Some investors that prefer to leave asset allocation to their fund managers will find that they have little exposure to UK equities within global funds.

Passives are among the most popular options for first-time investors, but those that track the common MSCI ACWI index would only have a UK weighting of 3.1%.

This does increase when looking at active funds, with the 515 portfolios in the IA Global sector holding an average allocation to the UK of 7.4% but is still some way short of where some investors will want their domestic market exposure.

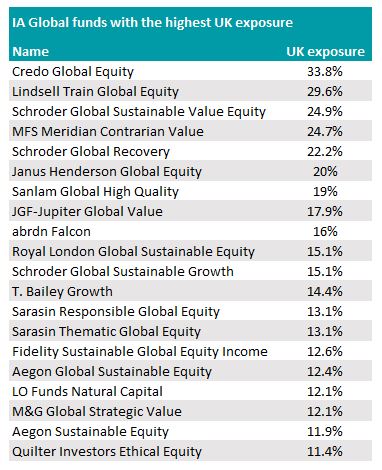

Here, Trustnet found the IA Global sector with the highest exposure to the UK for investors who want worldwide exposure, whilst keeping one foot firmly in their home market.

We removed funds below £100m in assets under management (AUM), as well as any energy, multi-asset or fund-of-funds so that the resulting portfolios are invested primarily in global equities.

Source: FE Analytics

The fund with the largest UK weighting was Credo Global Equity, with a 33.8% exposure to the region. This £106m portfolio is up 2.6% since the start of the year, making it a top-quartile performer over the period, despite being the smallest on the list at £106m.

Contrastingly, the largest fund on the list with £5.9bn in assets under management was Lindsell Train Global Equity, which also had the second highest UK exposure.

It was the 10th best performing fund in the sector over the past decade, climbing 126 percentage points ahead of its peer group with a total return of 292.5%.

Lindsell Train Asset Management has three other funds – North America, Japan and UK – and all three regions are well represented in the global fund, at 32.8%, 22.8% and 29.6% of the portfolio’s weighting respectively.

There was a strong tilt towards value strategies among those funds with the highest UK exposure. The domestic market has underperformed the growth-heavy US market for the best part of a decade but has come into favour this year as the market has turned.

The UK market is full of ‘old economy’ stocks, such as oil, mining and financials, with very few tech or healthcare superpowers that can be found elsewhere. As such, the market is a natural fit for value managers.

To shows this, Schroder Global Sustainable Value Equity’s 24.9% exposure to the UK was the third highest on the list, but its 10-year return was the lowest at 93.4%.

Elsewhere, JGF-Jupiter Global Value has been one of the best performers in the sector so far in 2022, up 12%, thanks in part to its large UK allocation, which at 17.9% was well above sector average.

Another example is the MFS Meridian Contrarian Value fund, which has a 24.7% exposure to the UK, despite being one of the youngest portfolios on the list – it was launched in 2019 and is up 38.2% since inception