Investors who want to grow their capital and simultaneously earn an income often opt for equity income funds but some investment trusts offer a compelling alternative.

Not only do many trusts have a yield above 4% but several of them are trading at wide discounts to their net asset value (NAV), offering investors the chance to snap up a portfolio of stocks on the cheap.

To avoid value traps and poor performers, Trustnet scrutinised the total returns of trusts on double-digit discounts with yields above 4% to find those with the strongest track records.

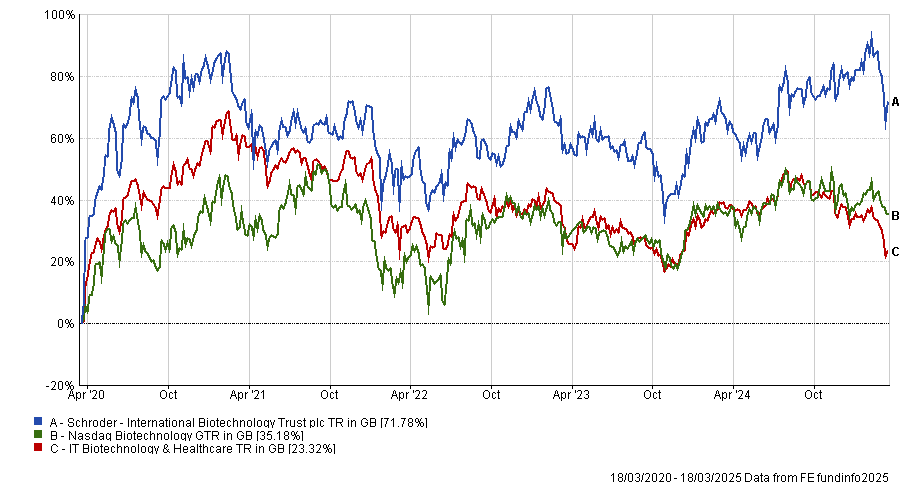

The International Biotechnology Trust ticked all three boxes comprehensively. It has a 4.4% yield and a 12% discount, according to data from the Association of Investment Companies (AIC), and has beaten its benchmark and sector over one, three, five and 10 years to 18 March 2025.

The current managers, Ailsa Craig and Marek Poszepczynski, have only been in charge since March 2021, so are responsible for four years of the trust’s track record.

It is the best-performing trust in the seven-strong IT Biotechnology & Healthcare sector over the past 12 months and second over three and five years.

Performance of trust vs benchmark & sector over 5yrs

Source: FE Analytics

The trust has a policy of making dividend payments equivalent to 4% of its net asset value at the end of the preceding financial year, through two equal semi-annual distributions.

Shareholders include the MIGO Opportunities Trust, managed by Charlotte Cuthbertson and Nick Greenwood at Asset Value Investors, and the CT Global Managed Portfolio Trust, led by Columbia Threadneedle Investments’ Peter Hewitt, who holds it within his income portfolio.

Cuthbertson said: “In a sector known for its volatility, Craig’s expertise and resilience particularly shines. Her biological insight and investment acumen, alongside co-manager Poszepczynski, have been crucial in navigating the complexities of the biotech sector with precision.”

