Four in 10 fund groups expect the US to be the best performing region in 2025, according to Quilter Investors’ latest investor trends survey.

Lindsay James, investment strategist at Quilter, said the US economy has proven incredibly resilient against the high interest rate environment. With president-elect Donald Trump promising additional fiscal spending and deregulation, “conditions look ripe for a stock market boon”.

Tom Stevenson, investment director at Fidelity International, agreed. “The US economy looks well primed and ready for growth, having expanded at a 2.8% annual rate in the third quarter after recording 3% growth the quarter before. The economy has shown itself to be resilient in the face of shocks, supported by a sharp fall in inflation and a generally healthy labour market,” he said.

Besides the ‘Trump bump’, another reason to consider US equities at present is the Santa rally phenomenon, whereby stock markets put in a good showing during the final month of the year. Since 1994, the S&P 500 has delivered positive returns in 23 Decembers and made losses in only seven, according to Fidelity.

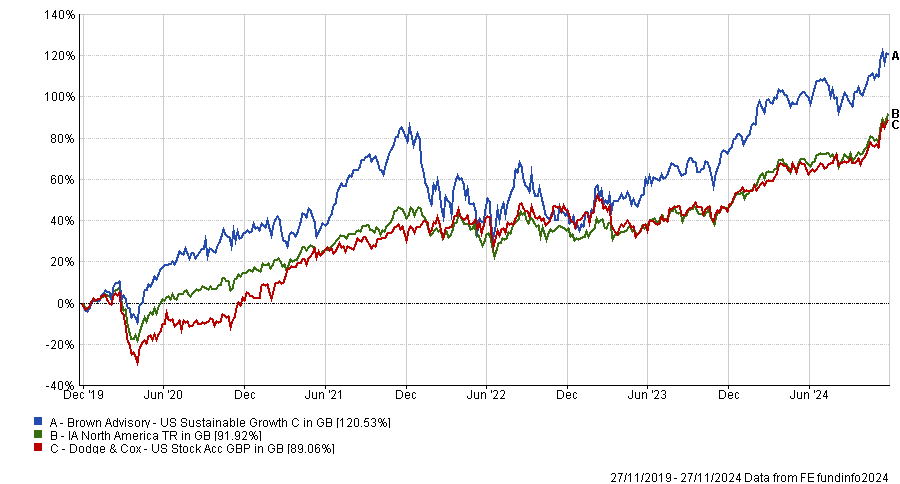

For investors who have a bullish outlook on US equities, Stevenson suggested three funds: Brown Advisory’s US Sustainable Growth and US Smaller Companies funds; and the Dodge & Cox Worldwide US Stock fund.

Brown Advisory US Sustainable Growth benefits from an experienced portfolio management team and a strong pool of company analysts, he said. “The fund is mostly invested in larger companies with a durable competitive advantage and steady rather than necessarily rapid growth. It also has a focus on quality. This is a reasonably concentrated growth portfolio of between 30 and 40 holdings.”

The Dodge & Cox Worldwide US Stock fund is also relatively concentrated but it has a more contrarian approach, often buying companies with depressed share prices. As such, it would blend well with Brown Advisory US Sustainable Growth, he said.

Performance of funds vs sector over 5yrs

Source: FE Analytics

“The Dodge & Cox fund’s value bias is reflected in a low forward-earnings multiple of 14.7x and trailing dividend yield of 1.8% as at the end of September. The same metrics for the S&P 500 were 22.5x and 1.3%.”

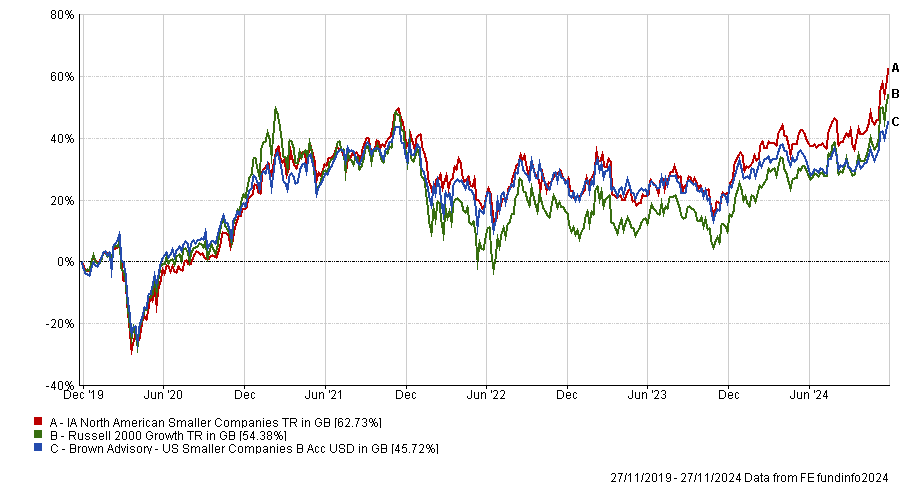

Smaller companies tend to earn a greater proportion of their profits from the domestic economy so they “may well be swept higher by the Trump tide”, Stevenson said. Hence why he suggested the Brown Advisory US Smaller Companies fund, which seeks stocks with above-average growth, sound management and competitive advantages. Brown Advisory is based in the US and has an extensive team researching and investing in smaller companies, he added.

Performance of fund vs benchmark and sector over 5yrs

Source: FE Analytics

Other US small-cap funds recently recommended by experts include Artemis US Smaller Companies and Federated Hermes US SMID Equity.

Not everyone is bullish on the US, however. While 38.9% of investment professionals told Quilter the US will outperform – more consensus than for any other region – another 12.5% of respondents believe the opposite, predicting the US will lag other markets next year.

James shares some of their concerns. Over the longer term, Trump’s isolationist economic policies “threaten to throw a spanner in the works” by driving up inflation and interest rates, she said.

“For a man who wants the stock market to be a barometer of his success, he will not want to drastically upset investors by causing any share price corrections. It will be a fascinating balance to watch him try to achieve.”

Stevenson also sounded a note of caution: “Recent trading sessions in New York suggest the ‘Trump bump’ could quite easily fade. There’s a renewed fear around the reduced likelihood of an interest rate cut, which is no longer a foregone conclusion. Moreover, future tariffs will likely impact US consumer companies through higher input costs.”

The dollar has soared over the past month, which will hurt exports and the earnings of American multinationals, he added.

“Despite these challenges, it’s hard to ignore the underlying strength of America’s corporate sector, or that the country has skirted a recession without the assistance of a sustained period of lower interest rates. Company earnings are currently expected to grow by around 9% this year and 15% next. These factors support the case for a continuation of the current bull market,” he concluded.