Investors often find comfort in buying a fund that others have already had the conviction to put their money in, but there are some small funds that do better than their giant peers.

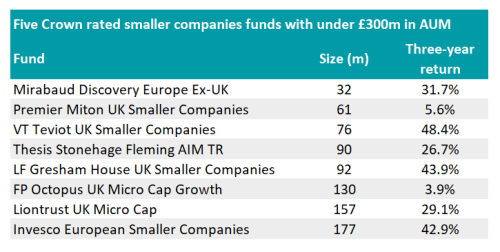

Trustnet found eight portfolios investing in smaller companies with less than £300m in assets under management (AUM) but that have a five FE Crown rating, ranking them in the top 10% of funds in the Investment Association universe over three years.

Only funds that demonstrate the best alpha, volatility and consistently strong performance make it onto this exclusive list, so these portfolios should not be underestimated for their small size.

We screened funds in all the smaller companies sectors, but only those in IA UK Smaller Companies and IA European Smaller Companies met the criteria.

Source: FE Analytics

The smallest fund to be awarded a five Crown rating was Mirabaud Discovery Europe Ex-UK, which has an AUM of €32m (£27m).

This portfolio made a total return of 31.7% over the past three years, beating its average peer in the IA European Smaller Companies sector by 13.6 percentage points.

Managers Hywel Franklin and Trevor Fitzgerald look for small-to-mid-cap companies that have “niche market dominance” and are “beneficiaries of transformational change” as well as “innovation leadership”.

Total return of fund vs sector over 3yrs

Source: FE Analytics

Mirabaud Discovery Europe Ex-UK may have given investors exposure to European small-caps, but closer to home Liontrust UK Micro Cap was a good option for those wanting an allocation to the UK market.

The £177m portfolio beat the IA UK Smaller Companies sector average over the past three years, climbing 29.1% whilst its peers trailed behind at 12.7%.

Analysts at FE fundinfo said it was a “true micro-cap fund” given it only invests the very smallest companies in the market, avoiding any stocks larger than £275m.

Total return of fund vs sector over 3yrs

Source: FE Analytics

They warned that the management team’s preference for defensive companies could reign in returns, but investors were likely appreciative of this quality given the poor backdrop for most other smaller company funds.

“The defensive characteristics the team looks for in companies means that the fund should fall less than its peers when equity markets are falling, but could trail in rising markets,” researchers said.

“Given the team’s focus on intangible assets, its funds have a bias toward technology stocks and thus the fund will do well when this area of the market is in favour.”

This fund was launched in 2016, but its strategy has been used on the three older funds run by the Economic Advantage team – Liontrust UK Smaller Companies, Liontrust Special Situations and Liontrust UK Growth – all of which outperformed their respective sectors since launch.

The team of six who run the fund is headed up by two FE fundinfo Alpha Managers, Anthony Cross and Julian Fosh, who have been with the firm since 1997 and 2008 respectively.

Whilst it outperformed over three years, it is also the most expensive, charging investors an ongoing charges figure (OCF) of 1.34%.

Nevertheless, the analysts at FE fundinfo said this high figure is not as hefty if investors are planning to hold the fund for a long period of time.

“The fund is only suitable for long-term investors,” they said. “This is due to the riskier nature of investing in smaller companies, which can result in higher trading costs. It also has high charges, which are mainly intended to deter short-term investors.”

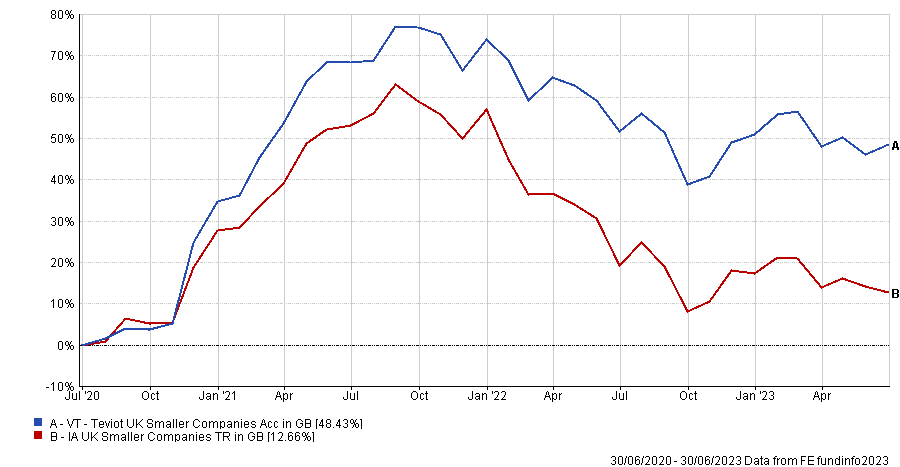

However, the highest returning portfolio with a five Crown rating despite its small size was the VT Teviot UK Smaller Companies fund.

This £76m fund was up 48.4% over the past three years, beating all its peers in the IA UK Smaller Companies sector.

Managers Barney Randle and Dan Vaughan use a value approach to buy one in eight of the companies in their investible universe.

Total return of fund vs sector over 3yrs

Source: FE Analytics

Thesis Stonehage Fleming AIM also delivered strong outperformance over the past three years, climbing 26.7% over the period.

This £89m fund is run by FE fundinfo Alpha Manager Paul Mumford alongside Nick Burchett and focuses on AIM rather than companies on the main market.

Alpha Managers were abundant on the list with Ken Wotton’s Gresham House UK Smaller Companies and Chris McVey’s Octopus UK Micro Cap Growth also among the five Crown rated funds.

The Octopus fund was up a modest 3.9% over the past three years whilst the IA UK Smaller Companies sector overtook with a 8.8 percentage point lead.

Nevertheless, analysts at RSMR said Octopus was “well regarded in the VCT and smaller company space and have amassed a large amount of industry contacts since they began running this strategy”.

Wotton’s £93m smaller companies fund more than tripled the return of the IA UK Smaller Companies sector over the past three years, soaring 43.9%.

Total return of funds vs sector over 3yrs

Source: FE Analytics