Income investing can be crucial for investors from all walks of life, although it is often associated with those in retirement who need the additional payouts to cover the shortfall between their pensions and their savings.

There are several ways to get an income, including picking assets that pay out the most, buying strategies that pay out a little less but can grow your cash pot, or by focusing entirely on funds that will grow their dividends over time.

Below, AJ Bell reveals its five fund, stock or investment trust picks for those who want income – no matter how they want to get there.

Starting with the high yielders, these investors will require their choices to pay out more than the 5% available from cash savings accounts, said Dan Coatsworth, investment analyst at AJ Bell.

“That might seem a high bar to clear, yet qualifying opportunities are widespread across stocks, bonds, funds and investment trusts,” he said.

For example, around a fifth of FTSE 100 companies pay a yield above 5%, making the UK market a “treasure trove” for high-yielding stocks.

“Investment trusts are also a popular hunting ground, with big yields from companies across the property, renewable energy and debt sectors,” he noted.

However, it is important not to get suckered in by a flashy yield number, as there is no point owning an asset that loses money in capital terms, even if it offers a strong yield.

Coatsworth’s selection therefore was office and retail sector landlord Land Securities, which has a 7.2% prospective yield. He liked the stock as it is now adding residential properties as a third string to its bow.

“Commercial property might have been out of favour over the past few years amid a rising interest rate environment, but Land Securities has its eyes on the longer-term prize,” he said.

“That’s why it is hungry to increase retail exposure when others are retreating from the space. The plan is to shift the portfolio towards assets that generate a higher income for the group, which implies higher dividends for investors down the line.”

Sticking with big payers, fund investors could opt for enhanced income strategies, which sell call options on stocks held in the portfolio to generate additional income.

“These options are contracts that give the buyer the right, but not the obligation, to buy the underlying asset at a specific price on or before a certain date,” said Coatsworth.

Although enhanced income strategies may underperform traditional equity income funds when markets rise, they can potentially make up for this during bear markets.

His option here was Schroder Income Maximiser, which targets a 7% yield and is run by the value management team behind Schroder Recovery. The bulk of its portfolio is in UK shares, but it also has money invested in US, French, Italian and German-listed companies, as well as a small amount in money markets.

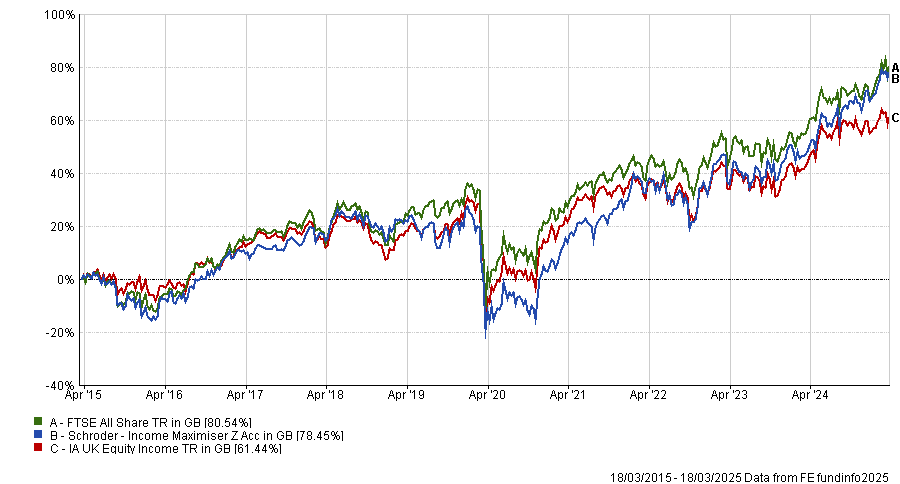

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

“Charging 0.91% a year, the fund has rewarded investors handsomely in the past,” said Coatsworth. Indeed, it has been a top-quartile performer in the IA UK Equity Income sector over the past one, three, five and 10 years.

Turning to dividend growers – those with lower starting yields but a penchant for upping this payout each year – Coatsworth described these as “dividend aristocrats”.

“The cost of living typically goes up each year so it’s important that dividends grow at least in line with inflation to ensure you maintain spending power. The ability of a company to grow dividends each year can also be a sign it’s a high-quality business,” he said.

There are lots of opportunities here, with many investment trusts upping payouts for more than half a century, but he chose to look to a more passive option: SPDR S&P Euro Dividend Aristocrats.

