UK equities have been out of favour in recent years, although they may be poised for a rebound.

Regardless of performance relative to global equities, there are benefits in investing in UK stocks, such as the elimination of currency risk, access to FTSE 100 multinationals and exposure to growing mid- and small-caps.

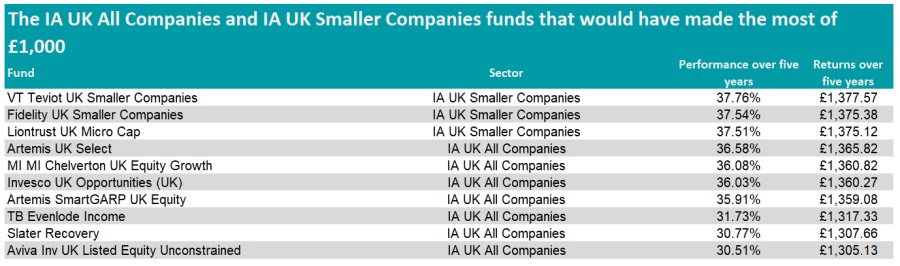

Below, Trustnet looks at the UK funds that would have made the most of £1,000 over five years.

Source: FE Analytics

As the table above shows, small-caps was the space where investors would have been more likely to get the best returns, with three funds from the IA UK Smaller Companies sector topping the ranking.

Over five years, VT Teviot UK Smaller Companies is slightly ahead, returning 37.8%.

The fund is an offering from boutique group Teviot and a minnow, with just £82m in assets under management.

Laith Khalaf, head of investment analysis at AJ Bell, said: “A more modest fund size can actually be an advantage for smaller companies managers given the lower levels of company size and liquidity they have to deal with.

“It’s a relatively new fund having been launched in 2017, but has performed well to date, showing a clean pair of heels to its benchmark index over six years.”

The runner-up, Fidelity UK Smaller Companies, has returned 37.54% over the same period and is known for its former manager Alex Wright, who now manages the group’s UK flagship Fidelity Special Situations fund.

Fidelity UK Smaller Companies is now managed by Jonathan Winton, like Wright, who invests with a value bias.

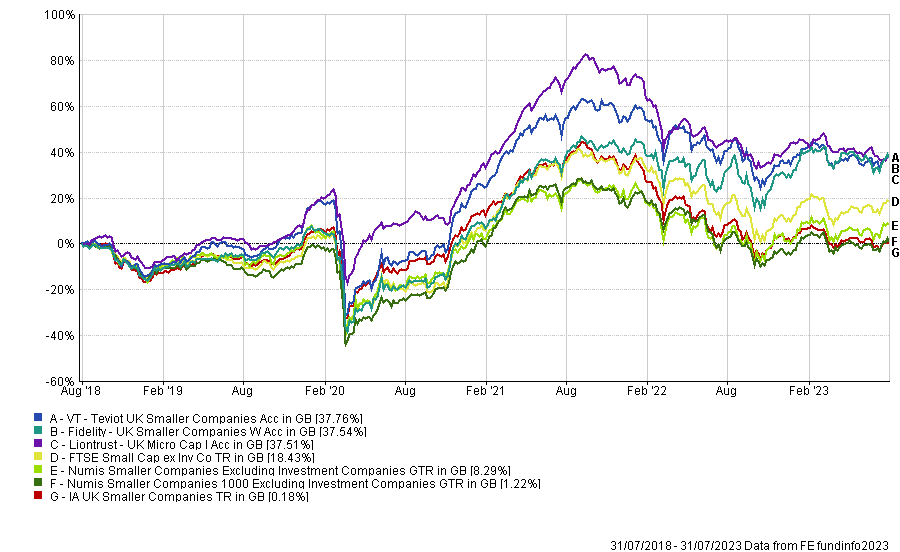

Performance of funds over 5yrs vs sector and benchmarks

Source: FE Analytics

Jason Hollands, managing director at Bestinvest, said: “The manager looks to pick up unloved smaller companies with recovery potential at attractive valuations.

“In the current environment, where UK smaller companies have been pretty beaten up, I would imagine he is seeing plenty of opportunities.”

The bronze medal belongs to Liontrust UK Micro Cap, which has returned 37.51% over five years. The fund invests in very small companies. Darius McDermott, managing director of Chelsea Financial Services, said the fund performed well during a period when risk-off investing has been paramount and micro-caps out of favour as a result.

He added: “The rest of the sector is pretty flat over the five years, so their outperformance is impressive.

“While the fund has given up a little of its outperformance in recent months, it really does go to show that good managers can make money in even the most challenging environments."

