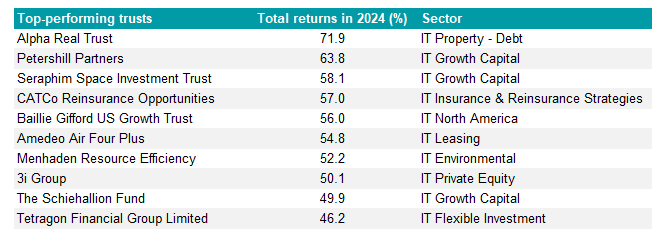

A diverse mix of investment trusts topped the performance charts last year with no one theme achieving dominance. The top five performers spanned real estate debt, alternative assets, space, reinsurance and US growth equities.

Alpha Real Trust, which focuses on asset-backed lending, debt investments and high return property investments in western Europe, led the pack with a 71% return. However, most of that performance was generated in December after a winding up and return of capital was announced, said Ben Yearsley, director of Fairview Investing.

Best-performing investment trusts in 2024

Sources: FE Analytics, Fairview Investing; the table above excludes venture capital trusts and trusts in the IT Unclassified sector.

Last year was a profitable one for a range of alternative and private market strategies. Petershill Partners, which invests in private equity and other alternative asset managers and is operated by Goldman Sachs Asset Management, returned 63.8%. By taking stakes in partner firms that earn fees from the funds they manage, Petershill participates in the fee income from more than 200 underlying funds.

Other strategies with private equity exposure that performed well last year included 3i Group, which returned 50.1%, and Baillie Gifford’s Schiehallion fund, which invests in late-stage private companies and rose 49.9%.

Seraphim Space shot up like a rocket, returning 58.1% in 2024. Emma Bird, head of investment trust research at Winterflood, said many of its space-tech assets were substantially undervalued and prospered last year in line with macro trends such as geopolitical tensions and a push for global connectivity.

She expects president-elect Donald Trump to prioritise defence spending and said his close relationship with Elon Musk, founder of SpaceX, provides a favourable backdrop for the trust going forward.

Meanwhile, extreme weather events and the impact of climate change propelled Catco Reinsurance Opportunities, which holds a balanced portfolio of global catastrophic reinsurance risk protections, to surge 57%.

Hot on its heels was Baillie Gifford US Growth, which returned 56% as its focus on US equities, growth companies and technology paid off. Its top 10 holdings include SpaceX, Shopify, Amazon, Stripe, Netflix and Meta Platforms.

The trust has moved from a three-year average discount of 13.8% to a 1.3% premium as of 1 Jan 2025 on the back of strong investment performance and also due to activist investor Saba Capital Management amassing a 25.2% stake.

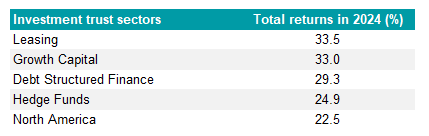

Leasing was the best-performing investment trust sector last year with a 33% return. It contains five trusts and is dominated by aircraft and shipping. As Yearsley pointed out, leasing is an area to which investment trusts provide access but is not commonly found in the open-ended world.

The Growth Capital, Debt Structured Finance and Hedge Fund sectors also put in a good showing, with North America rounding out the top five.

Best-performing investment trust sectors in 2024

Sources: FE Analytics, Fairview Investing

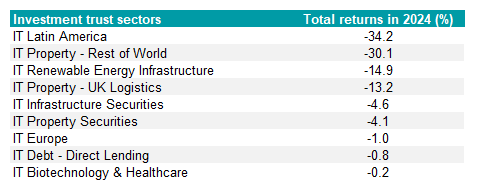

At the other end of the spectrum, nine of the 46 investment trust sectors (excluding VCTs and Unclassified) made a loss last year, as the table below shows.

Worst-performing investment trust sectors in 2024

Source: FE Analytics

“There was one clear loser last year: Latin America,” Yearsley said. “Argentina’s much-derided president Javier Milei has actually put the country’s finances on a much more even keel with his policies, leading to a fall in monthly inflation from 25% a year ago to 2.4% now. Unfortunately, Brazil is now in the eye of the storm with the Bovespa down last year and the real losing 23% versus the greenback.”

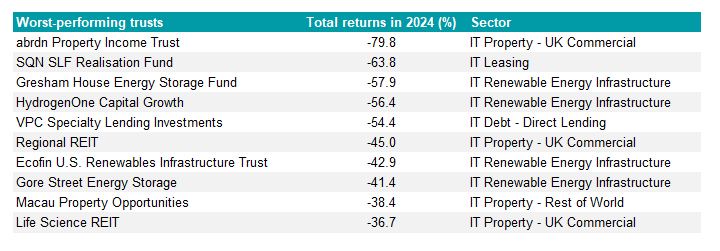

Looking at individual trusts, abrdn Property Income made the largest losses due to its share price falling in December when shareholders approved a voluntary wind-up and the return of capital.

Worst-performing investment trusts in 2024

Source: FE Analytics; the table above excludes venture capital trusts and trusts in the IT Unclassified sector.

Moving beyond the performance numbers, new records were set in 2024 for mergers and share buybacks.

Last year’s tally of 10 mergers doubled the previous annual record set in 2021. The largest was Tritax Big Box REIT’s combination with UK Commercial Property REIT, creating a company with £6.1bn in assets, followed by Alliance Trust and Witan Investment Trust forming Alliance Witan, which has £5.7bn in assets.

Investment trusts repurchased £6.95bn of shares in the first 11 months of 2024, according to Winterflood. The previous record for buybacks was £3.9bn during 2023.

Richard Stone, chief executive of the Association of Investment Companies, attributed this flurry of activity to discounts remaining wide, “prompting boards to take action”. The average discount widened from 13.7% at the beginning of last year (excluding 3i) to 15.2% by 12 December 2024.

In addition to mergers and buybacks, 32 investment trusts cut their fees last year, he pointed out.