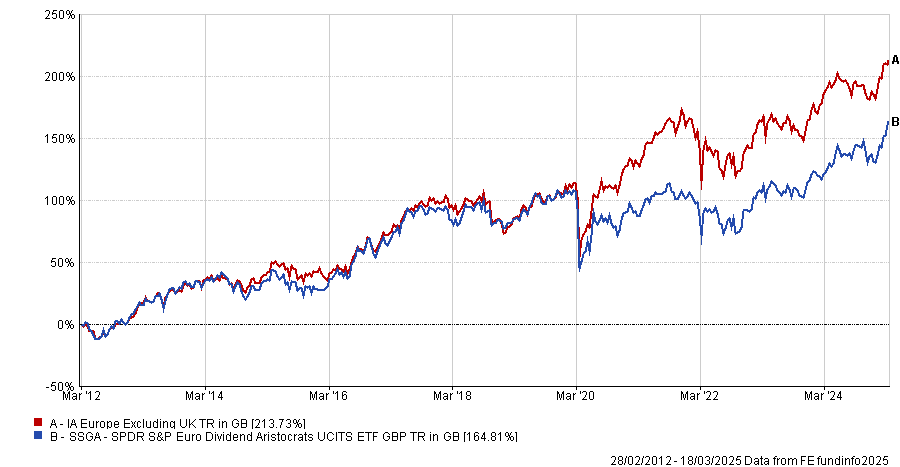

It tracks an index of 40 high-yield Eurozone companies that have had stable or growing dividends for at least 10 consecutive years. It yields 4% and the ETF has achieved strong returns since launch in 2012, as the below chart shows.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

“Europe is all the rage this year as investors turn their back on the US stock market and look for cheaper options in other parts of the world. The SPDR ETF is big in financials, utilities and industrials and top holdings include insurer Ageas and pharmaceutical group Sanofi,” he said.

Then there are those that can grow their capital, as well as provide an income. This blended approach may appeal to someone in retirement looking to make their pension last longer, said Coatsworth.

“JPMorgan Global Growth & Income has won fans in recent years, helped by robust performance and offering more jam today than previous investor favourites such as Scottish Mortgage, which is more about jam tomorrow,” he said.

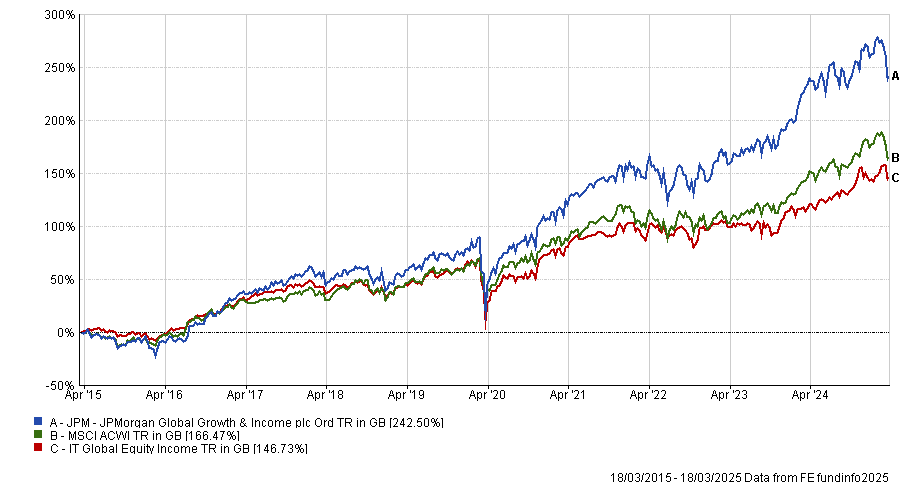

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The global ‘best ideas’ investment trust has almost £3bn in assets under management and it is expected to take on the assets of Henderson International Income, upping its scale once again.

“The portfolio features a blend of tech, media and retail names as the dominant holdings, alongside a sprinkle of other sectors on a smaller basis,” Coatsworth said, and gives investors “a happy medium of dividends and capital gains”.

Lastly, for those who want dependable monthly income, Man Income is the pick. This may appeal to people who have received their salary like clockwork throughout their working life and want the same reassurance that they will get something to help out with their outgoings.

“Investments play a role in replacing that income – either selling small chunks to generate capital or, ideally, using dividends to pay the bills,” he said.

“Individual stocks typically pay dividends twice a year but that frequency might not suit someone who has monthly bills to settle. An investor could create a portfolio with dividends trickling in across different months. Alternatively, there is a growing number of funds and investment trusts paying dividends monthly to investors.”

Man Income yields 4.3% and is helmed by FE fundinfo Alpha Manager Henry Dixon, who aims to beat the FTSE All Share index by investing in companies of all sizes on the UK stock market. “He looks for undervalued and unloved companies that have a dividend yield at least in line with the market,” Coatsworth said.