Troy Asset Management is well known for its prioritisation of capital protection. The group was set up by Lord Weinstock, whose outlook was shaped by the fate of a previous venture: after transforming the General Electric Company from a telecommunications firm with a turnover of £135m in 1963 to a global company with profits of £1bn by 1996, he retired, leaving the firm with £3bn in cash on its balance sheet.

Yet a series of disastrous acquisitions made by his successor at the height of the dotcom bubble led to a collapse in GEC’s share price and it eventually folded.

As a result, when Troy was established by Lord Weinstock and Sebastian Lyon in 2000, the prime message was “don’t lose it”. This is why all of its funds focus on delivering returns without taking on excessive amounts of risk, which they do through holding quality businesses that have strong balance sheets and deliver a high return on equity.

In this context, the Trojan Global Equity fund appears to be something of an anomaly. Its exposure to tech giants such as Alphabet (Google) and Facebook has certainly paid off over the years, yet when the current strategy was implemented by its managers at the end of 2013, such companies were regarded as something of an unknown quantity. So how does this fit in with Troy’s philosophy?

Manager Gabrielle Boyle said that adapting to a changing competitive landscape is a vital component of what makes a quality business. Or to put it even more bluntly, “part of being risk-averse is knowing you can’t stand still”.

“The fundamentals of these tech businesses are so compelling, if you covered up the names and just looked at the consistency of the financials, you would think, ‘wow, these are incredible’,” she said.

“Fair play to Sebastian in that he’s a very conservative investor and always has a keen eye on what can happen. But he also recognises that there is as much risk in doing nothing and not embracing change.”

George Viney, Boyle’s co-manager, said that breaking down the valuation components helped him understand the financial productivity of these tech businesses, making the decision to buy into the sector much easier.

“You understand what is driving that – the depth and quality of the competitive advantages that these businesses have – and then you see they're investing like hell,” he said.

“The incremental margins are way higher even than our consumer staples businesses and that makes them attractive in terms of valuation metrics.”

The valuation argument is a moot point, with the tech sector often described as looking incredibly expensive on conventional metrics. However, Viney pointed out that despite the gains made by holdings such as Alphabet over the past decade, the impact of multiple expansion on returns is lower than you might expect.

“To us, it's absolutely amazing that the growth in free cashflow per share is pretty much exactly the compound annual total shareholder return we've earned since we first became an owner of Google in 2013,” he explained.

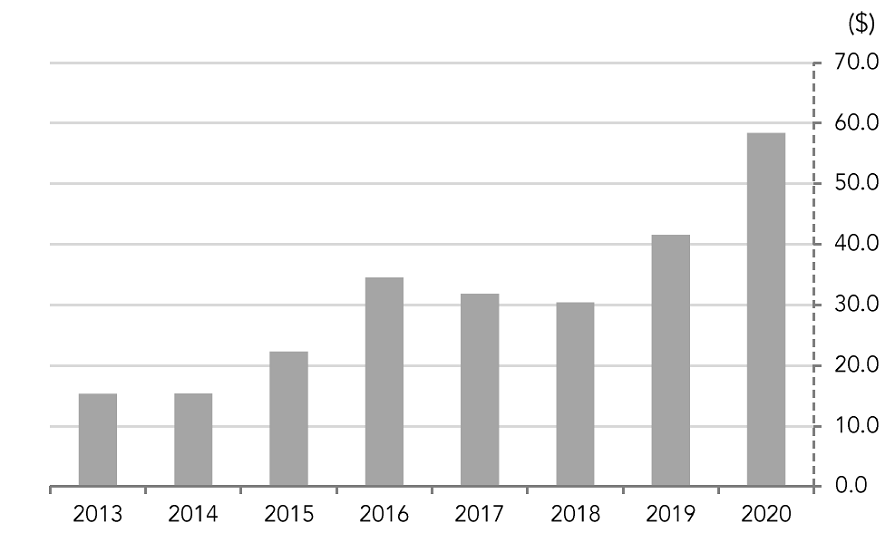

Alphabet's free cashflow per share

Source: Troy Asset Management

“The clear implication is that the driver of returns is free cashflow, not valuation.”

This underlines one of the cornerstones of Viney and Boyle’s strategy – markets consistently underestimate the time period over which great businesses can compound higher returns.

“Google is a great example of that,” Viney added. “Visa and Microsoft would be others. They are valued as above-average businesses, but in reality, they are so much better than the average, they hardly compare at all.”

The managers don’t invest in all tech giants: their aversion to companies with high levels of debt means they have avoided Netflix, while Amazon’s habit of reinvesting the profits from AWS into other parts of the business made it difficult to value.

Yet even if the managers don’t invest in these disruptive businesses, this doesn’t mean they ignore them.

Boyle described technological change as “an unstoppable train”, saying it would be difficult to overestimate its impact over the coming years. She added that while e-commerce, digital payments and cloud computing have already turned the world of retail and work on their head, these themes are still in their early stages.

While this is hardly ground-breaking news, she pointed out this doesn’t just have implications for the tech sector.

“Technology has changed everything for every company that we invest in, whether it’s Microsoft that has completely changed its business model to move to the cloud, or a consumer staples business like Nestlé, which is having to deal with the forces of disruption and change in terms of how it sells its products and how it interacts with its customers.”

She added: “This is a job where you have to accept that you're going to get it wrong a significant amount of the time, because that's just the nature of the game. For us, that means that we try and learn from those mistakes. And frankly, we're prepared to change if that happens.”

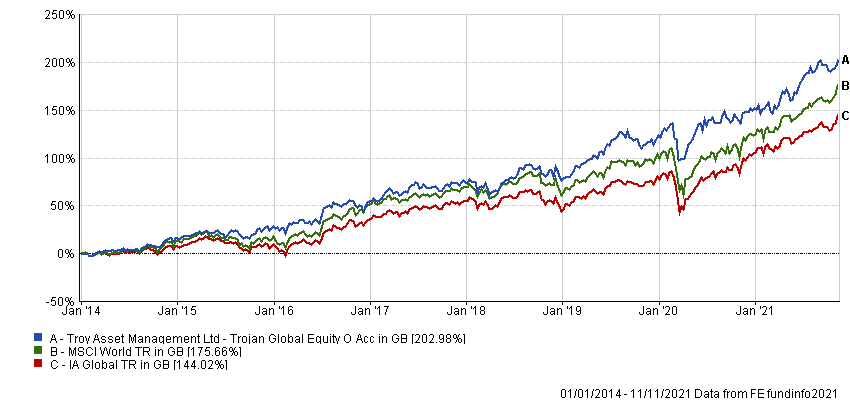

Data from FE Analytics shows Trojan Global Equity has made 203% under the current strategy, compared with 175.7% from the MSCI World index and 144% from the IA Global sector.

Performance of fund vs sector and index under strategy

Source: FE Analytics

The £440m fund has ongoing charges of 0.92%.