Investors with leftover ISA allowance may wish to add to their favourite investment trusts before the deadline on 5 April, as data shows the average closed-ended fund has made £2,748 for every £1,000 invested over the past 10 years, according to research by the Association of Investment Companies.

But for those who may not have favourites, whittling down which of the more than 300 options available are worth their money can be an enormous task.

This is where six independent financial advisers and wealth managers have stepped up, suggesting trusts to suit investors with different goals and risk profiles.

Younger investors

Starting with those perhaps newest to investing, younger people with time on their hands before needing the cash can afford to take more risk and let their money increase over the long term. They will, however, require patience and the stomach to potentially watch their investments fall in the short term.

For these people, Tom Poynton, executive director of Baron & Grant, said: “Investment trusts focusing on sectors such as technology, healthcare, emerging markets and smaller companies may appeal, as they offer the opportunity for long-term capital appreciation. Reinvesting any dividends and compounding returns is particularly effective at this stage.”

His top recommendation is Asia, with the Scottish Oriental Smaller Companies Trust gaining his vote. It combines two risk factors: Asian equities can be more volatile as they are linked heavily with China, while smaller companies have bigger swings than their large-cap peers.

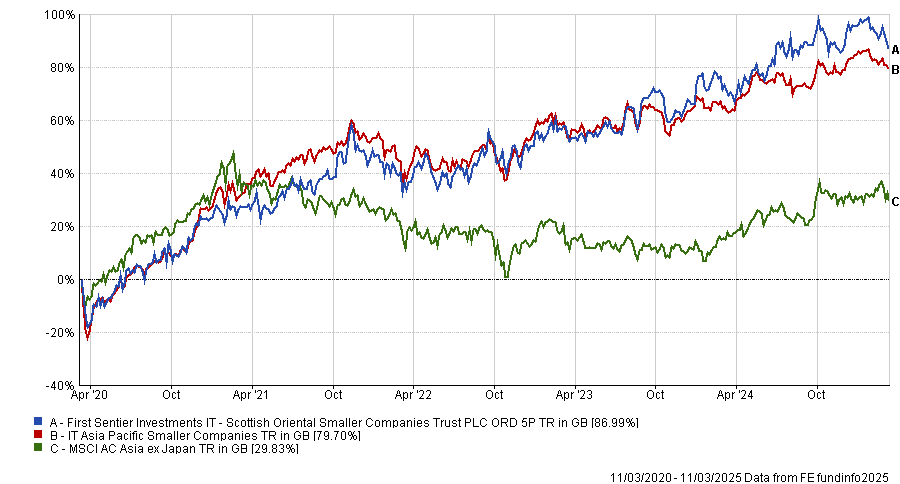

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

It trades at a double-digit discount, meaning the share price is more than 10% below the total net asset value (NAV) of the portfolio.

“The management has recently shifted to a higher conviction portfolio. A recent five-to-one share split should also aid liquidity and accessibility,” he said, adding that the trust has an impressive long-term track record.

For Paul Chilver, director and financial planning manager at Birkett Long IFA, investors in this age range can also afford to look outside the traditional listed equity market.

He chose Oakley Capital Investments in the private equity sector, which has “excellent medium to long-term performance although it has struggled in recent months”.

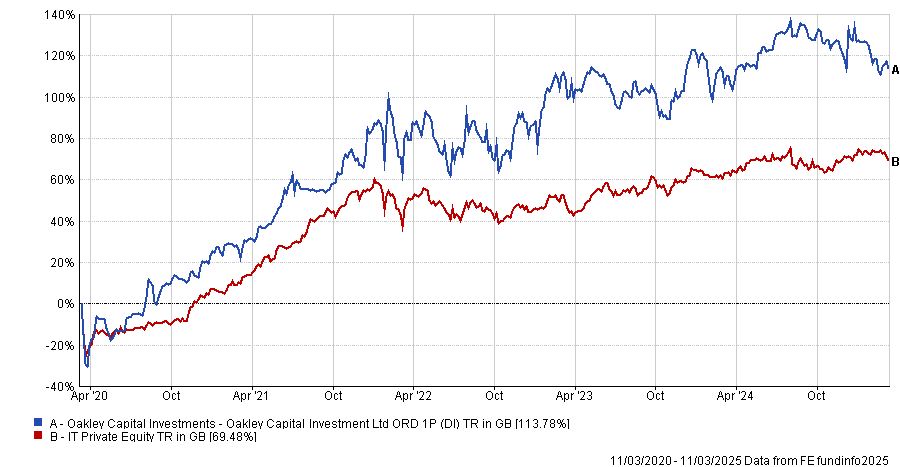

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

Indeed, it has made 113.8% over five years and “currently trades at a potentially attractive discount of over 30%,” he added.

