The Fidelity Global Special Situations fund has been popular among investors, reaching £3.3bn of assets under management (AUM) but its failure to beat the MSCI World index and its benchmark, MSCI All Country World, in the past five, three and one years, may leave investors wondering why.

It means those with money in the fund would have been better off with a cheaper index tracker over the medium term.

Fidelity Global Special Situations has lagged the MSCI World index by more than 5 percentage points over the past three years, both singularly and cumulatively, which made it eligible for the Bestinvest doghouse, where it ranked as the second-largest underperforming fund in the whole peer group.

Other worries around the fund were added last year via a manager change, as Jeremy Podger, the FE fundinfo Alpha Manager who ran it, announced his retirement and was replaced by Christine Baalham and Tom Record.

These are just a few of the reasons why investors might be wondering what to do with this fund. Joe Richardson, discretionary investment manager at Dennehy Wealth, found another, namely the extreme valuations in the US and the potential downside risk. If he was holding this fund, he would “certainly be looking elsewhere”.

But not all experts agreed, with some considering it a good play going forward.

About 65% of the portfolio is invested in US equities, including major holdings in Microsoft, Alphabet and Amazon, unusual choices for a value fund which, according to its factsheet, aims to buy “undervalued [companies] whose recovery potential is not recognised by the market”. This is what made it “a concerning hold” for Richardson.

“To reach run-of-the-mill valuations associated with future returns of approximately 10% annually, the S&P500 would need to fall by about 70%,” explained Richardson.

This fund is “too heavily exposed to that risk,” so the manager would sell and move on to other markets that are less correlated to the US and positioned to perform well in a new era of higher interest rates, inflation and volatility – sectors such as commodities, particularly gold, and regions such Japan and parts of Asia, both “better opportunities” at present.

For investors who are still interested in recovery plays, the Ninety One Special Situations is a more attractive option according to Richardson, given its value tilt and the fact this environment offers some “extremely compelling stocks” trading at “incredibly cheap levels” compared to markets and their own history.

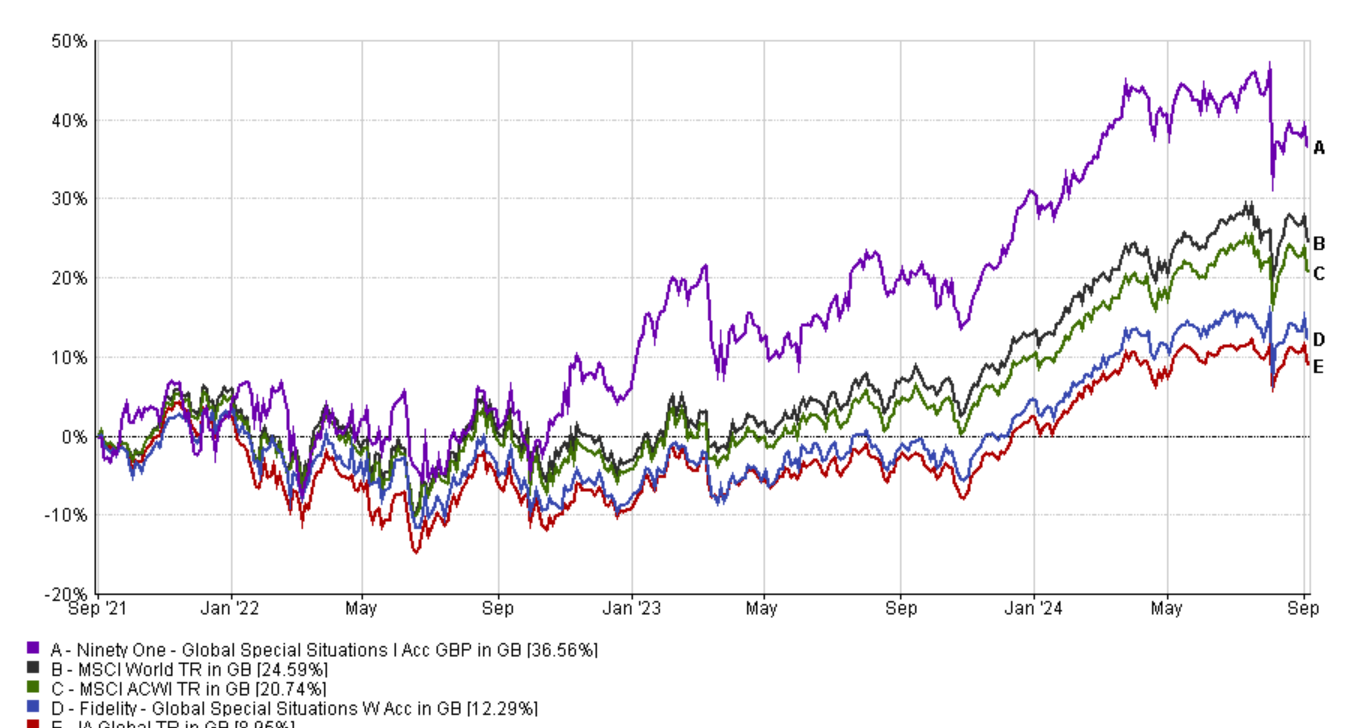

“This positions the fund well for strong returns in an otherwise expensive world,” he said. The Ninety One fund, despite a much smaller size, has made higher returns than its Fidelity competitor, as highlighted in the chart below.

Still, 40% of its holdings are again in the US, which made Richardson hesitant. “A significant correction in the S&P would likely drag down most, if not all, of these stocks, regardless of whether they are undervalued or not,” he said.

Performance of funds against sector and indices over 3yrs

Source: FE Analytics

Charles Stanley managing director Rob Morgan had a more nuanced take on the matter. Despite the “special situations” moniker, he considered the fund a core position, as it isn’t particularly tilted to a value style as one would expect form a special situations fund.

“Whether to retain or buy this fund, therefore, will depend on how it sits in the context of a wider portfolio,” he said.

While Fidelity “may not offer enough diversification” for those looking for a more defined value tilt, it represents “a solid option” as a core holding and would be a ‘hold’ for Morgan if that is the intention of the investor.

The Ninety One fund in comparison has “a significantly different portfolio” to the average global fund, which stems from its contrarian and deeper value approach, making it a candidate for a satellite position in a portfolio.

For Darius McDermott, managing director at FundCalibre, Fidelity Special Situations is “an all-weather strategy that integrates both growth and value opportunities”.

After meeting the new managers last quarter, he was “impressed with their differing but complementary skill sets”, which should ensure a “well-rounded” approach.

The fund therefore is suitable for “a variety of market conditions”, including the new growth cycle that we are entering, according to McDermott.

“With global interest rates expected to decline and the market broadening out, we anticipate that growth-oriented stocks may regain prominence,” he said. “This shift could bolster the performance of more balanced funds in this space, Fidelity Global Special Situations included.”