Private investors have been ploughing money into bond funds and direct fixed-income holdings to take advantage of elevated yields, with coupons of 4-5% from gilts and 5.5% from sterling-denominated investment grade corporate bonds.

Fixed income allocations have risen by 195% amongst interactive investor’s (ii) customers over the past two years, with gilts making up the bulk of this increase. Assets held in direct gilts are up nearly 21-fold since 30 June 2022, ii revealed, while investors also put money into corporate bond funds across a range of sectors.

Part of the reason for this surge in activity is the fact that major central banks have postponed interest rate cuts this year as inflation proved stickier than expected, meaning bond yields have remained elevated.

Jim Cielinski, global head of fixed income at Janus Henderson Investors, said this has “extended the opportunity for fixed income investors to lock in some attractive yields”.

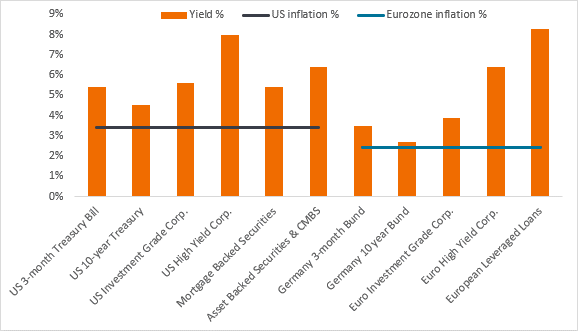

“Investors are being paid to wait for rate cuts to emerge. Yields are at levels that typically pay well above inflation and offer the prospect of capital gains if rates decline.”

Bond yields are well above inflation

Sources: Janus Henderson, Bloomberg

April LaRusse, head of investment specialists at Insight Investment, agreed, noting retail and institutional investors are “looking to lock in absolute yields”, which is “creating a positive environment for issuance, which has picked up strongly in the first half of 2024”.

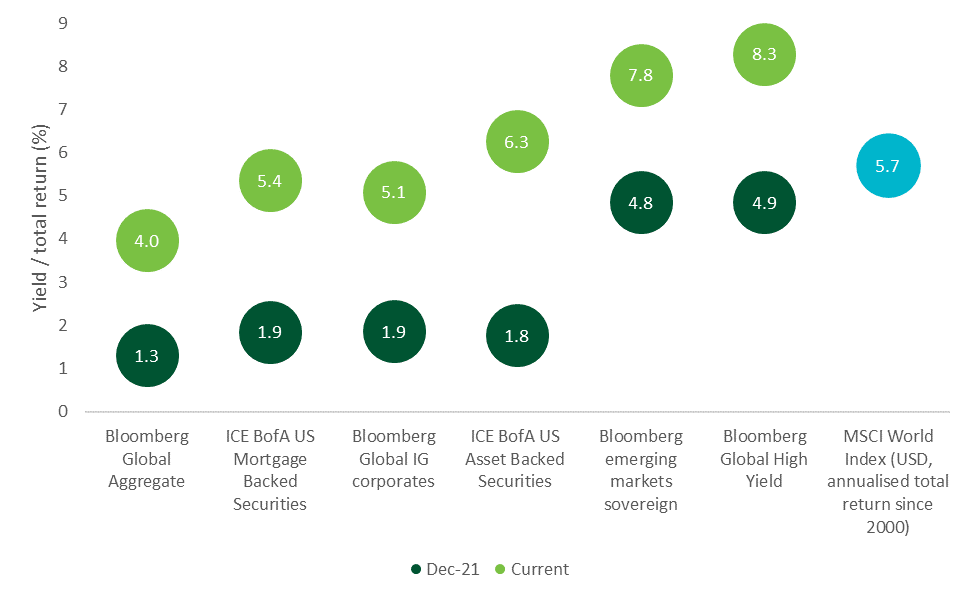

The vast majority (86%) of global fixed income assets are now yielding 4% or more, versus less than 20% in the decade leading up to the pandemic, according to data from LSEG Datastream and the BlackRock Investment Institute. Several sectors within the bond markets are even offering yields comparable to the long-term returns associated with equities, as the chart below shows.

Bonds now rival long-term equity returns

Source: Insight Investment and Bloomberg, data to 31 May 2024

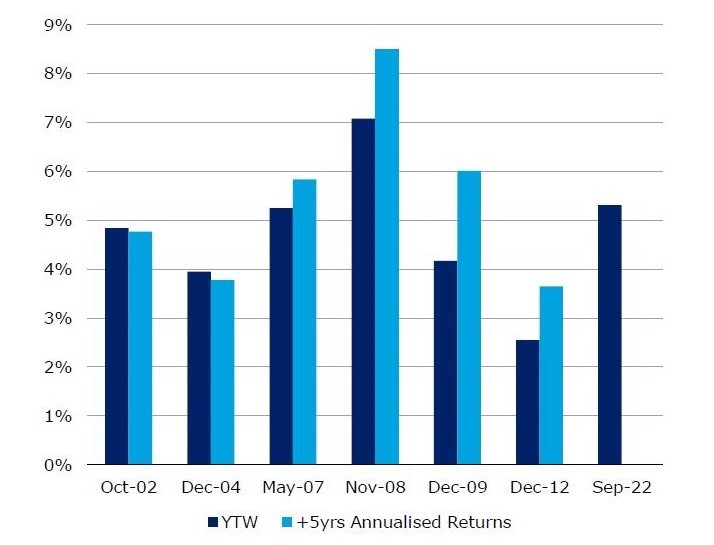

With investment-grade credit, the entry yields tend to indicate the total returns investors will receive in the medium term, said Nachu Chockalingam, senior credit portfolio manager at Federated Hermes.

Investors moving into investment grade credit now with yields at 5.5% should receive annualised returns of about 5.5% over the next three to five years. “For the fairly low credit risk that you're taking, you're getting a pretty decent yield,” she said.

The composition of returns may change over the next 12 to 18 months as the rate component declines but the spread increases, she added.

Starting yields versus 5yr annualised returns for global investment grade bonds

Sources: ICE Bond Indices, Federated Hermes

Most experts agree that the direction for interest rates – and therefore bond yields – is downwards, although fund managers and economists differ in their predictions for the speed and timing of cuts. When bond yields fall, prices rise, so investors should make capital gains from their bond positions.

Joe Little, global chief strategist at HSBC Asset Management, thinks this bodes well for bond portfolios. “We think the environment of renewed disinflation and policy pivots signals a return to fixed income in the second half of the year. There are more central banks cutting rates now, and that has a big effect for bond market performance,” he said.

However, Joost van Leenders, senior investment strategist at Van Lanschot Kempen, expects yields to remain at elevated levels even after monetary policy easing gets underway. “Even though inflation should moderate further, and central banks will cut rates, we think the room for yields to fall is limited. Yield curves are significantly negative in the US and the Eurozone, which shows that falling inflation and lower policy rates are anticipated,” he explained.