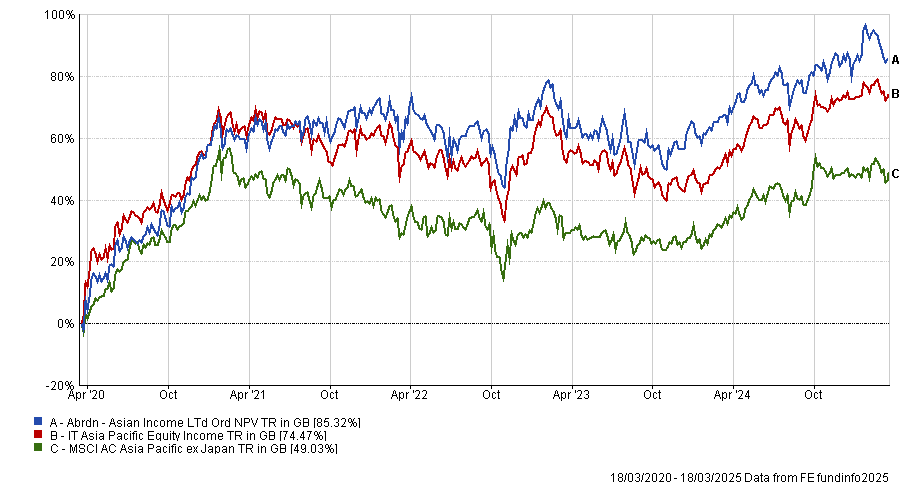

The abrdn Asian Income Fund also achieved the triumvirate of yield, discount and returns, although it did not outperform in every time period. It beat its sector and benchmark over three and five years but trailed both over a decade. It has increased its dividend for 16 consecutive years, according to the AIC, and currently has a yield of 7.3%. It is trading on a discount of 10.2%.

Performance of trust vs benchmark & sector over 5yrs

Source: FE Analytics

Peel Hunt included it in the firm’s 2025 playbook of investment companies for income.

Anthony Leatham, head of investment companies research at Peel Hunt, said: “The abrdn Asian Income Fund offers a strong combination of attractive total returns and a yield premium over the market and peer group, supported by a consistent dividend track record.

“We believe the disciplined focus on quality, dividends, valuation and growth, along with the constant reappraisal of companies in the portfolio and portfolio positioning, bodes well for both index outperformance and potential discount narrowing.”

Aberdeen’s well-resourced Asian equity team includes 40 investment professionals across six local hubs. “The team’s edge has been across mid-cap companies with strong balance sheets, often with family ownership. We also see the benefits of regular and proactive engagement,” Leatham said.

Asia is becoming an attractive region for income-seeking investors. Half of the Asia Pacific ex-Japan index currently yields more than 3% and over 50% of the total return from Asian equities is being delivered by dividends, supported by robust free cashflow cover and strong balance sheets, he noted.

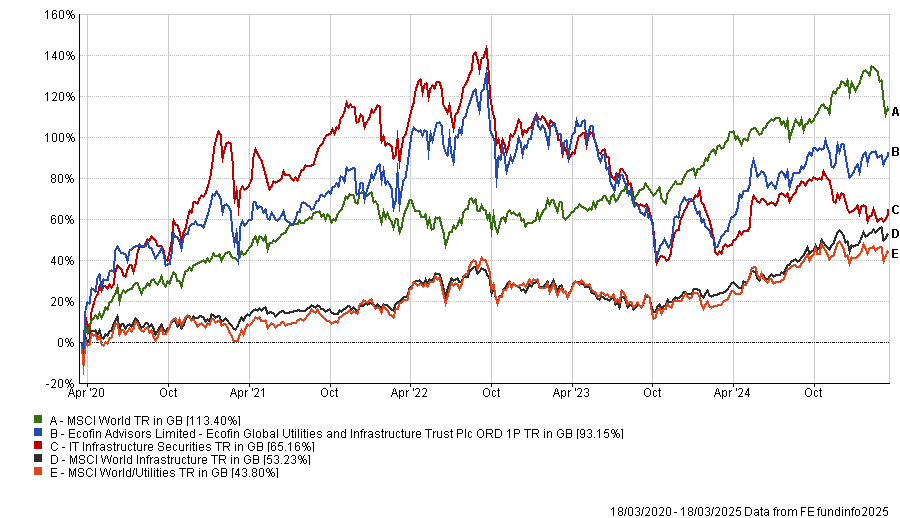

Elsewhere, Ecofin Global Utilities and Infrastructure is a contender with a 4.3% yield and a 10.3% discount, but it is difficult to measure its performance. It does not have a single benchmark and there are only two trusts in the IT Infrastructure Securities sector, although Ecofin has beaten its rival – Premier Miton Global Renewables – by a wide margin over one, three and five years.

On its factsheet, it shows five different indices as yardsticks, spanning infrastructure, utilities and stocks: S&P Global Infrastructure; MSCI World Utilities; MSCI World; FTSE All Share; and FTSE ASX Utilities.

