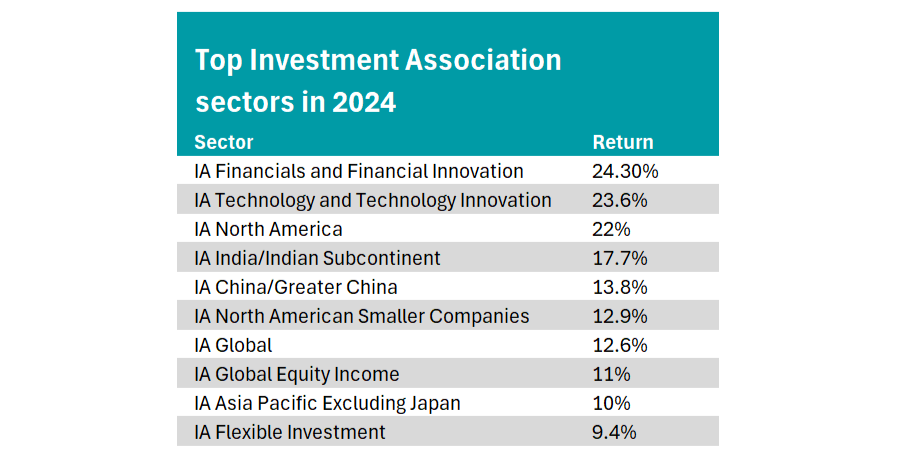

US equity and tech funds did well in 2024, as expected, but what might surprise investors is that financial services stocks did even better.

The IA Financials and Financial Innovation sector returned 24.4% last year, surpassing both the IA Technology and Technology Innovation and IA North American sectors.

Ben Yearsley, director at Fairview Investing, observed: “Banks, for example, have been throwing off cash like it’s going out of fashion using it to fund dividends and buybacks.”

Source: FE Analytics

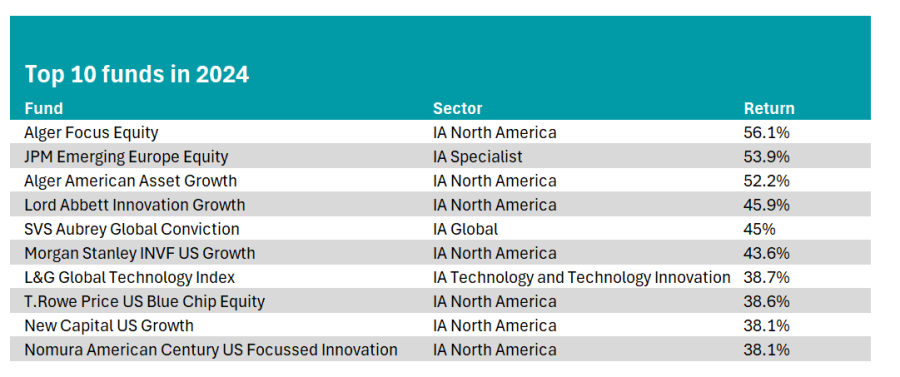

However, on the individual fund level, US and tech funds established themselves as the best absolute performers in 2024. As Yearsley added: “The top 10 last year was all about the US.”

For example, the £22m Alger Focus Equity fund held five of the Magnificent Seven and surged by 56.1%. Similarly, the L&G Global Technology Index, which tracks the technology-focused companies of the FTSE World index, was up by 38.7% last year.

The second-best performer was JPM Emerging Europe Equity, which soared by 53.9%.

Source: FE Analytics

Below, Trustnet highlights some of other best-performing funds in 2024, most of which had a strong US component.

