Within the investment trust space, the UK equity income sector is an obvious place to look for investors who prioritise dividend income, especially given the UK market’s attractive valuations and recent rebound, yet there are many more esoteric ways to spice up a portfolio of income-generating trusts.

Peter Hewitt, who runs the CT Global Managed Portfolio trust, has added private equity, renewable energy, Asian equities and UK small-cap trusts to his income portfolio to supplement his core UK and global equity income trusts. “You don’t want all your eggs in one basket”, he noted.

CT Global houses two portfolios – one for shareholders who prioritise income and the other one for investors who want capital growth. Both portfolios are held in investment trusts but they have different line-ups catering to their specific goals.

For the income portfolio, Hewitt has woven in some regional diversification using JPMorgan Global Emerging Markets Income, Schroder Oriental Income, abrdn Asian Income, Chikara’s Japan Income and Growth Trust and JPMorgan European Growth and Income.

He has also taken advantage of the “humungous discounts” in the private equity trust sector to gain exposure to fast-growing companies and strong performance.

He holds NB Private Equity, which has committed to paying 3.5% of its net asset value (NAV) in dividends, as well as Princess Private Equity and Apax Global Alpha, whose dividends are 4.5-5% of their respective NAVs. However, “because they’re all selling at monster discounts of 25-30%, the yield on their share price is much more”, he explained – in the realm of 7% for Apax and Princess.

“I just think it's great that an income portfolio can get exposed to private equity, which normally you wouldn't get a chance to,” he added.

NB Private Equity, which is managed by Neuberger Berman’s Paul Daggett, is the income strategy’s second-largest holding. It has a diversified portfolio of more than 100 mid-sized US businesses in the technology, software, healthcare and industrials sectors. Many of its holdings are co-investments with other top-ranking private equity managers.

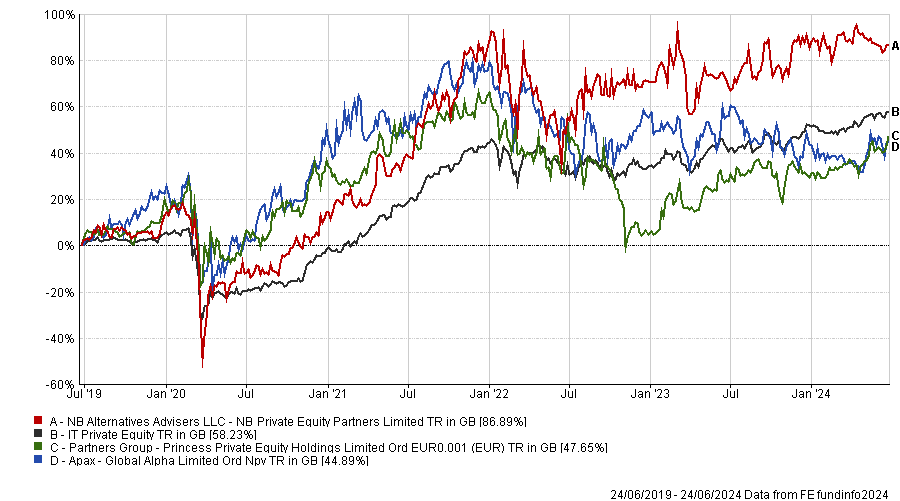

Performance of trusts vs sector over 5yrs

Source: FE Analytics

Hewitt also holds International Biotechnology Trust, which has committed to paying a 4% dividend from capital reserves, and Bellevue Healthcare.

Another area where “valuations are incredibly attractive” is UK small-caps and here, Hewitt added JPMorgan UK Small Cap Growth & Income to his growth portfolio in February and the income portfolio in April 2024.

The trust is managed by Georgina Brittain and Katen Patel and was recently created by merging a small-cap and a mid-cap trust they also ran.

“I was kicking myself because Georgina Brittain, who runs it, I should have bought her trust a decade ago. She's a very good, experienced manager,” Hewitt admitted. Brittain’s long-term performance has been exceptional, although volatile, and her growth style means she tends to perform better in rising markets, he noted.

This growth bias provides effective diversification against his other income and value-oriented managers and the trust has a solid dividend yield to boot. Although it produces a 2.5% natural dividend yield, the board has committed to paying dividends of 4% per annum – 1% quarterly – drawing from capital reserves.

Hewitt uses gearing to boost the income further by borrowing at 4% to invest in trusts paying dividends of 6-7% such as Greencoat UK Wind and 3i Infrastructure. The net asset values of renewable energy trusts have been “very steady” but “the share prices are all over the shop, because they're very sensitive to bond yields and interest rates,” he noted.

Hewitt has also taken advantage of CT Global’s structure to elevate yields through income transfer. The growth portfolio receives dividends worth approximately 1% of its assets, which its shareholders do not want or need, so these are transferred over to the income strategy, which pays back its growth sibling with 1% of its capital.

“The market tends to value 1% of dividends higher than 1% of capital. It’s taxed more, but that's just life,” he observed.

Increasing the income portfolio’s dividends through income transfer has “meant I've never really had to chase very high dividend yields, which can be risky”.

A flexible attitude to dividend payers is something Hewitt shares with the managers of his largest holding for the income strategy, Law Debenture. It houses a professional services company, which equates to 20% of its asset value, but contributes a third of the trust’s revenues.

This means that the trust’s managers, Laura Foll and James Henderson, can be more flexible when picking stocks. They are not beholden to high dividend-payers because the trust already has plenty of income at its disposal.

“James and Laura start off with that huge advantage and so they can go searching not just in the higher yield space like City of London does; they've got a wider remit and that is reflected in better performance over the long run,” Hewitt explained. “That extra flexibility has resulted in really quite strong performance and on top of that great dividend growth.”

The £1.1bn trust yields 3.5-4% and has grown its dividends by 5-7% per annum. It is the best performing trust in the IT UK Equity Income sector over the five years to 24 June 2024, and is the third-best performer in its sector over one and three years.

Performance of trust vs sector over 5yrs

Source: FE Analytics

Foll and Henderson also run Lowland, which features in both of Hewitt’s portfolios, and Henderson Opportunities, which Hewitt holds for his growth clients.

The income portfolio, meanwhile, counts several ‘usual suspects’ amongst its top 10 holdings, including Mercantile investment trust, Murray International, the Merchants trust and City of London.