Performance of trust vs sector & relevant indices over 5yrs

Source: FE Analytics

Widening the net to investment companies on a discount of 7% or more brings another crop of triple-threat trusts into the scope of this research.

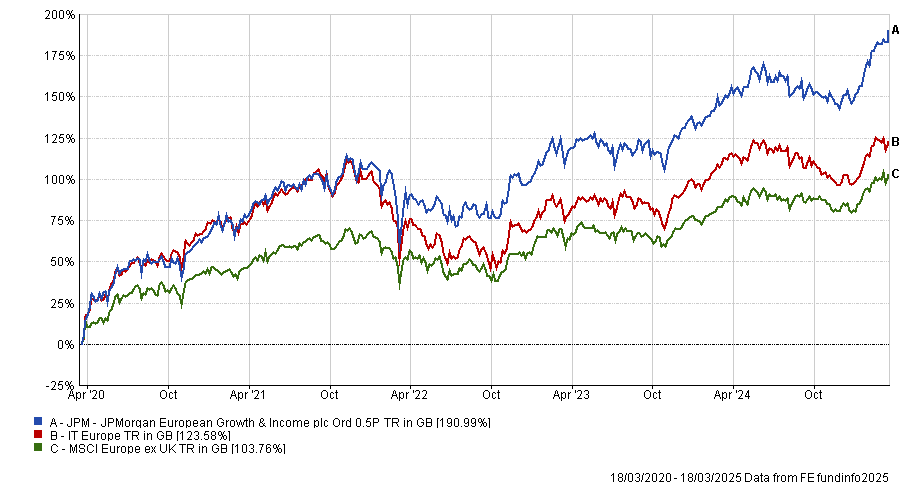

JPMorgan European Growth & Income has a 4.2% yield and a 7.6% discount. It has outperformed its benchmark over one, three, five and 10 years, although it lagged its sector over a decade.

The trust has an FE fundinfo Crown Rating of four, placing it within the top 25% of its asset class for alpha, volatility and consistently beating its benchmark over the past three years.

It is managed by Alexander Fitzalan Howard, Tim Lewis and Zenah Shuhaiber and its largest holdings are Novo Nordisk, SAP, Novartis, ASML and Roche.

Performance of trust vs benchmark & sector over 5yrs

Source: FE Analytics

Marcus Phayre-Mudge’s TR Property beat its benchmark over three, five and 10 years but was in line with its peer group average. It has a 5.3% yield and an 8.5% discount. The trust has increased its dividend for 14 consecutive years.

Elsewhere, BlackRock Frontiers hurdled the MSCI Frontier Markets index over three, five and 10 years (however, it changed its benchmark in 2018 to the MSCI Emerging ex Selected Countries + Frontier Markets + Saudi Arabia Index).

It was included within Peel Hunt’s income playbook for 2025 and has a 4.8% yield. Its income stream comes from cash generated by its underlying investments (as opposed to a yield target).

Led by Sam Vecht, the trust is trading on a 7.2% discount and its portfolio is cheap, according to Leatham; back in January, it had a price-to-earnings ratio of approximately 8x. Frontier markets overall look attractively valued compared to global developed market equities, so the trust offers a double discount, he added.

Three other trusts had a yield above 4% and a discount wider than 7% but a mixed track record.

JPMorgan Asia Growth & Income beat its benchmark over one, five and 10 years but lagged over three years and fell behind its peer group average over three and five years. It has a 4.2% yield and a discount of 8.2%.

BlackRock World Mining bested its peer group over five and 10 years but fell behind over one and three years. It boasts a 4.6% yield and a 9.8% discount.

Finally, Murray International beat its bogie over one, three and five years but not over 10. It hurdled the peer group average over three years but trailed during other periods.

It has a 4.4% yield and recently became an AIC ‘Dividend Hero’ for increasing its dividend for the 20th consecutive year in 2024.

The trust was run by veteran stockpicker Bruce Stout until his retirement last year and is now co-managed by Martin Connaghan and Samantha Fitzpatrick, who worked alongside Stout since 2017 and 2019, respectively. It is trading on a 7.5% discount.