The current troubled macroeconomic environment can be overwhelming for investors as uncertainty makes it more difficult to have strong convictions.

As a result, investors may not feel comfortable with making significant investment decisions with little visibility on where the opportunities are.

Yet, Stonehage Fleming argues that there are plenty of options for investors with long-term horizons. FE fundinfo Alpha Manager Gerrit Smit, who runs Stonehage Fleming Global Best Ideas Equity, suggested looking at businesses with quality, a strong competitive edge and an attractive valuation, as those are the type of companies that should thrive over the next 10 years.

He said: “That means investing in businesses with sustainable strong organic growth, world-class management, high profitability, a strong balance sheet, and high cash generation.”

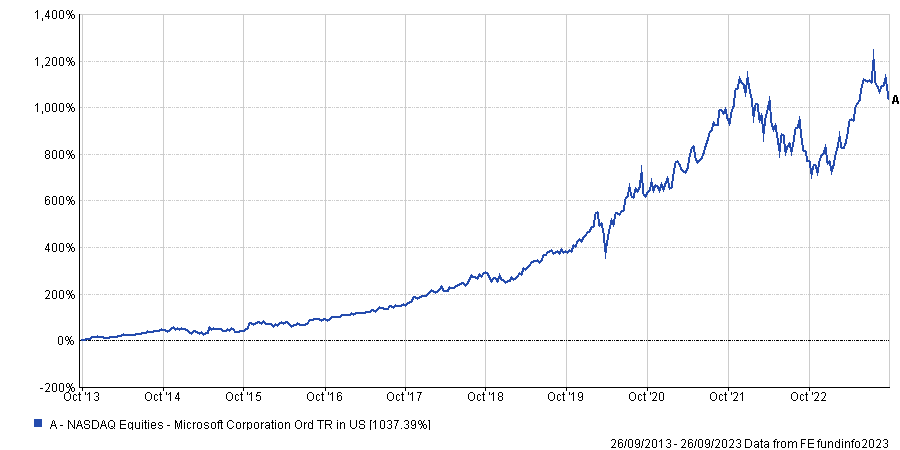

Three stocks reflect those characteristics perfectly, he said, and he expects to be holding them in his fund in a decade’s time. the first is Microsoft, which is currently the largest position in his fund, accounting for 6.9% of the portfolio.

The company has evolved over the past 10 years. While historically a sales-driven software supplier, the firm has expended its client services business resulting in a greater diversity of revenue drivers, a high recurring revenue mix and strong pricing power.

Smit said: “As well as being firmly embedded in many companies globally via Office and Windows, Microsoft remains positioned strongly to upsell new solutions.

“It also continues to benefit hugely from the growth in its core Azure cloud business, all in a very strong cash generative way.”

Performance of stock over 10yrs

Source: FE Analytics

The company is also a structural beneficiary of the Fourth Industrial Revolution (4IR), a concept embodying the rapid technological advancement experienced in the 21st century.

Smit added: “Microsoft is a leader in 4IR as well as in [artificial intelligence] AI and can continue to grow earnings and cash flow on a sustainable basis. It has become, and should remain, the staple of the modern world investor.”

Alex Crooke, manager of the Bankers Investment Trust, also shares the enthusiasm for the $2.5trn tech giant, seeing room for a lot of more gains with the impact of AI. Microsoft is the trust’s highest-conviction holding at the moment, accounting for 3.5% of the portfolio.