Middle-aged investors

Balancing risk and reward is key for those in their middle years. While growth is still important, there is a greater focus on wealth preservation and diversification as money needs can come from all angles, whether it be caring for parents, raising children or moving into your dream home.

Genevra Banszky von Ambroz, partner at Evelyn Partners, said: “Generally, middle-aged investors will still have a long-term horizon but a slightly lower appetite for risk.”

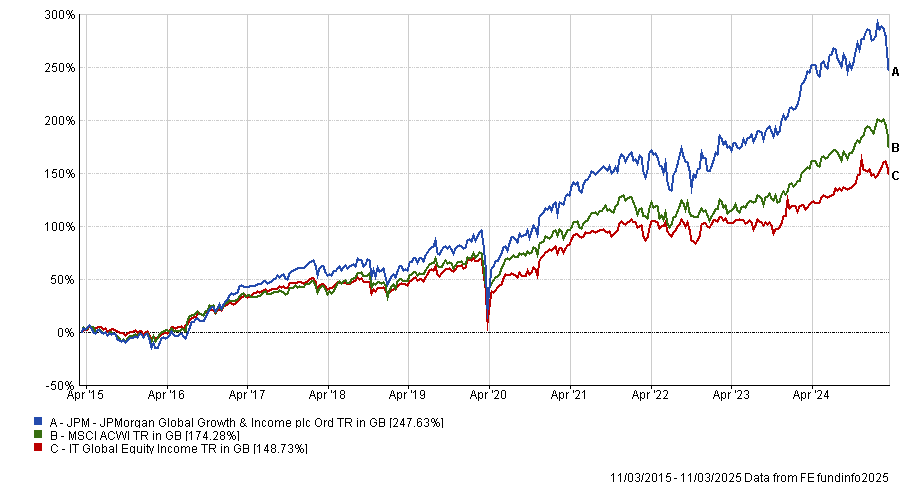

She suggested investors may want to start with something that pays an income but also aims to increase the cash pot and selected JPMorgan Global Growth & Income, which yields 4.3% and owns “the most attractive growth opportunities in the world”.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

This could be paired with something in the alternative space, such as Cordiant Digital Infrastructure, which trades on a discount of 30% and yields 4.6%.

“This is a portfolio of private digital infrastructure assets, managed by an extremely experienced team. Those who look for shared commitment from the management teams should look no further; executive chairman Steven Marshall has been a meaningful buyer of the shares over the past couple of years so he clearly believes in the strategy,” she said.

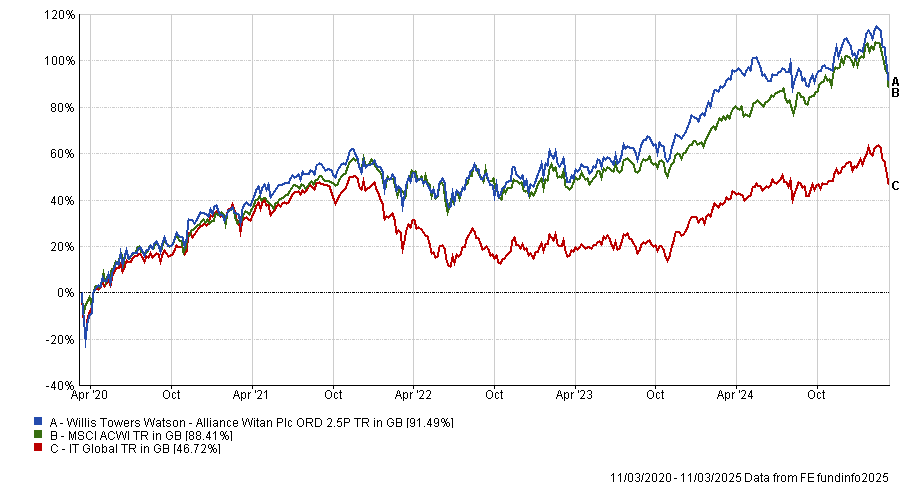

Philippa Maffioli, director at Blyth-Richmond Investment Managers, suggested a one-stop-shop such as Alliance Witan, which has a lower dividend yield of 2.2% but focuses on total return (capital and income).

It hires external managers to run different parts of the portfolio, with the overall construction falling to Willis Towers Watson.

