The first quarter of 2021 has been a bumpy ride for global equities as markets rotated out of growth into value in anticipation of a global economic recovery.

The year began on a mostly positive note for equities until government bond yields began to rise rapidly when markets started to anticipate rising inflation and a broader economic recovery.

The following months saw growth stocks start to falter and value stocks rally in what could be the beginning of the investment style’s long-awaited reversion to the mean.

With this backdrop, the table below shows which Investment Association sectors were best performing sectors of the first quarter.

Source: FE Analytics

The highest two performing sectors were those investing in UK equities, with the top performer being the IA UK Smaller Companies sector where the average fund delivered a 9.03 per cent return for the period.

Smaller companies and equity income sectors made up six of the top 10 performing sectors during first quarter of 2021.

The second highest performing sector was IA UK Equity Income, where the average fund delivered a total return of 6.78 per cent.

Since the UK equity market has many high dividend payers and is generally heavily weighted towards value stocks, UK investors benefitted from the rotation out of growth stocks into value stocks during the quarter.

The third and fourth highest performing sectors were focused on smaller companies. The IA North American Smaller companies sector was a top performer for the quarter with a return of 6.52 per cent.

Source: FE Analytics

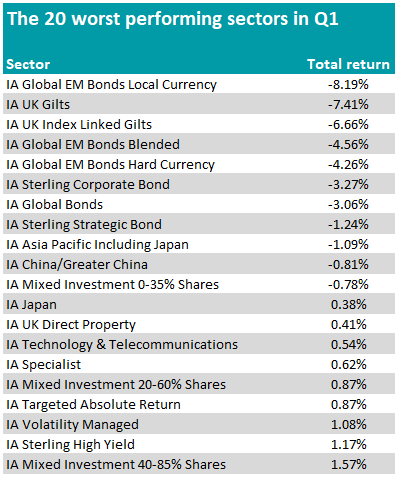

The bottom performing sectors were mostly fixed income strategies. Rising bond yields hit these strategies hardest, with the capital losses wiping out years of income for many sectors.

Emerging market bonds were the worst performers, with an average 8.26 per cent loss for the quarter.

IA UK Gilts and IA UK Index Linked Gilts were the next worst performers, with respective losses of 7.41 per cent and 6.64 per cent.

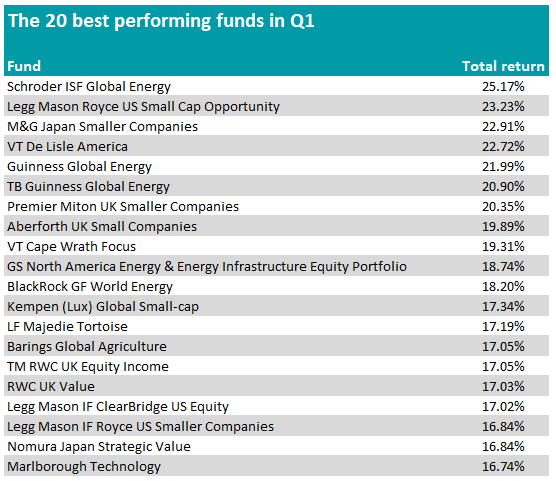

Looking at the individual funds, energy-orientated strategies were the most common top performers during the first quarter of 2021. Four energy funds were amongst the top-10 performing funds for the quarter.

Schroder ISF Global Energy was the best performer with a return of 25.17 per cent for the period.

These strategies benefitted from both the rotation into value as well as a rising oil price which increased by roughly 25 per cent during the period.

Smaller companies equity strategies were a common top performer during the quarter, with four of the top-10 performers being small-cap focused funds.

Source: FE Analytics

The Legg Mason Royce US Small Cap Opportunity fund was the second highest performer over the three-month period, with a return of 23.23 per cent. Almost a quarter of the fund is weighted towards companies in the industrials sector, which should benefit from a re-opening of the global economy.

The US small-cap fund was followed closely by M&G Japan Smaller Companies in third place, which returned 22.91 per cent over the period.

The Japanese small-cap fund has a value-orientated approach and almost half of its exposure to the industrials sector.

Several Japanese equity strategies featured in the list of top performers as the Japanese economy has benefitted from an impressive virus response.

The bottom performers of the quarter were predominantly gold-focused and Latin American equity strategies.

Source: FE Analytics

Despite rising inflation expectations, the price of gold hasn’t performed as well as most gold bugs would have hoped.

Eight out of the top-10 worst performers for the quarter were gold and precious metals focused equity funds.

The worst performer for the quarter was WS Charteris Gold & Precious Metals with a loss of 19.95 per cent.

Many precious metals funds that invest in gold mining companies that are leveraged to the price of gold, which is down roughly 10 per cent since the year began.

Latin American markets have been hit particularly hard over the quarter, as their economies continue to struggle with the coronavirus pandemic. Brazil has been the hardest hit.

The worst performing Latin American fund was the HSBC GIF Brazil Equity fund with a loss of 14.62 per cent over the period.