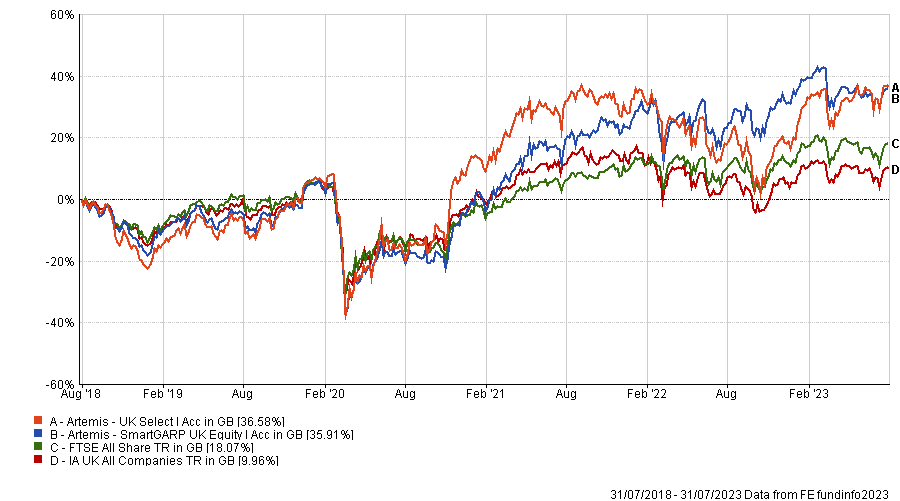

Artemis UK Select is the best performing fund in the IA UK All Companies sector. While it does not have an explicit small-cap mandate, the fund uses a multi-cap approach.

McDermott said: “The fund was lagging the sector pre-Covid, but recovered very strongly - its outperformance starts pretty much on ‘vaccine day’ (the day the vaccine breakthroughs were announced) - and has continued since.

“The manager is a very astute stock picker with an eye for valuations and he took advantage of cheaper share prices to invest in some companies that have done very well."

Performance of funds over five years vs sector and benchmark

Source: FE Analytics

Artemis SmartGARP UK Equity is another fund from Artemis that made the list, returning 35.91% over five years.

The fund, which used to be called Artemis Capital, is a ‘best ideas’ fund managed by Philip Wolstencroft who aims to identify growth companies available at a reasonable price.

Hollands said: “This fund is predominantly invested in large- and mid-cap stocks. The fund currently has a whopping 43% in financials, with HSBC Holdings the largest position at 8.7%.”

Another top performer sits on the border between the IA UK All Companies and the IA UK Smaller Companies sectors: MI Chelverton UK Equity Growth.

The fund has performed well over the long term, though its mid- and small-cap focus has left it wallowing at the bottom of the sector in recent times.

Khalaf said: “Clearly the exposure to more modestly sized companies can prove to be a performance kicker over extended time periods, though by the same token volatility will be heightened compared to more large-cap funds.”

Performance of funds over five years vs sector and benchmark

Source: FE Analytics

Invesco UK Opportunities is another top performer, focusing on larger companies with a valuation-driven process.

Rob Morgan, chief analyst at Charles Stanley, said: “Performance has been impressive through the cycle with the fund keeping up relatively well during growth-led markets and coming into its own during points when valuation discipline has mattered.

“With relatively little in the way of sector bias the good results are primarily driven by strong stock selection with the manager also adept at avoiding the value traps that can be prevalent in the less expensive end of the market. Overall, it is a strong core fund for UK equity exposure.”

Other performers in the top 10 include TB Evenlode Income, Slater Recovery and Aviva Inv UK Listed Equity Unconstrained, which all have returned more than 30% over five years.

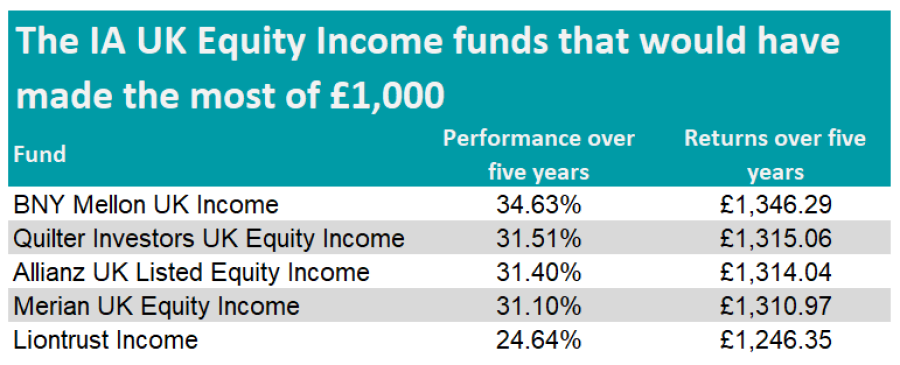

As their purpose slightly differs, we have separated the best performing funds in the IA UK Equity Income sector.

The IA UK Equity Income funds that would have made the most of £1,000

Source: FE Analytics

In this sector, the best bet over five years have been BNY Mellon UK Income, managed by BNY Mellon’s subsidiary Newton Investment Management. The fund focuses on large-cap UK equities but also includes some exposure to overseas companies.

Hollands said: “The focus here is sound businesses generating sustainable dividends. Sector exposure will differ materially from the index, with the fund being currently heavily underweight consumer staples and overweight industrials.”

Top holdings include FTSE 100 blue-chips Shell, GSK, Barclays, Lloyds Bank and British American Tobacco.

Performance of fund over 5yrs vs sector and benchmark

Source: FE Analytics

Other top performers include Quilter Investors UK Equity Income, Allianz UK Listed Equity Income, Merian UK Equity Income and Liontrust Income.