President Donald Trump's announcement of tariffs last week shook markets, kickstarting the largest global sell-off since 2022. Most tanked in the aftermath, with the S&P 500 sliding more than 10% since ‘Liberation Day’, although there have been green shoots of recovery since in the past few days.

However, even before Liberation Day, Rob Perrone, an investment analyst on the Orbis Global Balanced fund, argued that investors had developed incorrect expectations of equity and bond markets.

Post the global financial crisis (GFC), investors had been “investing in easy mode” because stock markets delivered exceptional returns. “This is not how markets usually work," he argued.

“My professional career has been a low rate, low inflation era” and investors have developed “fundamentally unreasonable” assumptions about markets because of this, Perrone said.

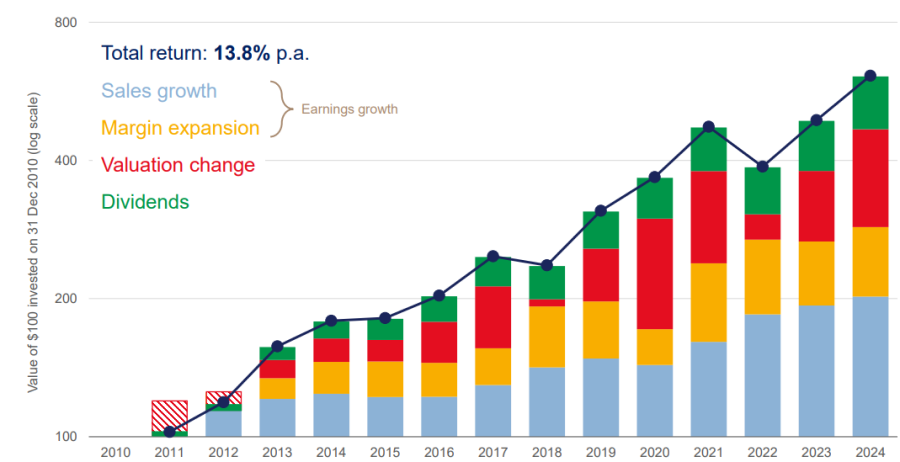

He argued that the S&P 500’s 13.8% per annum return since 2010 was based on record-breaking growth in sales, margins, valuations and dividends, which would not be sustainable. Investors have made forecasts for the future of equity markets that they will be unable to deliver, because they were based on an uncommon 20 years.

He explained that the S&P 500’s exceptional return each year was because of a 5.2% expansion in sales, a 2.5% expansion in margins, a 3.6% rise in valuations and a 1.9% rise in dividends, as indicated by the chart below.

S&P 500 performance breakdown since 2010

Source: Orbis analysis. Bloomberg. Data accurate as of 31 Dec 2024

“For margin expansion to boost returns by 2.5% per year again, margins need to go up from today’s much higher starting point. Similarly, for valuations to boost returns by another 3.6%, valuations would need to go up again from today’s much more expensive levels,” he explained.

Perrone said this conclusion required investors to believe that margin expansion and valuations can grow by record-breaking levels while already at exceptional highs.

“Great expectations are already in the price, so to expect a great return, investors need to believe that reality will prove even more amazing than markets already expect,” he concluded.

Additionally, investors who began putting their money into the stock market after the financial crisis have developed “enormous faith in central banks’ ability to handle inflation” because neither interest rates nor inflation were concerns.

Even in the past four years there have been tailwinds pushing inflation down, such as globalisation or Europe not spending, which have now begun to reverse, he added. Meanwhile, Trump’s latest wave of tariffs and weaknesses in the supply chain could easily push inflation even further, but markets are failing to recognise this.

Investors had similar assumptions about bonds, which typically increased in value during this low interest rate, low inflation era. Yields were pushed ever lower by investors who were forced to buy bonds with miniscule (and in some cases negative) coupons.

“Inflation was the bond market assassin” he said, noting that bonds could easily disappoint investors if the “rosy picture” of inflation was incorrect.

Instead of solely relying on bonds, he is using a long-short strategy, choosing instead to hedge as much as 17% of the fund’s equity exposure with short positions. To do this, the team invests in stocks they like while hedging the index, which helps minimise losses when the market sells off.

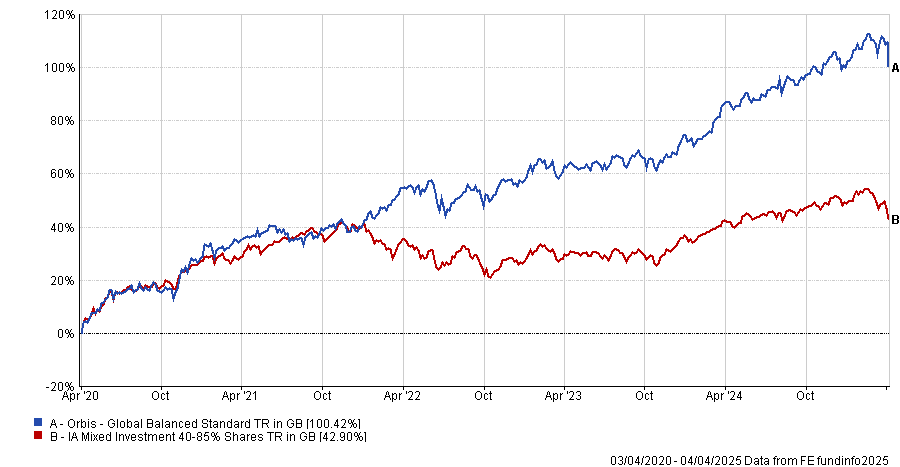

This approach has paid off, with the fund delivering a top-quartile return in the IA Mixed Investment 40-85% shares over the past one, three and five years. Additionally, it has ranked within the top 10 funds of the peer group in the past six months, when market volatility has risen.

Performance of fund vs sector over the past 5yrs

Source: FE Analytics

Perrone explained: “When you combine long stockpicking with shorting indices you get a volatility profile, which is not far-off long-term bonds, but with return drivers that are different to the rest of the market.”

That is not to say the fund eschews bonds entirely. In the fixed income space the team has pivoted away from nominal bonds, favouring index-linked bonds such as US TIPS (Treasury Inflation-Protected Security) as they are worries the market is becoming complacent on inflation.

“There is real steepness in the TIPS curve and lower inflation expectations the further out you go.” As the market looks most complacent about inflation over the long term rather than the short term, the compelling inflation-protected yields available on US TIPS make them a far better option than gilts or traditional Treasuries, he said.

“If I bought a 30-year TIP today, I could get a 2.3% yield locked in and protected from inflation. In a market where we think investors are too optimistic about inflation and central banks that looks compelling.”