A full-blown trade war, dot-com bubble 2.0, deregulation fever and a shock trade agreement are four possible scenarios for investors to consider as they invest their way through the rest of 2025, according to Investec analysts Elliott Hardy, Alan Brierley and Ben Newell.

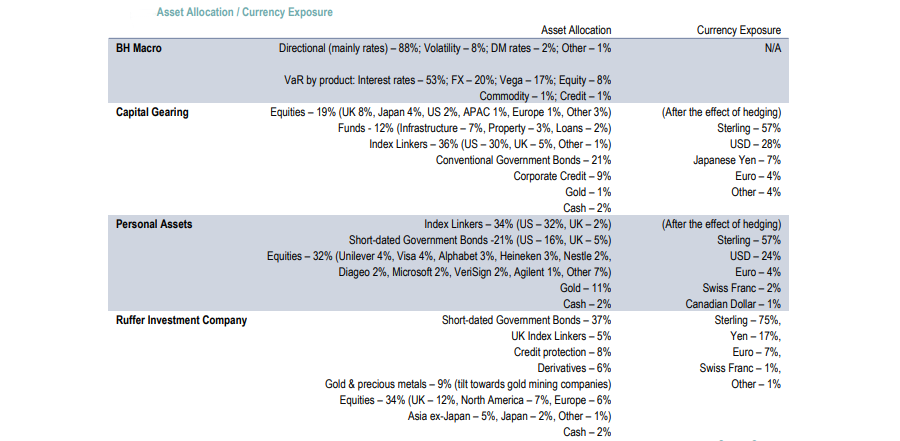

They looked at the impact each scenario would have on four defensively positioned investment trusts they recommend: BH Macro, Capital Gearing, Personal Assets and Ruffer.

Scenario 1: Full-blown global trade war

This year has already been dominated by US president Donald Trump, whose ‘Liberation Day’ tariff tirade sent markets into a spin. The repercussions are still being felt, with markets dropping again this morning, and there are seemingly no signs as yet that he is willing to make changes or roll back some of his protectionist rhetoric to appease investors.

Indeed, this morning the complete list of ‘reciprocal’ tariffs came into effect, including a 104% tariff on Chinese imports to the US.

Many countries have already discussed retaliating with tariffs of their own, including China, which heightens the risk of a full-blown global trade war.

In a trade-war scenario, stocks would fall while bond yields would rise (and bond prices fall) due to stagflation, the Investec analysts said in their report discussing the use of defensive holdings in investors’ portfolios.

“Economic fortunes across developed economies are likely to diverge, increasing the need for diversification within portfolios,” they noted.

Here, the team highlighted BH Macro and Ruffer as two trusts investors may wish to hold. Both have “proven to have low participation rates with falling equities”, they said.

“BH Macro’s strategy is expected to follow a ‘random walk’ with respect to equity valuations, acting as a diversifier during periods of enhanced stock/bond correlation.

“Ruffer’s protection strategy, including VIX calls and equity downside puts, should benefit from convex payoff structures if the market falls further.”

Scenario two: Goldilocks

But there is also the potential for Trump to concede to market forces and backtrack on his tariffs following the sharp drop in US stocks over the past week. If this cash is shifted into other developed economies, it may force the president to introspectively look at whether the costs are worth the fight.

In this case, stocks would rise while bond yields would fall as inflation concerns heightened by the tariffs would gradually abate. This is something the analysts described as the ‘Goldilocks’ case.

Defensive strategies would likely underperform in this scenario, although they noted that equity allocations in the likes of Capital Gearing, Personal Assets and Ruffer should “support absolute returns, while duration risk should also be supportive”.

In particular, they noted that Capital Gearing’s allocation to alternative investment trusts “is expected to perform particularly well, with a ‘double whammy’ of strengthening NAV [net asset value] returns and discount tightening as investors rotate back into the sector in search of income”.

Source: Investec

Scenario three: Deregulation and tax cuts

Away from Trump’s tariffs, perhaps the best outcome for investors would be a rise in deregulation, the potential for which led stocks to rally towards the end of 2024. It could do so once again if deregulation becomes a reality.

A series of US tax cuts could shift attention away from tariff policies, which would also need to moderate in this scenario.

“Consumer and business confidence return, at least domestically, supporting US equities. As the engine room of the global economy, US strength spreads to other major economies, with momentum trades dominating once again,” the Investec analysts said.

In this case, US equities should recover but inflation would “remain sticky” and the sustainability of the US fiscal deficit would be questioned. While stocks would rise, bond yields would also increase (meaning fixed income assets would become cheaper).

“Experiences in this scenario will vary. Funds with significant exposures to US TIPS should benefit if breakeven inflation expectations rise, while increasing pressure on the US fiscal position presents a potential risk,” they said.

“Equity portfolios will also experience varying outcomes. For example, certain US quality names in Personal Assets’ portfolio may benefit, while income-focused investment trusts in Capital Gearing’s portfolio are unlikely to see similar gains.”

Scenario four: Stock market crash

Lastly, a full-blown market collapse akin to the dot-com bubble could take place. For this to happen, US artificial intelligence (AI) leaders would need to lose ground to overseas competitors, while the Magnificent Seven stocks (Amazon, Alphabet, Tesla, Meta, Microsoft, Apple and Nvidia) would fail to translate their spending on AI into returns on investment.

“Earnings continuously disappoint, leading to a significant market correction and investors flock to bonds and gold for a safe haven,” the analysts said. Stocks would fall while bond prices would spike, leading to yields coming down.

“BH Macro and Ruffer are well-positioned for this scenario due to their low participation rates in market downturns. Fixed income exposure should benefit from a falling yield environment, aligning with the defensive positioning of the investment companies featured in this report,” they said.

However, investors should not take the above as an exhaustive list of possible outcomes. “We caution that this is a very simplistic way to look at the world, and the reality is that a reversal of Trump’s tariff policies, the potential for AI disruption, and/or a multitude of other variables may quickly change the playbook,” they concluded.