Investors risk missing out on strong returns from UK companies if they continue to wait for a catalyst that may never materialise, according to Mark Niznik and William Tamworth, managers of the recently acquired Artemis Future Leaders Trust.

Tamworth said: “Our big bugbear is that people are always obsessing about catalysts for performance, and if they cannot see one, they will not invest.”

Tamworth explained: “When you look at the building blocks of the UK, things are not that bad. Unemployment is low, real wages are rising, and many companies have no net debt, putting them in a better position for sustained growth.”

The managers argued this has blinded investors to the fact the UK is full of “future leading businesses” with strong balance sheets, great fundamentals and attractive valuations.

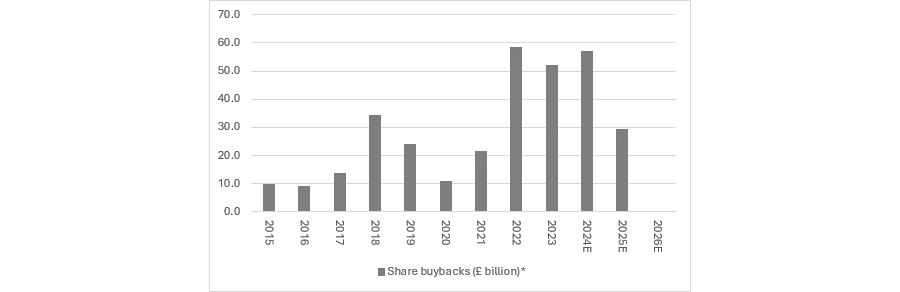

For an example of the strength of UK businesses, Niznik pointed to the rise in share buybacks. “In my 40 years of fund management, there has never been as many share buybacks, including in the small- and mid-cap space, as we are getting now,” he added.

He explained that share buybacks were typically only carried out by large companies with significant excess capital and strong market positions. The fact that share buybacks have not lost momentum this year and have even become common lower down the market capitalisation indicated that UK businesses were increasingly flush with capital.

Russ Mould, investment director at AJ Bell, noted share buybacks amongst the FTSE 100 had risen to around £16.7bn already this year. “The index is therefore on track to challenge the 2024’s total of some £57bn , itself only a fraction below the record sum of £58.2bn returned to shareholders via this mechanism in 2022.”

UK share buybacks over the past 10yrs

Source: AJ Bell

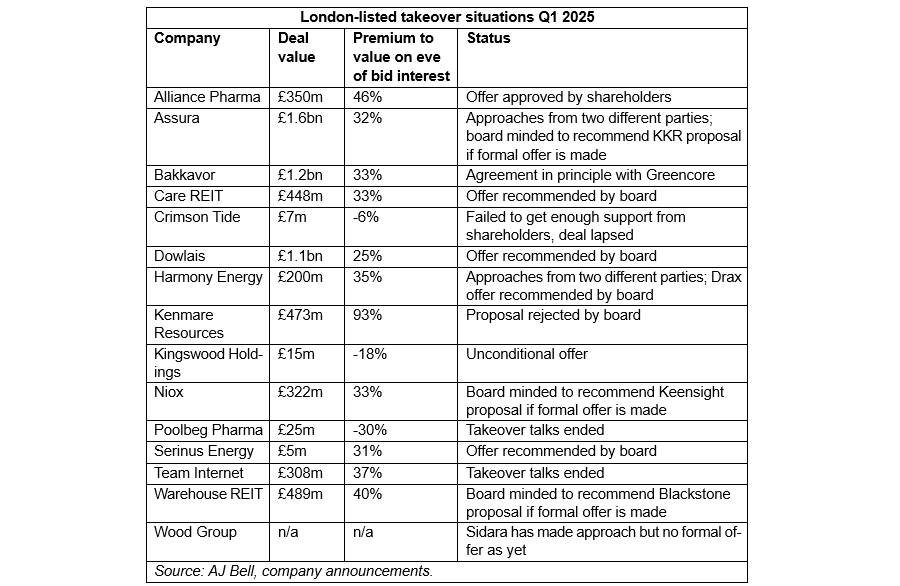

Additionally, UK businesses are still highly popular among international rivals, demonstrated by ongoing mergers & acquisitions (M&A). For example, recent research by AJ Bell demonstrated there were more than a dozen takeover attempts in the first quarter of 2025 across the market capitalisation spectrum.