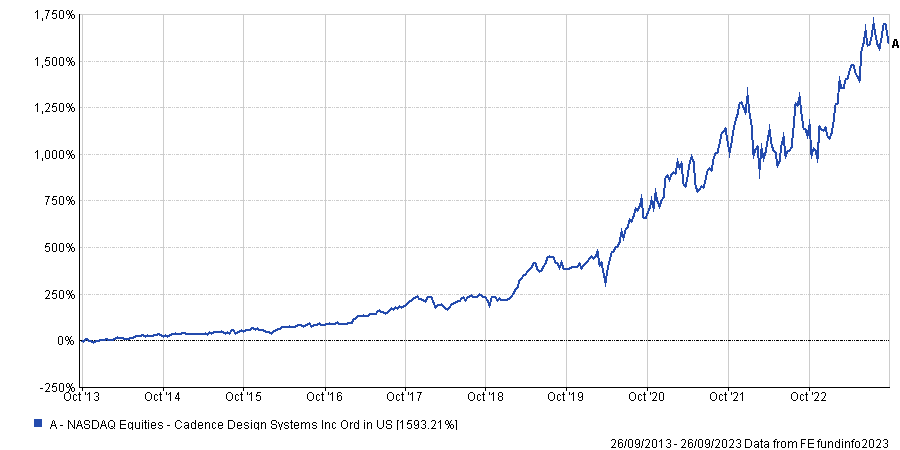

Cadence Design Systems, a California-based software company, is another strong conviction of Smit with the stock featuring in the top 10 holdings of his fund.

The company spends more than 30% of its turnover in innovation and research and development (R&D). The amount spent and the patents resulting from it form a sizeable barrier to entry, putting Cadence in a dominant position in its market.

Smit said: “Its computational design software is absolutely mission critical for R&D engineers at the world’s leading semiconductor and electronic systems firms.

“The business has cemented strong partnerships with industry leading semiconductor companies such as Nvidia and TSMC with more than 85% of its revenue recurring, delivering strong double-digit compounded cash flow growth.”

Performance of stock over 10yrs

Source: FE Analytics

Similar to Microsoft, Cadence has benefited from the AI rally this year with a surge in demand for its AI-related design software. Smit believes this dynamic can continue growing in the high double digits.

He added: “With its proven delivery record and strategically critical services, the chances are stacked in its favour that it will remain one of the pre-eminent business partners in the semiconductor industry globally.”

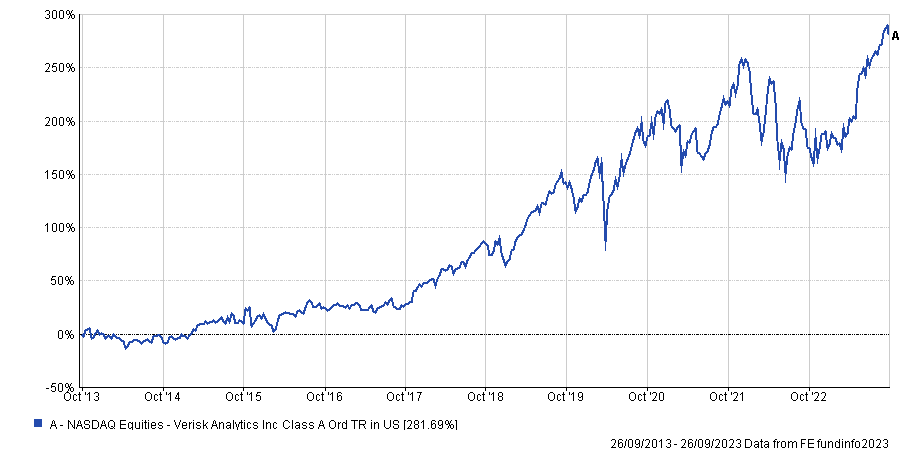

Finally, Smit sees Verisk Analytics, a New Jersey-based data analytics and risk assessment company, as a winner of the coming 10 years.

The company was formed from a group of insurers pooling their individual resources to form a specialist analytics business. It has become one of the main providers of information and analytics to the casualty insurance industry, with its data being vital to price insurer’s risk and to reduce fraud.

Performance of stock over 10yrs

Source: FE Analytics

Smit said: “The business is now well established with a very shareholder-orientated new CEO and CFO. It has appointed a solid board, enhanced remuneration practices, initiated dividend payments and begun providing financial guidance to shareholders.

“More than 80% of its revenue mix is subscription based, while its solid organic growth and profitability record – with further initiatives in place to drive even higher profitability – mean shareholders can look forward to sustainable delivery for at least the next decade.”

He expects that climate change issues and cyber security, in particular, will be strong growth areas for Verisk. Furthermore, the company is also benefiting from technological changes as it has already implemented AI and machine learning in many of its data products.