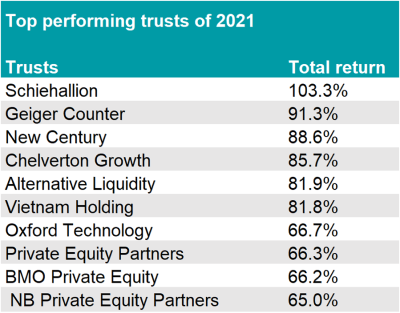

Private equity and commodity trusts topped the list of best investment companies of 2021, while portfolios invested in Chinese equities and travel stocks were at the bottom of the rankings.

Last year was a difficult one to predict. While economies reopened and nations eased out of lockdowns, leading to a recovery in global trade, the Omicron variant and high inflation spooked investors towards the end of the year.

Below, Trustnet reveals the best and worst performing trusts of last year.

Top Trusts

Baillie Gifford’s Schiehallion trust led the way, with a 103.3% rise in 2021 as private equity enjoyed a strong 12 months.

The trust aims to invest in late-stage businesses that have the potential for transformational development and although some of its largest holdings, such as the Wise PLC and Affirm Holdings declined in value over the year, its smaller growth assets were able to deliver significant profits.

The trust capitalised on this by raising more money last year than any other trust, bringing in a total of £503m in new money as of Oct 2021.

Following in second was the Geiger Counter trust, which returned 91.3% over 2021 thanks to its top holdings in the commodities and precious metals sector.

NexGen Energy, which makes up 17.8% of its total asset holdings was up 68.9% in the past year, reflecting the success of energy companies in 2021.

The commodities and natural resource sector was up 29.8% over 2021 overall as investors leapt on the increasing price of energy.

Top holdings in uranium mining companies such as Cameco CAD have also led to the trust’s high returns. Demand for the commodity, which is used in power plants, increased after world leaders collectively endorsed nuclear power at the COP summit in November.

Performance of trust vs sector

Source: FE Analytics

The New Century trust, which invests in a diversified collection of UK assets, came in third with an increase 88.6%.

Also ranking highly was the VietNam Holding trust which went up 81.8% as the Vietnamese economy rebooted after a slow performance in 2020.

The Oxford technology trust also had a good year, increasing 66.7% over 2021. With many analysts predicting a flood of interest in the technology sector this year, the trust may see additional growth moving forward.

Just making it into the top ten was the Tufton Oceanic Assets trust, up 59.7% over 2021. The portfolio, which owns shipping vessels, benefitted from the recovery of global trade.

In fact, IT UK Logistics was the top ranking sector of the year, increasing 47.3%. The sector made huge gains as the supply chains that were lagging over the last few years bounced back into action.

With production delays expected to continue well into this year, the UK logistics sector may continue on a steady growth rate, especially if driver shortages are not sorted soon.

Source: FE Analytics

Also benefiting from the reopening of society were the IT Property – UK Commercial and IT VCT Specialist: Media, Leisure and Events sectors, which went up 30.5% and 29.9% respectively. The sectors made decent inflows after months of lockdown closures where economic activity was halted.

India was the third-highest sector, up 31.3% over 2021. The country’s economy performed well this year after high covid levels slowed recovery in 2020.

Nick Wood, head of fund research at Quilter Cheviot, said: “With China still looking a rather uncertain place to invest, India could be a good alternative for investors over the next few years looking to take advantage of a growing middle class and increased infrastructure spending.”

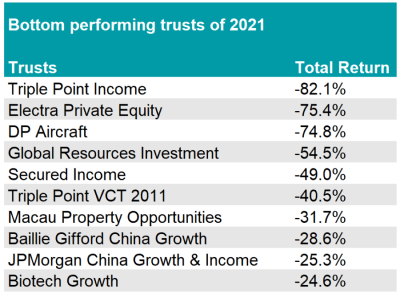

Bottom Trusts

The worst performer of the year was the Triple Point Income trust, which was down 82.1%. Its hydroelectric power assets, which make up the majority of its holdings, did not perform well last year, leading to large losses.

Another Triple Point venture with an energy focus, the Triple Point VCT 2011 also made the bottom 10, down 40.5% last year. Both trusts intend to sell off large amounts of their hydroelectric assets moving forward.

The DP Aircraft trust that runs £3.1m in assets also had a poor year, sinking 74.8% over 2021. With strict travel restrictions remaining in place to reduce the spread of covid, aircraft businesses have been in lesser demand.

Source: FE Analytics

The Global Resources Investment trust was down 54.5% in 2021 despite a good performance from the sector overall. Even though energy assets and related materials such as uranium were in high demand, the value of some metals such as gold and silver dropped last year.

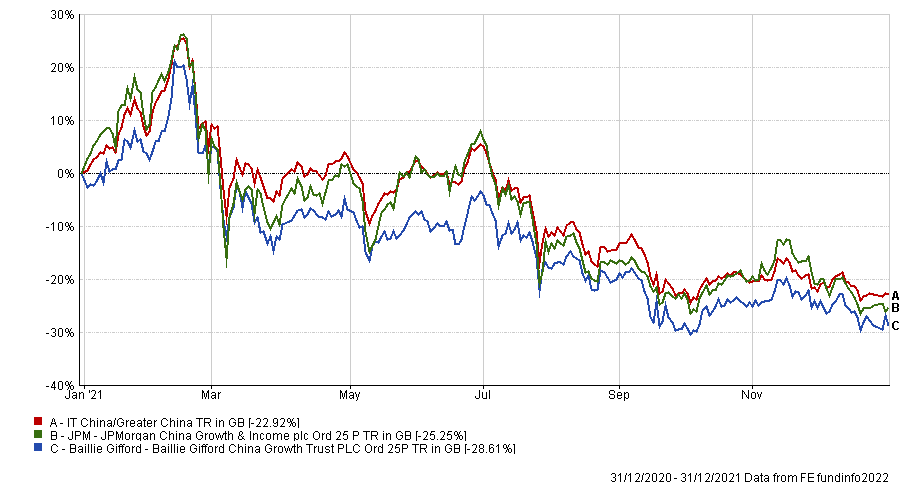

Trusts invested in Chinese markets, such as Baillie Gifford’s China Growth and JP Morgan’s China Growth and Income trusts suffered large losses in 2021. The IT China/Greater China sector overall had an underwhelming year, down 22.9%.

Strict policies implemented on Chinese businesses with the goal of ‘common prosperity’ have led many investors to withdraw from the market.

Performance of trusts vs sector

Source: FE Analytics

Likewise, the Latin America sector was down 13.8% in 2021 due to political uncertainty as well as high covid levels that curbed production.

The Japanese Smaller Companies sector was also down 2.3%. With lockdowns lasting up until September last year, domestic consumption in the county was low.