Dan Coatsworth, investment analyst at AJ Bell, added: “The UK takeover juggernaut has kept on trucking. It is the usual situation of unloved UK stocks falling off the radar for many investors and attracting opportunistic bids”.

For Niznik, the rise of buybacks and M&A activity is a sign that UK companies are much better quality than many investors think. Tamworth and Niznik argued that investors have missed this because they have developed misconceptions about the wider UK market.

Niznik explained the UK has gone from “one macro issue to another” with Brexit, political uncertainty, discussions of a fiscal black hole and a harsher Budget on businesses than expected.

He said these negative narratives have made investors pessimistic and unwilling to invest in stocks with the right set of qualities without an obvious catalyst, adding: “As investors, we talk ourselves down quite happily, which undermines confidence."

However, he argued that perceptions could turn for the better due to the more secure political environment and strong business fundamentals in the UK compared with the rest of the world.

“The UK has all the elements of a cracking investment, the only thing missing is confidence. Whether that is confidence from businesses and consumers in the economy or confidence investors have in the investments they make. If perceptions change even a little, there is a significant opportunity,” Niznik said.

As a result, Tamworth argued that investors should not wait for a catalyst. The perceptions and reality on the UK are so different, “very little needs to change to make a lot of money," meaning investors could easily miss out.

“While most of the market will not invest without a catalyst, we are the opposite. If we see a business on a good valuation, we do not care what the catalyst is or when it comes through, we are happy to be patient and wait," Tamworth explained.

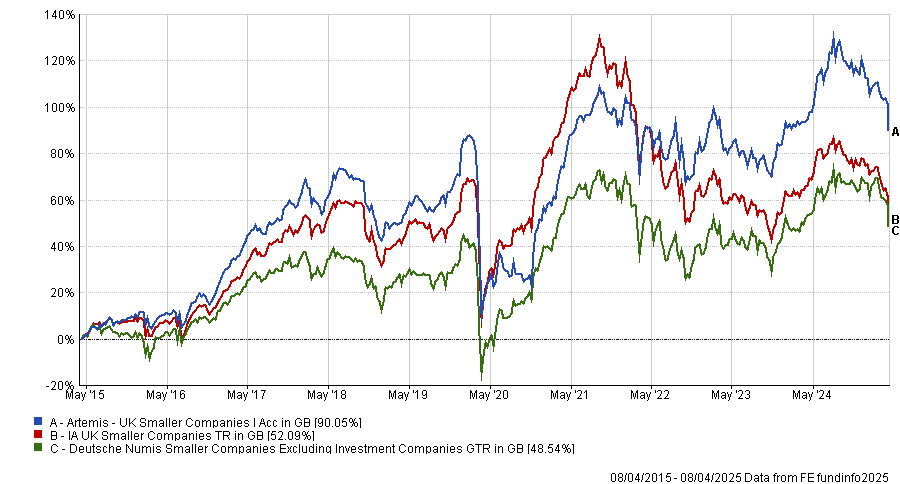

Niznik and Tamworth have employed this approach in their open-ended strategy, the Artemis UK Smaller Companies fund to great effect.

Performance of fund vs sector and benchmark over the past 10yrs

Source: FE Analytics

The fund is up 90.1% over the past decade, beating the average competitor in the IA UK Smaller Companies’ sector and the Deutsche Numis Smaller Companies benchmark.

It has delivered further top-quartile results in the IA UK Smaller Companies sector over the past one, three and five years and has an FE fundinfo Crown Rating of five.

“To my mind, the narrative around the UK is much worse than the fundamentals that underpin it. You only need things to be a little less bad than the narrative to find some significant opportunities,” Tamworth concluded.