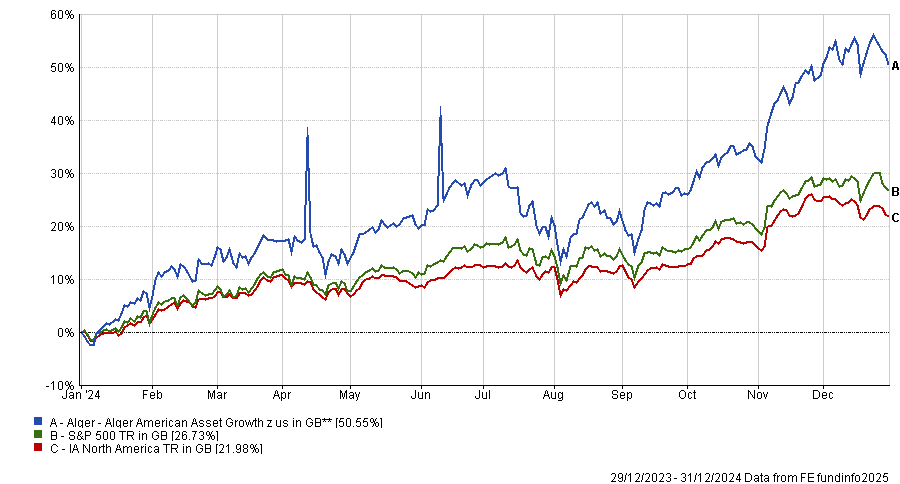

Alger American Asset Growth

The £430m Alger American Asset Growth portfolio, managed by Patrick Kelly since 1999, stood out last year. The fund was up by 52.2% in 2024, compared to the IA North America sector average of 22.1%. As a result, it also surpassed the highly competitive S&P 500, which surged by 26.7% last year.

This was the second-best performance in the entire sector, surpassed only by Alger Focus Equity.

Performance of fund vs sector and benchmark in 2024

Source: FE Analytics

This followed years of consistent outperformance for the fund, which has featured within the top quartile of the highly competitive IA North American sector over three, five and 10-year periods.

This strong performance made the Alger strategy one of the best candidates for alpha generation last year, with the fund generating 9.7% alpha in 2024.

This outperformance was due to its portfolio structure and composition, with the fund holding six of the Magnificent Seven within its top 10 holdings. With 9.2% and 9.1% in Microsoft and Nvidia, respectively, the fund would have benefitted from both companies surging share prices in the past year.

However, the fund’s high conviction approach also made it one of the riskiest portfolios in the sector, with an average volatility of 20.9%.

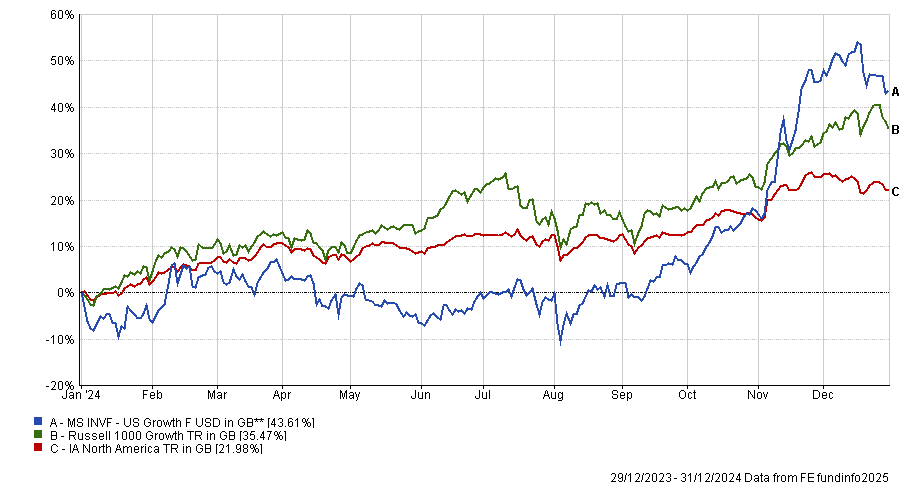

Morgan Stanley INVF US Growth

Another US-domiciled fund that stood out was the £2.8bn MS INVF US Growth portfolio led by Dennis Lynch since 1997.