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

“The multi-manager approach ensures broad exposure across companies, sectors and global markets. The 11 managers choose no more than 20 stocks each and the portfolio aims to consistently outperform global stock markets, smooth out highs and lows and keep risk under control,” she said.

“The trust is committed to increasing dividends annually and can boast 58 years of rising dividends, making it an AIC dividend hero.”

Retired investors

Last but by no means least, retired investors are more likely to place a premium on capital preservation while also requiring an income to live off.

This may lead them to investment trusts with strong dividend yields in defensive sectors, such as infrastructure, bonds or real estate. Inflation protection is likely to also be key.

Saftwar Sarwar, chief investment officer at Binary Capital, said: “For retired investors wishing to avoid volatility and to preserve their capital, Personal Assets Trust managed by the team at Troy Asset Management is a compelling investment.

“The trust aims to protect its shareholders against inflation and market risk, and has consistently delivered steady returns in pretty much all investment and economic scenarios.”

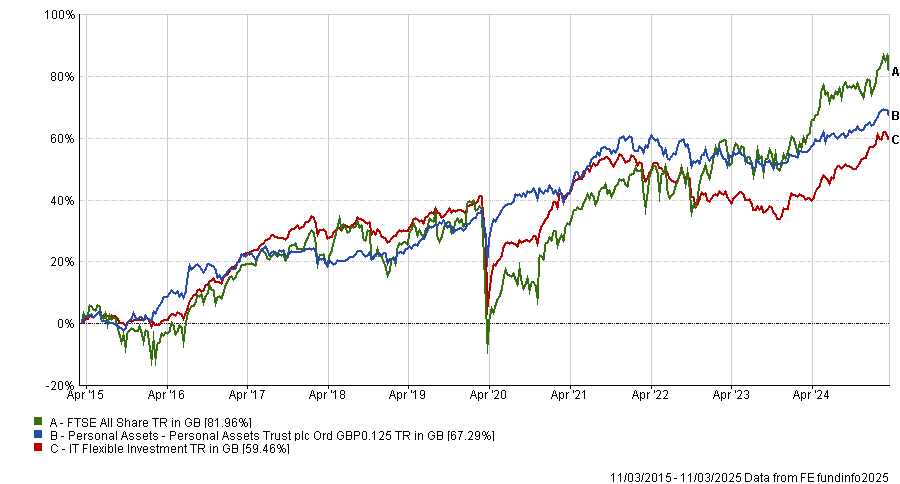

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Poynton meanwhile chose the Merchants Trust, which was also favoured by Maffioli. It aims to deliver a high, growing income stream and capital growth by investing mainly in high-yielding large UK companies.

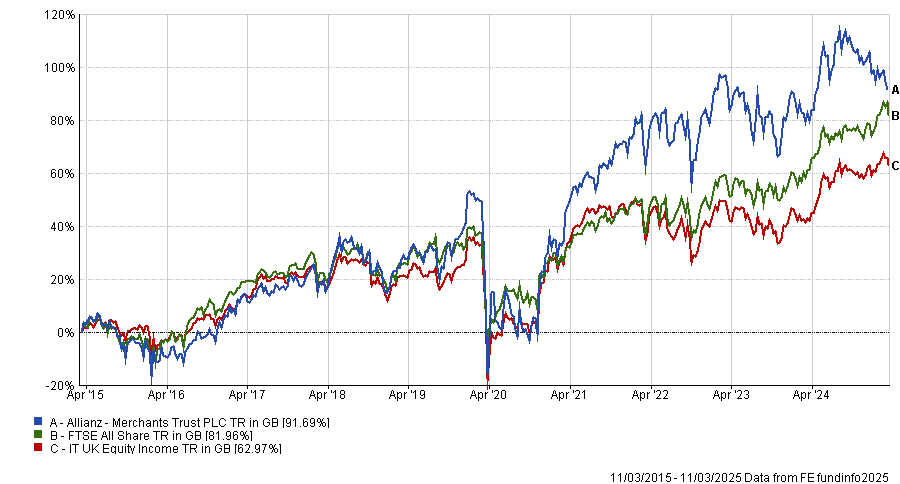

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Established in 1889 and boasting a 42-year record of consecutive dividend increases, the trust currently yields 5.4% and shares can be purchased at a 5% discount, which Poynton said was “compelling”.

Maffioli added: “Fund manager Simon Gergel believes the UK market's valuation is well below long-term averages at a time when many other markets are highly rated, making it a perfect time to invest in British blue chips.”