AJ Bell has added Schroder Asian Alpha Plus to its favourite funds list and removed Fidelity Asia and Schroder European.

Schroder Asian Alpha Plus was chosen for its strong management team, deep pool of research analysts and considered investment approach, said Paul Angell, head of investment research.

Richard Sennitt has been lead manager since 2021 when veteran investor Matthew Dobbs – with whom he worked for 15 years – retired. He is assisted by co-portfolio manager Abbas Barkhordar.

Angell said: “The pair work with a large group of on-the-ground analysts who cover the breadth of the Asian equity market and look to identify companies with growing earnings, stable balance sheets and most importantly, strong management teams.”

The £1.2bn fund holds 55 to 60 best ideas and focuses on companies earning above their cost of capital.

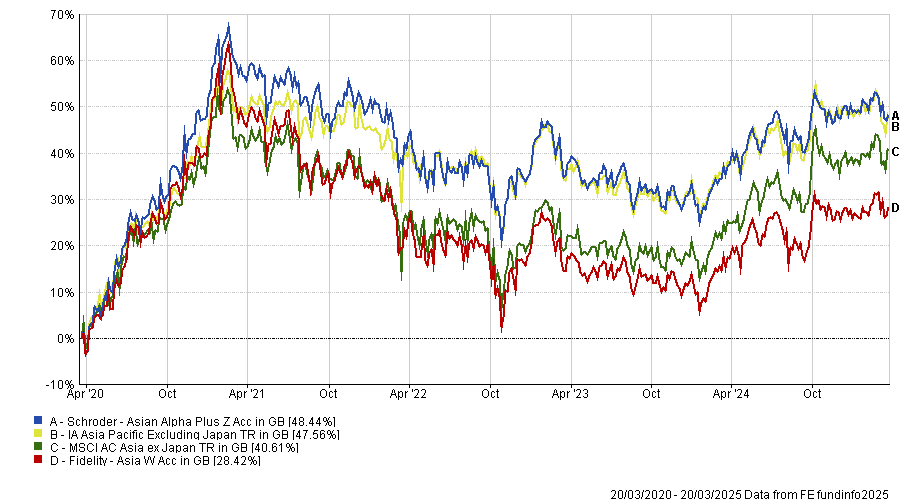

Performance is in the second quartile of the IA Asia Pacific Excluding Japan sector over one and five years to 20 March 2025, meaning that the fund outperformed its peer group average, but sits in the third quartile over three years.

The portfolio is also favoured by analysts at Hargreaves Lansdown, who said: “Over the long-term, investors have seen strong relative returns. However, most of this performance can't be attributed to the current management duo. We think the fund has good long-term prospects, though there are no guarantees how the fund will perform in future.”

The fund's investment style means it can, at times, be more volatile than the average fund in the IA Asia Pacific ex Japan sector, the analysts pointed out.

“At the moment, the fund is focused on sectors that can be more sensitive to the health of the economy but could benefit from longer-term trends such as the growing use of technology and online consumer spending. This means the fund is currently focused on sectors such as technology, financials and consumer services,” they said.

Schroder Asian Alpha Plus joins four other funds investing in the Asia Pacific region on AJ Bell’s buy list: Invesco Asian, Jupiter Asian Income, Stewart Investors Asia Pacific Leaders and Vanguard FTSE Developed Asia Pacific ex Japan.

AJ Bell has removed Fidelity Asia, however, to make room for Schroders.

“Fidelity Asia’s lead manager, Teera Chanpongsang, has shown himself a capable investor and has a similarly deep pool of analysts. The two funds also have similar investment philosophies,” Angell noted.

“However, we believe investors are better served by the approach of the Schroders team, which typically results in a more balanced portfolio that is less volatile when their investment style is out of favour.”

Performance of funds vs benchmark and sector over 5yrs

Source: FE Analytics

The £2.3bn Fidelity Asia fund has lagged its peer group over three and five years but is second quartile over 12 months to 20 March 2025.

It remains recommended by analysts at both Barclays and interactive investor.

Rob Mansell, portfolio manager at Barclays, said three things set the fund apart. “First, Chanpongsang’s experience – he has a long and successful track record in fund management. Second, Fidelity has one of the largest teams of analysts in Asia, which is critical in terms of its research capability.

“And finally, the team and manager have followed the same robust investment process for years. These three factors together have resulted in a formidable performance track record for investors.”

Schroder European is also leaving the favourite funds list because AJ Bell has grown less confident in the £547m fund’s manager, Martin Skanberg, and his investment approach.

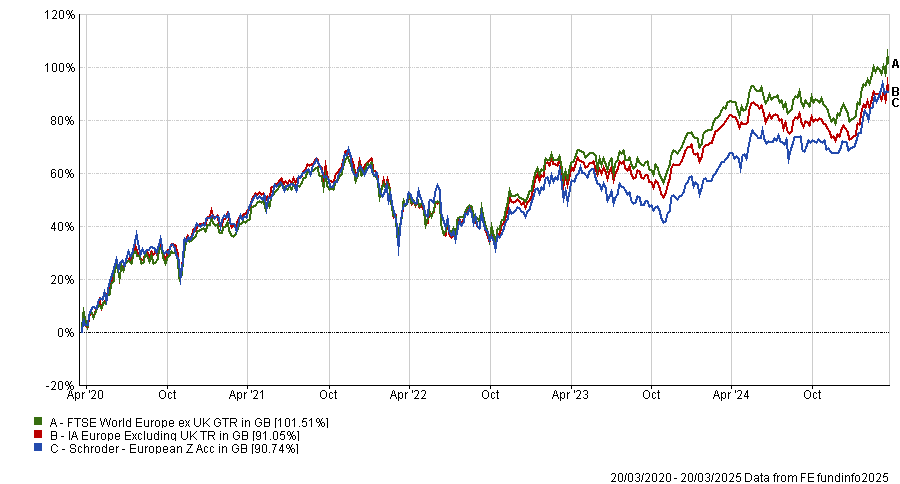

Skanberg endeavours to build a balanced portfolio of growth, value, cyclical and defensive stocks. “Despite this noble aim, the fund’s performance has underwhelmed over the medium to longer term, delivering returns below its index and peers,” Angell said.

Performance of fund vs benchmark and sector over 5yrs

Source: FE Analytics

Performance has recovered more recently however and the fund is in the top quartile of its peer group for the year to 20 March 2024.

AJ Bell was the only platform among the ‘big five’ (Hargreaves Lansdown, interactive investor, AJ Bell, Fidelity and Barclays) to recommend the fund, meaning it has lost its sole backer.

It leaves Baring Europe Select, BlackRock Continental European Income, BlackRock European Dynamic, Lightman European and Vanguard FTSE Developed Europe ex UK ETF as options recommended by AJ Bell for those seeking exposure to European stocks.