Last year, it was the sixth best-performing portfolio in absolute terms and the fourth best in the IA North America peer group, with a performance of 43.6% in 2024.

Performance of fund vs sector and benchmark in 2024

Source: FE Analytics

This represented a comeback after disappointing three-year performance, when the portfolio was down by 9.6%, the second-worst performance in the overall sector.

However, the strategy performed better in the long term, delivering a second-quartile result in five years and a top-quartile performance over the past decade.

This fund stands out because it holds just one of the Magnificent Seven stocks, Tesla, in its top 10. Instead, businesses such as Cloudflare and Roblox feature prominently.

Its outperformance was achieved through a higher-risk approach than many competitors, with 25.7% volatility. As a result, this was the highest-risk portfolio in the sector, making this a strategy better suited to more adventurous investors.

Four other US equity funds were amongst the top 10 performers last year: Lord Abbett Innovation Growth, T.Rowe Price US Blue Chip Equity, New Capital US Growth and Nomura American Century US Focussed Innovation.

SVS Aubrey Global Conviction

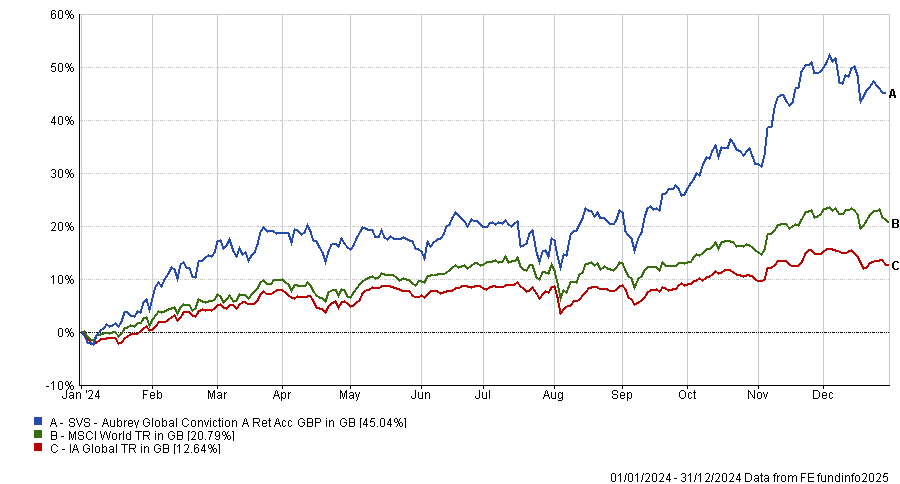

Finally, the £51.7m Aubrey Global Conviction fund more than doubled the return of its benchmark last year, rising 45%, compared to 20.8% for the MSCI World Index. It was the second-best performing strategy in the 545-strong IA Global sector and the fifth-best fund in any sector.

Performance of fund vs sector and benchmark in 2024

Source: FE Analytics

The strategy differed from the rest of the top 10 due to a significant non-US component. For example, Indian-based multinationals such as Zomato and Bharti Airtel featured prominently in the top 10 holdings, allowing the fund to benefit from India’s strong growth last year.

The fund holds only one Magnificent Seven stock, Meta Platforms, in its top 10. However, the fund remains highly exposed to the US, with 79% of the portfolio invested in North America.

At the other end of the spectrum, the IA Latin American sector took the biggest hit last year, with strategies in the sector having slid by around 25%. By comparison, the second worst performing sector was the IA UK Index Linked Gilts, which fell by 9.7% in 2024.

Source: FE Analytics

These sector trends were reflected in individual fund performance, with the Blackrock GF Latin America fund down by 32.4%, the second-worst performance in the sector.

Other Latin American strategies such as abrdn Latin American Equity, Barings Latin America and Schroder ISF Latin America also featured as some of the worst performing funds last year.