop

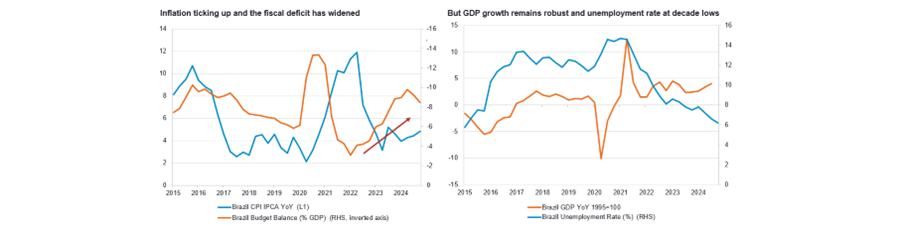

Brazil has sold off due to concerns about the rising fiscal deficit, with increasing inflation expectations prompting the central bank to start hiking interest rates again. While the fiscal backdrop has deteriorated, the broader macro backdrop remains reasonably robust, with good GDP growth and unemployment at decade lows.

Brazil: The fiscal deficit has widened but the broader macro backdrop remains relatively robust

Source: Bloomberg, 31 January 2025.

With no indications so far of asset quality deterioration or a rise in non-performing loans, we think that the fiscal backdrop should be resolved once there is a change of policy – and with an election due at the end of 2026, there is light at the end of the tunnel.

While we have looked to limit exposure to more rate-sensitive names, given the monetary policy backdrop in Brazil, we broadly expect any negative impact to be on the consumer and companies with debt on the balance sheet, rather than the high-quality, predominantly financials companies we own that are typically more driven by idiosyncratic factors and which should prove resilient even in a weaker fiscal and higher-rate backdrop.

One name we particularly like is Inter & Co, the holding company for Banco Inter, a digital bank in Brazil. The stock has been hit by negative sentiment towards the country, but the impact that higher interest rates will have on fundamentals is very limited.

Mexico: Opportunities in high-quality stocks that have disproportionately derated

In Mexico, the derating has been driven largely by political turbulence both north and south of the border. Weakness last year was initially down to concerns about a lack of checks and balances on the government after a landslide victory for president Claudia Sheinbaum.

Although we are closely monitoring indications of institutional decay, for example with regards to the recent judicial reforms, we are broadly constructive on the new president who has indicated she will be focused on protecting central bank independence, investing in nearshoring infrastructure and ensuring amiable relations with the US.

The US election result and concerns about higher tariffs prompted another leg down in the Mexican market and currency at the end of the year. While this is a fast-evolving space and a risk to monitor closely, we think that much of this concern is already priced in with the market trading at decade lows.

We continue to see opportunities among Mexican companies that have disproportionately derated. One high conviction position includes tortilla maker Gruma, a company with excellent pricing power given its dominant position in the tortilla market which is enjoying margin expansion due to ongoing premiumisation opportunities.

Given the weakness in the Mexican market, the stock is trading at attractive valuations, which overlooks the fact that 72% of Gruma’s revenue comes from outside Mexico and that it is a US dollar earner, meaning it should be relatively protected from any increase in tariffs given its localised production bases in the US.

Opportunities down the market-cap spectrum

We scour the entire breadth of the market-cap spectrum for ideas and see opportunities across local Latin American markets. While the majority of the portfolio’s exposure is to the two main markets Brazil and Mexico, we see opportunities in some of the smaller markets, too.

One holding we particularly like is Peruvian gold and copper miner, Buenaventura. The share price has suffered due to local pension funds in Peru seeing outflows and selling equities.

However, operational performance has been strong, guidance was upgraded (something relatively rare in mining) and the backdrop for both commodities has been very strong.

Copper is a particular area of conviction for us, with attractive supply-demand dynamics, underpinned by the copper-intensive energy transition and a very muted supply outlook.

We also think the backdrop for gold is attractive, which we expect to benefit as central banks continue to move their FX reserves to gold over the next few decades.

Overall, we are optimistic about the region, and believe the derating in the broad market obscures the still-attractive quality characteristics of the index.

In our view, expectations have not been priced high enough currently, representing we think, potential buying opportunities for those taking a selective approach.

Chris Tennant is a portfolio manager of Fidelity Emerging Markets Limited. The views expressed above should not be taken as investment advice.